| Section | Slide(s) |

| Step 1: Choose Partnership Format | 3 |

| Step 2: Year End LIFO Election Planning | 4 |

| Step 3: Client Outreach | 5 |

| Step 4: LIFO Election Benefit Analysis & Due Diligence | 6 – 7 |

| Step 5: Onboarding, Calculation, Deliverables & Implementation | 8 |

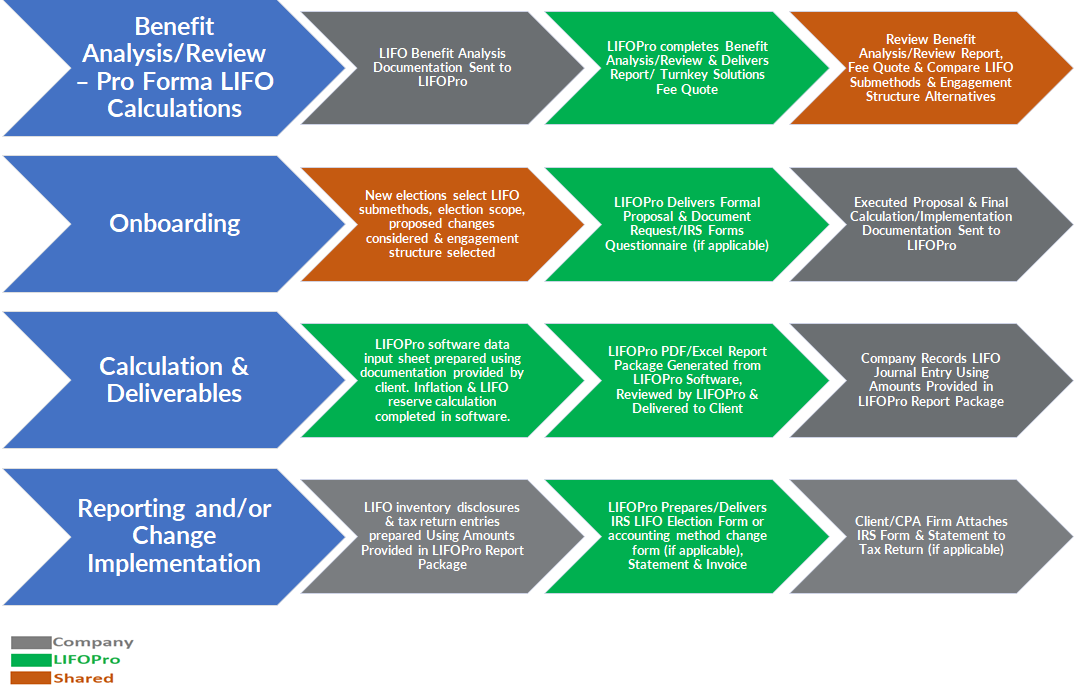

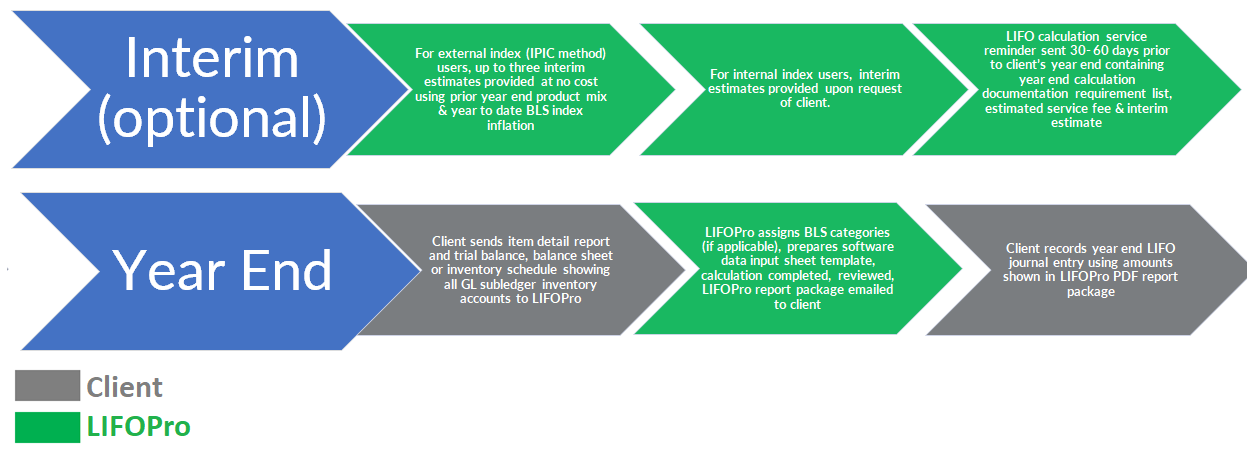

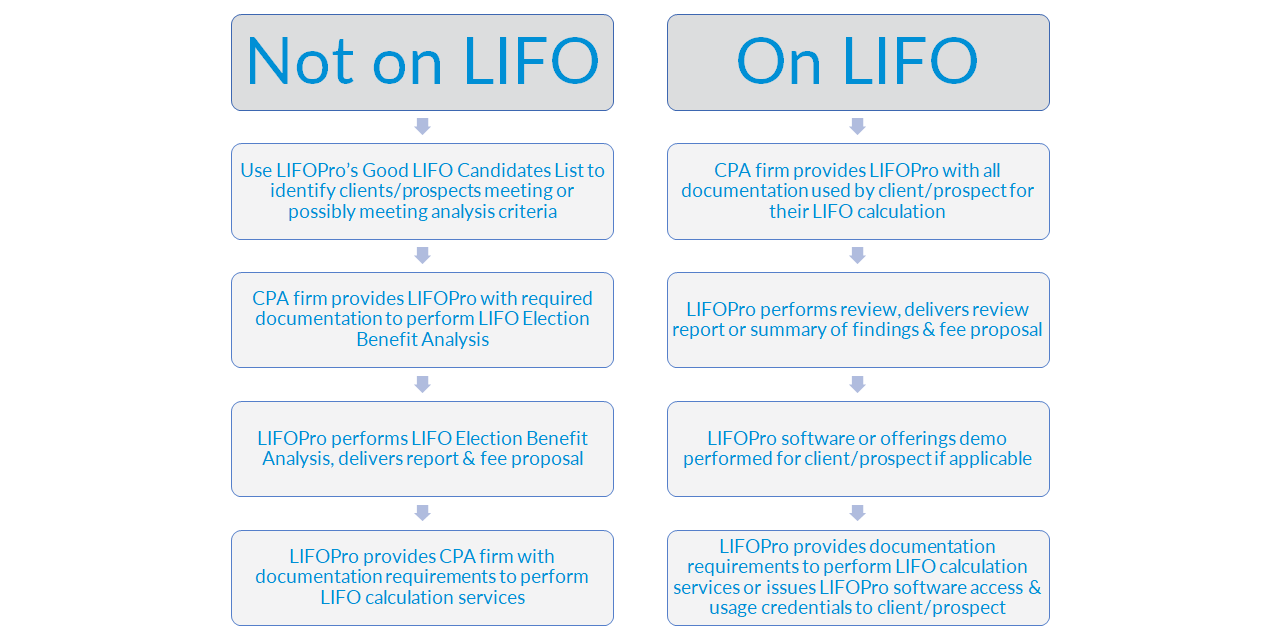

| Turnkey Outsourcing Solutions Process Flow Chart | 9 – 10 |

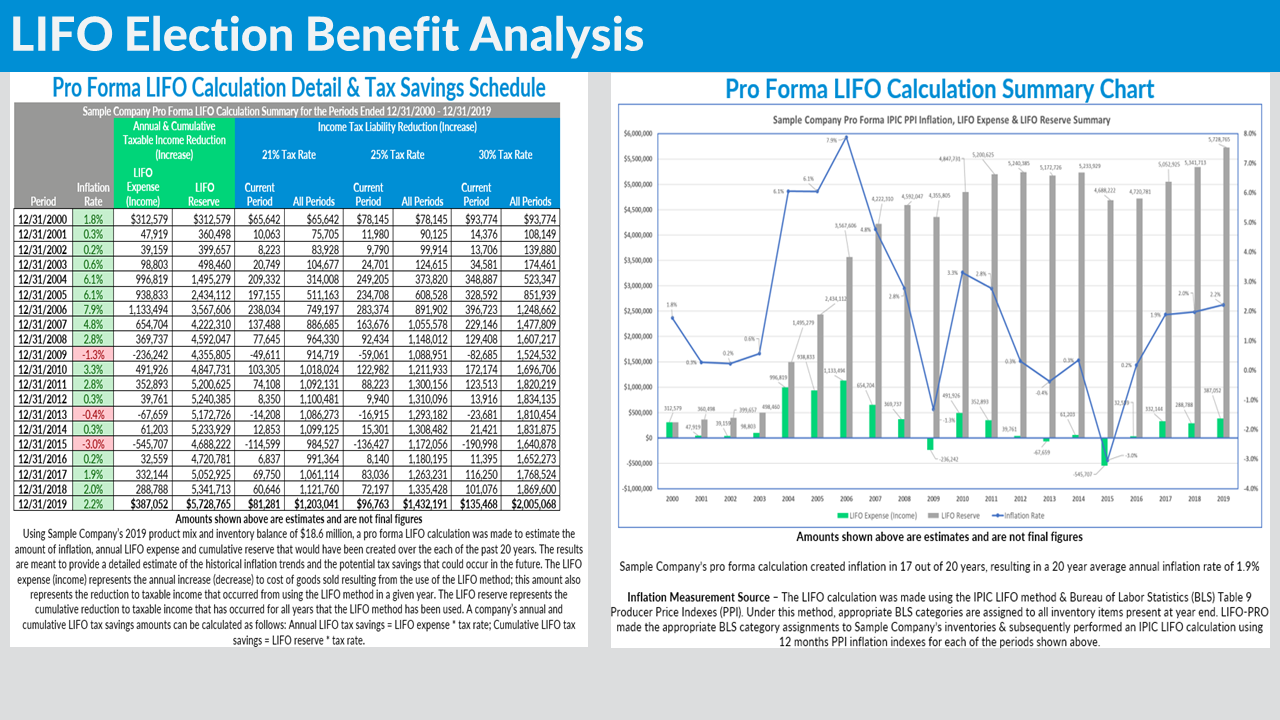

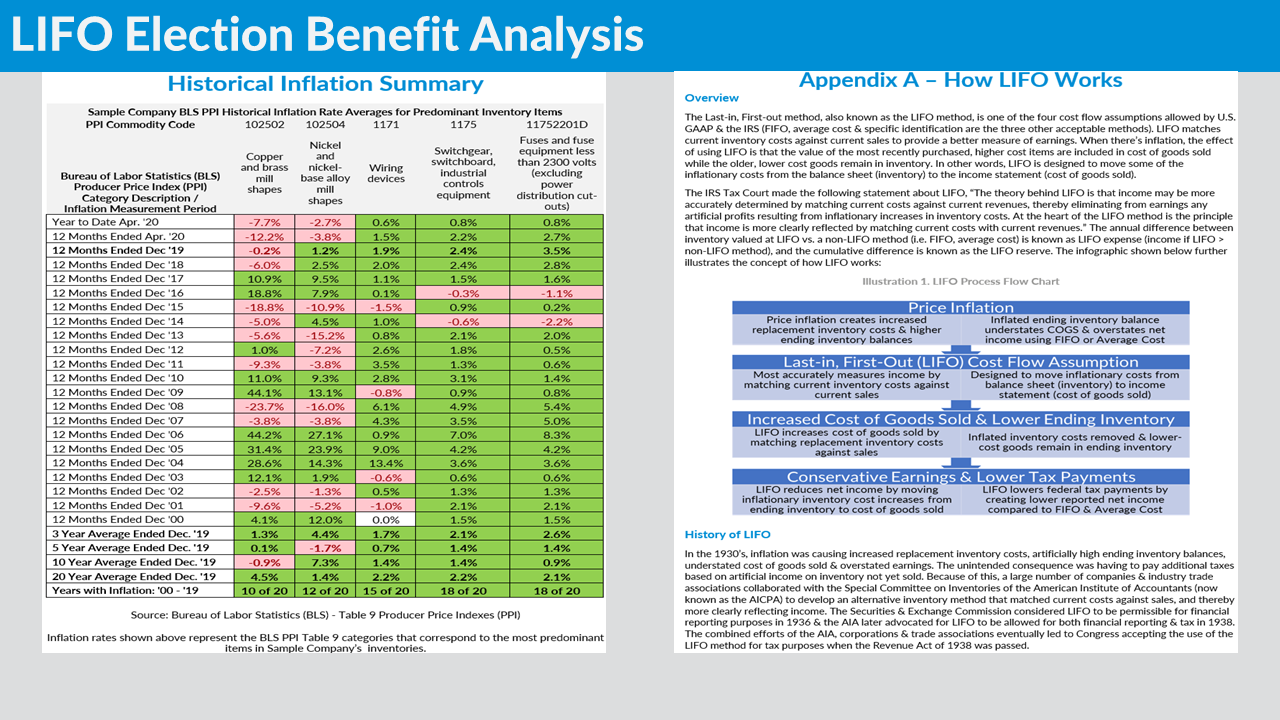

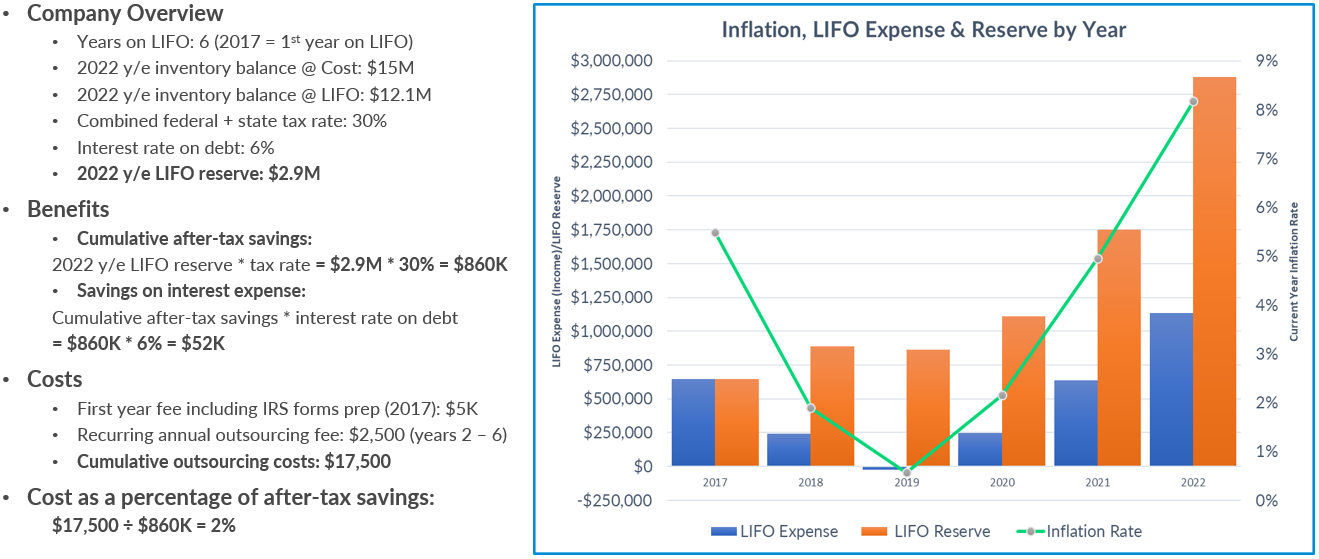

