Congress Considering LIFO Repeal to Pay for Tax Reform

Some members of Congress are considering using LIFO repeal to generate revenue for the reduction in corporate tax rates. Recent reports also indicate that several GOP Senate Finance Committee members strongly favor LIFO repeal, and believe that trading LIFO repeal for reduced corporate tax rates to be a fair & necessary tradeoff.

What is Effective Tax Policy?

The success of the various tax policies enacted by Congress should be measured by these criteria:

- Achieves the desired result in terms of having a positive effect on the U.S. economy in terms of growth & job creation

- Avoids negative unintended consequences.

Measuring the Effectiveness of Repealing LIFO

The LIFO inventory method would be rated as an extremely effective tax policy compared to other income tax provisions judged by the criteria listed above. The LIFO inventory reserve balance changes are directly correlated to the annual inflation applicable to the inventory purchases and inventory balances, and businesses with inventories continuously must reinvest in order to keep an adequate supply. A company that values their inventory using the LIFO method offsets the inflated costs of purchasing inventories during times of inflation. Furthermore, companies reduce their LIFO reserve during times of deflationary or falling prices and actually pay a higher net amount of corporate income taxes when compared to a company that uses the FIFO method. This means that the LIFO method has a self-levelling balance that allows companies to most accurately match their costs of goods sold against revenues when using this cost flow assumption. Another example of an effective tax policy would be the IRS Section 179 write off allowances for business equipment. Most business people would agree that this is a very effective way to stimulate business equipment investment, however the limits for these write-offs are completely arbitrary and are not consistent from year to year (adding to the complexity of the tax code).

The defining principles of effective tax policy require that one or more of the following conditions to be met to justify LIFO repeal:

- Extremely high corporate tax rates would needed to have existed in 1939 when Congress first allowed the use of the LIFO method

- Proposed corporate tax rates would have to be significantly lower than what they were when LIFO was first allowed by Congress in 1939

- Increased inventory costs caused by inflation would have to cease to exist

A sound argument could be made in favor of LIFO repeal if it were found that Congress originally enacted LIFO to curb the negative effects of extremely high corporate tax rates that businesses were suffering from at the time. Another justification could be made that repealing LIFO would allow Congress to achieve reducing the corporate tax rate to a level that is much lower than what is was when LIFO was originally allowed in 1939. One last argument could be that since the main reason that LIFO was enacted was to offset the effects of increased inventory costs caused by inflation, LIFO should be repealed because inflation has ceased to exist. If any of the above conditions were met, repealing LIFO could be considered effective tax policy.

The historical data provides analysis of the three conditions listed above to determine if LIFO repeal is justified

Historical Corporate Tax Rates

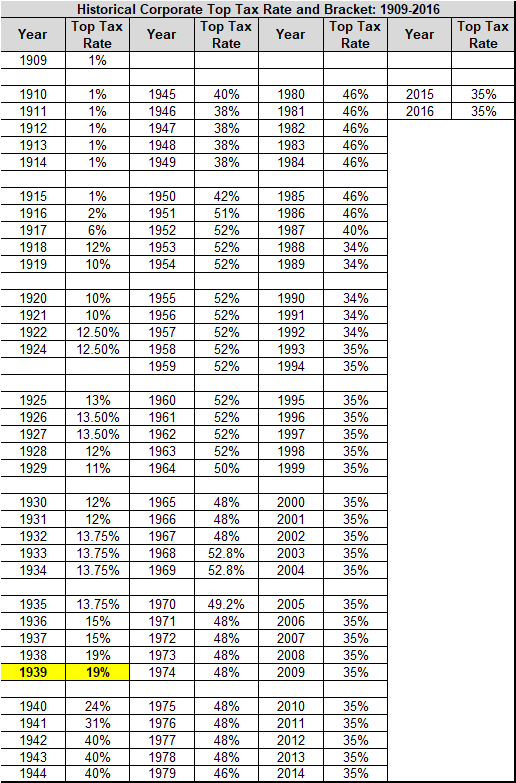

The table below shows the historical top corporate tax rates:

As shown in the table above, the top corporate tax rate was 19% when Congress first permitted the use of the LIFO inventory method in 1939. Comparatively speaking, the 1939 rate of 19% was the lowest corporate tax percentage that existed between 1940-2016. Furthermore, the 1939 rate is one percent lower than the 20% corporate tax rate proposed in the House’s tax reform package that was released this week. Based on this historical data, the conclusion can be made that 1) Extremely high tax rates did not exist when Congress first allowed the use of the LIFO method and 2) The House Tax Reform proposed corporate tax rate of 20% is not significantly lower than the 19% rate that existed when LIFO was first allowed by Congress in 1939.

Historical Inflation Rates

As shown in the table above, the CPI average annul inflation rate has been between 1-3% over the past twenty years. This data parallels the Federal Open Market Committee’s (FOMC) 2% target inflation rate. Based on the data shown above and FOMC’s inflation policies, the conclusion can be made that increased inventory costs caused by inflation have historically persisted at a steady rate and will not cease to exist.

The LIFO Method is Effective Tax Policy

Retention of the LIFO inventory method is particularly important in now because the benefits provided by the use of this method has a positive effect on the most important of the primary goals of the federal government in fighting the adverse effects of the current severe recession on our economy. These goals include the following which are described below along with the effect the use of the LIFO method has on each:

Stimulus effect – The income tax savings provided to businesses by the LIFO method significantly increases capital available to businesses that in turn can be used to reinvest & grow

Job creation – The LIFO method would allows companies the capital necessary to hire additional employees

Credit availability – This is one of the main problems resulting from the huge losses bank and other credit providers have suffered and the loss of LIFO wipes out a very important financing source, especially for small businesses.

Harmful effect on small businesses –The loss of the LIFO method would be more harmful to small businesses than to larger companies for the reasons described above.

Unintended Consequences of LIFO Repeal

According to a 2016 Tax Foundation Study, repealing LIFO would cause the following to occur:

- Reduce GDP by $11.6 billion per year

- Reduce federal revenue by $518 million annually

- Potentially result in over 50,000 job losses in the short run