| Sample LIFO Election Benefit Analysis Report Excerpts | 11 |

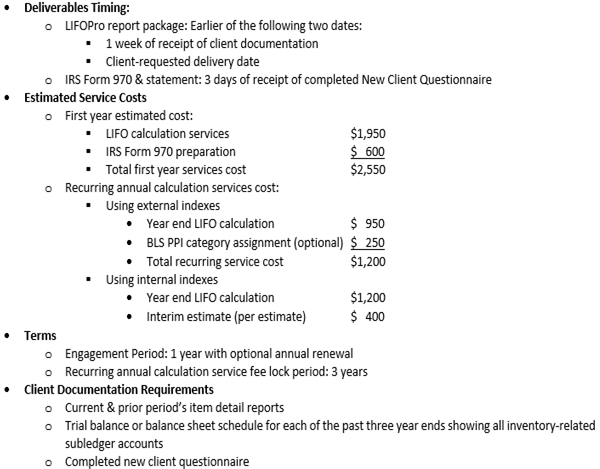

| Sample LIFOPro Fee Quote Excerpts | 12 |

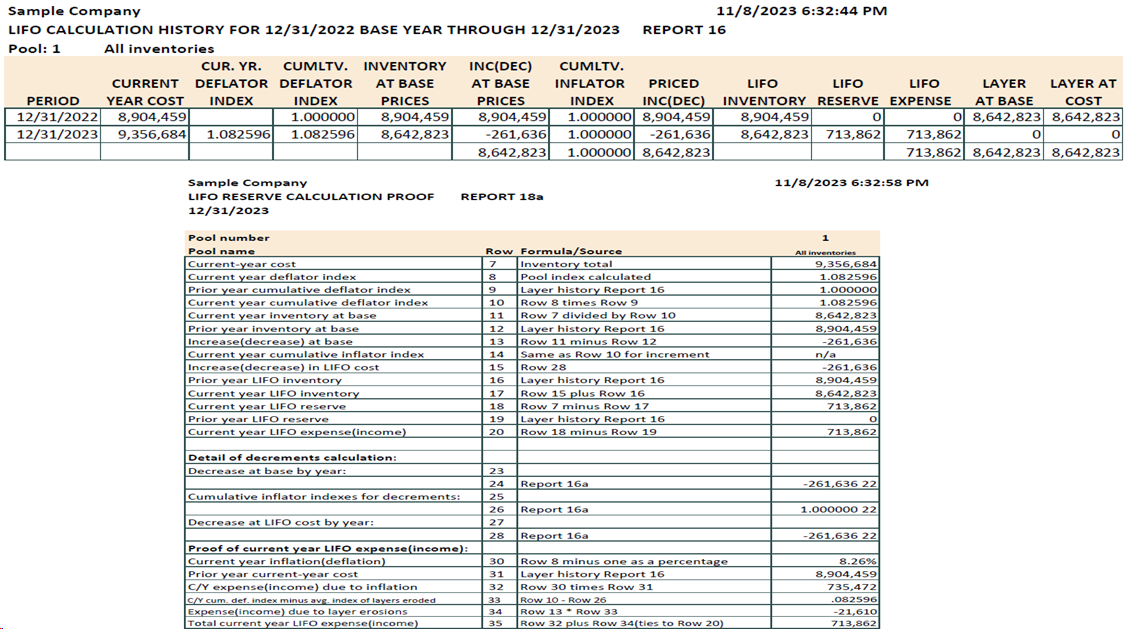

| Sample LIFO PDF Report Package Excerpts | 13 |

| Frequently Asked Questions | 14 |

| Resources | 15 |

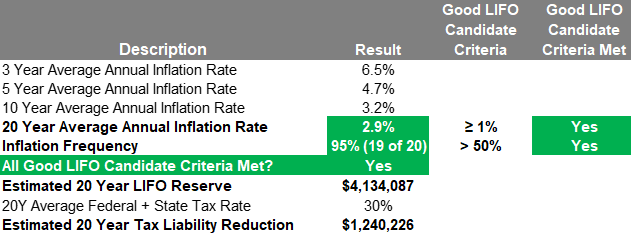

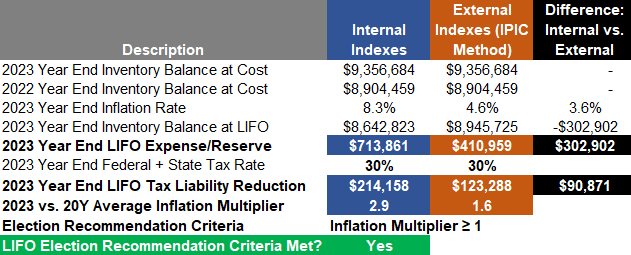

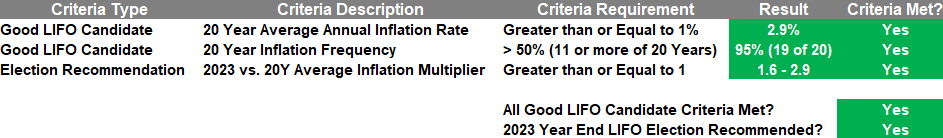

All criteria have been met for Sample Company to be considered a good LIFO candidate & for a LIFO election to be recommended for the 2023 year end.

LIFOPro’s CPA Firm Partnership Playbook Presentation Slide Deck

2023 Top LIFO Opportunities & Strategies Guide

2023 Good LIFO Candidate List & Identification Tool

LIFO Election Benefit Analysis Document Request List – Non Dealers

LIFO Election Benefit Analysis Questionnaires – Dealerships

Auto Dealership LIFO Election Benefit Analysis Questionnaire

Other Dealership LIFO Election Benefit Analysis Questionnaire

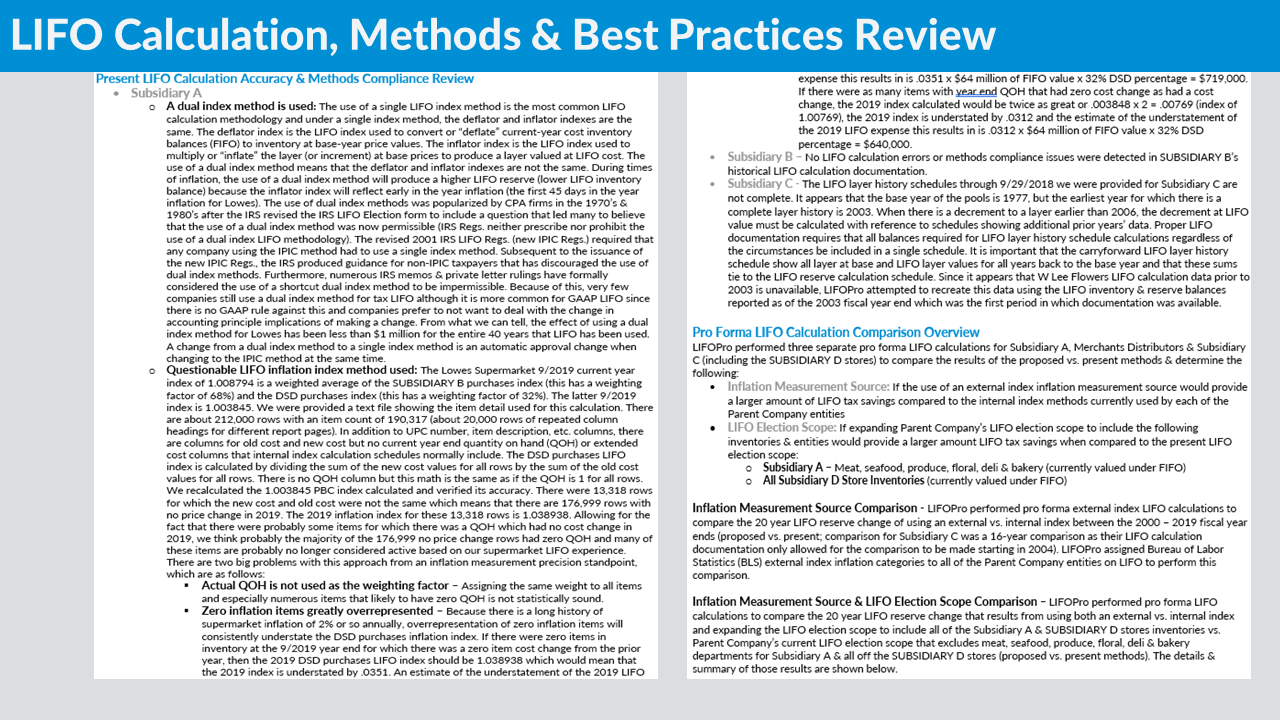

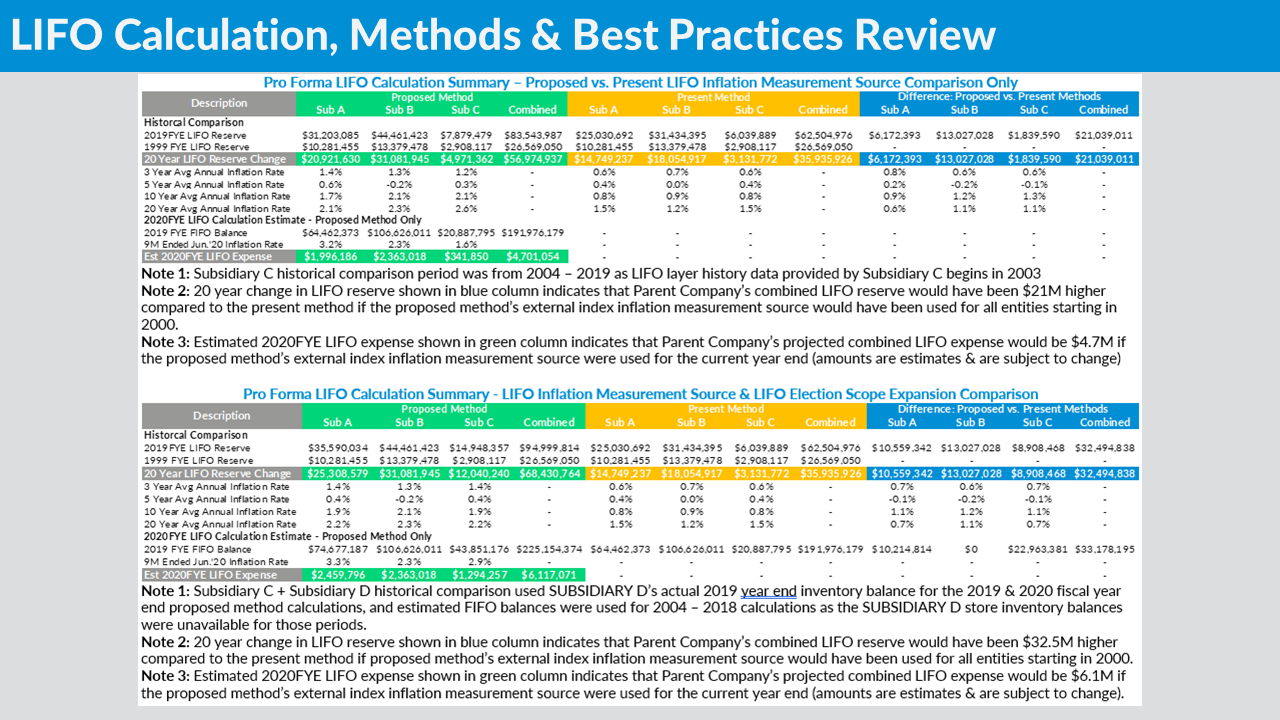

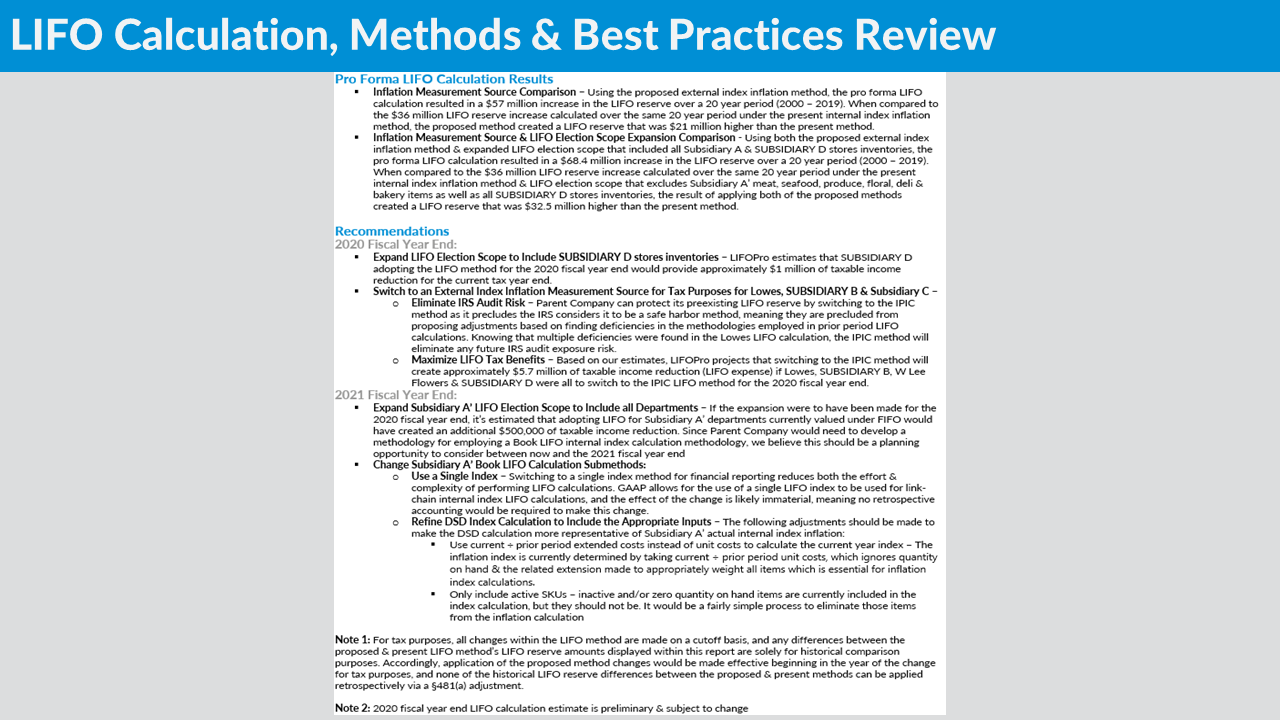

Sample LIFO Election Benefit Analysis Report

Companies on LIFO

Companies Electing LIFO

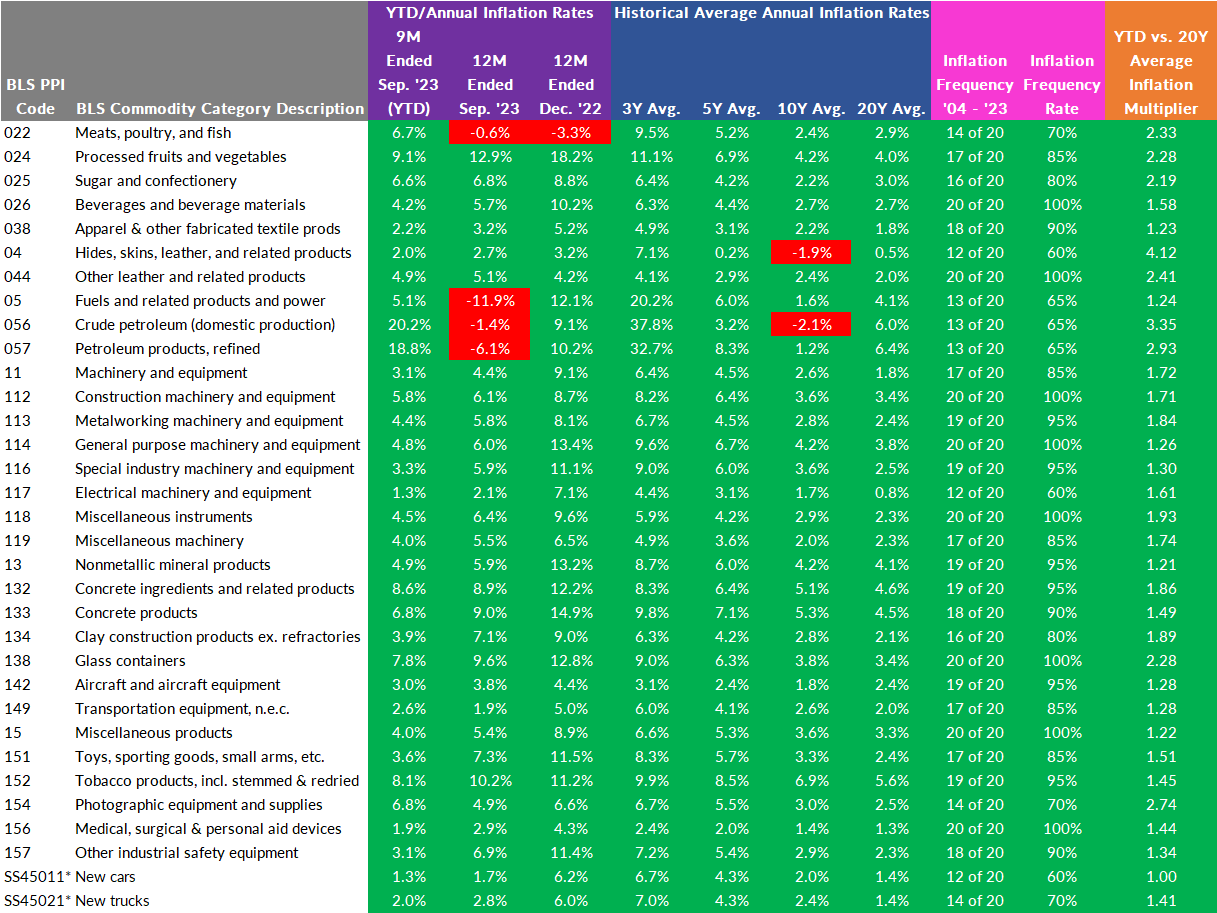

LIFOPro annually publishes our Top LIFO Election Candidates list to identify the best opportunities for obtaining tax benefits from adopting LIFO for the upcoming year end. The list uses price indexes published by the Bureau of Labor Statistics which are used to calculate a series of current and historical inflation metrics. These externally-sourced inflation metrics are plugged into LIFOPro’s proprietary grading system and scoring criteria in order to develop and publish our top LIFO candidates list each year. The ultimate goal of the list is to allow companies and CPA firms to quickly identify the best LIFO election opportunities and to easily calculate the estimated tax benefit that could occur from electing LIFO. This list is also often used as a prerequisite to obtaining a free LIFO Election Benefit Analysis from LIFOPro (for example, if a company or CPA firm identifies that their company or client is on this list, LIFOPro would recommend obtaining a complete benefit analysis from us free of cost/obligation). This list offers the most comprehensive, objective and reliable means of quickly identifying the best LIFO candidates, the top 2023 LIFO election candidates and the information required to quickly estimate the election year taxable income reduction & savings from LIFO

LIFOPro offers two separate lists of top LIFO candidates, which are as follows:

LIFOPro’s proprietary grading system and scoring criteria was designed for purposes of developing the most comprehensive LIFO case study and providing the most reliable and understandable findings and recommendations. Since the benefits of LIFO are primarily driven by inflation but is also an accounting method that’s intended to be used in perpetuity, LIFOPro developed various inflation measurement metrics that sought to answering the following questions:

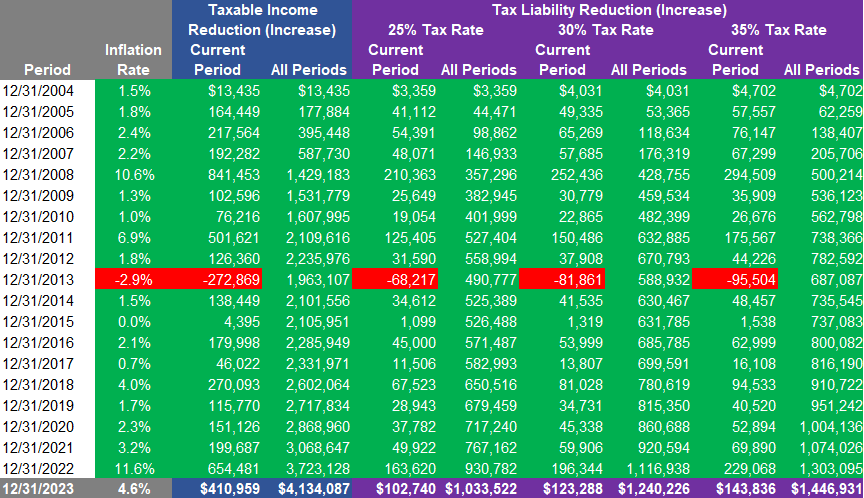

Ignoring the complexities of a LIFO calculation and other factors that could affect the final result, a heavily-relied upon approach for estimating the LIFO reserve change in any given year is provided below (LIFO reserve = difference between inventory at cost i.e, FIFO or average cost and the LIFO inventory value; the year over year change in the LIFO reserve is known as LIFO expense when it increases & LIFO income when it decreases. The LIFO expense and reserve is always the same amount in the election year since the prior year LIFO reserve balance is always zero in the year of election). The formula shown below can be put to immediate use by obtaining the prior year end’s inventory balance and the inflation rates provided in this blog.

Quick Election Year LIFO Tax Benefit Formula

Election Year LIFO Tax Benefit Example

| BLS PPI Code | BLS Commodity Category Description | 9M Ended Sep. '23 (YTD) | 12M Ended Sep. '23 | 12M Ended Dec. '22 | 3Y Annual Avg. | 5Y Annual Avg. | 10Y Annual Avg. | 20Y Annual Avg. | Inflation Frequency '04 - '23 | Inflation Frequency Rate | YTD vs. 20Y Average Inflation Multiplier |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0211 | Bakery products | 3.1% | 5.2% | 14.2% | 6.9% | 4.6% | 2.9% | 3.1% | 19 of 20 | 95% | 1.02 |

| 021107 | Other sweet goods, excluding frozen | 6.4% | 11.2% | 20.5% | 9.8% | 7.4% | 4.3% | 3.8% | 18 of 20 | 90% | 1.70 |

| 021108 | Soft cakes, excluding frozen | 6.8% | 4.8% | 12.9% | 9.9% | 6.7% | 3.4% | 3.9% | 15 of 20 | 75% | 1.75 |

| 021121 | Cookies, crackers, and related products | 2.8% | 2.8% | 7.5% | 3.9% | 2.8% | 1.4% | 1.8% | 16 of 20 | 80% | 1.57 |

| 0214 | Cereal and pasta products | 5.1% | 7.6% | 15.6% | 10.5% | 6.7% | 2.7% | 3.4% | 15 of 20 | 75% | 1.50 |

| 021409 | Cereal and mill products, other than flour | 6.5% | 9.3% | 13.0% | 10.4% | 6.6% | 2.6% | 3.3% | 15 of 20 | 75% | 1.96 |

| 022 | Meats, poultry, and fish | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.33 |

| 0221 | Meats | 11.1% | 8.1% | -0.8% | 11.1% | 6.4% | 3.0% | 3.1% | 15 of 20 | 75% | 3.56 |

| 022101 | Beef and veal products, fresh or frozen | 21.4% | 19.2% | -6.1% | 15.0% | 7.8% | 4.3% | 3.8% | 12 of 20 | 60% | 5.71 |

| 022104 | Pork products, fresh, frozen, or processed, except sausage | 2.9% | -2.7% | 0.3% | 7.0% | 4.1% | 0.2% | 2.0% | 12 of 20 | 60% | 1.50 |

| 022105 | Other meats, fresh, frozen, or canned | 5.8% | 3.5% | 6.0% | 9.3% | 6.5% | 3.4% | 3.2% | 15 of 20 | 75% | 1.85 |

| 022203 | Young chickens, including bulk, chilled, frozen, whole, and in parts | 4.1% | -9.9% | -6.0% | 9.9% | 4.6% | 1.6% | 2.5% | 12 of 20 | 60% | 1.66 |

| 022208 | Canned, cooked, smoked or prepared poultry | 18.4% | -14.0% | -22.0% | 2.8% | 0.7% | 0.1% | 1.0% | 13 of 20 | 65% | 18.75 |

| 023105 | Other milk products | 2.6% | 3.6% | 10.9% | 5.4% | 3.9% | 1.9% | 2.3% | 14 of 20 | 70% | 1.11 |

| 024 | Processed fruits and vegetables | 9.1% | 12.9% | 18.2% | 11.1% | 6.9% | 4.2% | 4.0% | 17 of 20 | 85% | 2.28 |

| 0241 | Canned fruits and juices | 10.8% | 12.6% | 14.9% | 10.0% | 5.6% | 3.9% | 3.9% | 16 of 20 | 80% | 2.80 |

| 024101 | Canned fruits, excluding baby foods | 5.2% | 6.1% | 18.0% | 9.3% | 6.8% | 4.2% | 4.0% | 15 of 20 | 75% | 1.29 |

| 024102 | Canned and fresh fruit juices, nectars, and concentrates | 14.4% | 16.8% | 13.3% | 10.6% | 5.2% | 3.7% | 3.8% | 16 of 20 | 80% | 3.79 |

| 0242 | Frozen fruits, juices and ades | 11.2% | 14.2% | -0.1% | 12.6% | 3.5% | 3.9% | 4.0% | 13 of 20 | 65% | 2.77 |

| 0244 | Canned vegetables and juices | 3.6% | 8.9% | 24.0% | 10.8% | 8.4% | 3.8% | 3.4% | 16 of 20 | 80% | 1.06 |

| 0245 | Frozen vegetables | 15.0% | 18.7% | 24.5% | 14.0% | 8.8% | 5.2% | 4.5% | 18 of 20 | 90% | 3.34 |

| 024502 | Frozen potato products (French-fried, patties, puffs, etc.) | 26.8% | 31.7% | 32.4% | 19.2% | 11.2% | 6.3% | 5.7% | 18 of 20 | 90% | 4.68 |

| 0248 | Dried and dehydrated food | 7.6% | 12.0% | 12.0% | 8.3% | 5.3% | 3.7% | 17 of 20 | 85% | 2.05 | |

| 025 | Sugar and confectionery | 6.6% | 6.8% | 8.8% | 6.4% | 4.2% | 2.2% | 3.0% | 16 of 20 | 80% | 2.19 |

| 0252 | Raw cane sugar and sugar cane mill products and byproducts | 9.1% | 12.6% | 14.3% | 11.1% | 9.2% | 4.6% | 3.8% | 13 of 20 | 65% | 2.37 |

| 0253 | Refined sugar products and byproducts | 7.7% | 13.3% | 8.8% | 8.2% | 6.5% | 3.2% | 3.3% | 14 of 20 | 70% | 2.31 |

| 0254 | Confectionery materials | 20.9% | 16.6% | 17.0% | 14.5% | 8.9% | 3.1% | 3.8% | 16 of 20 | 80% | 5.55 |

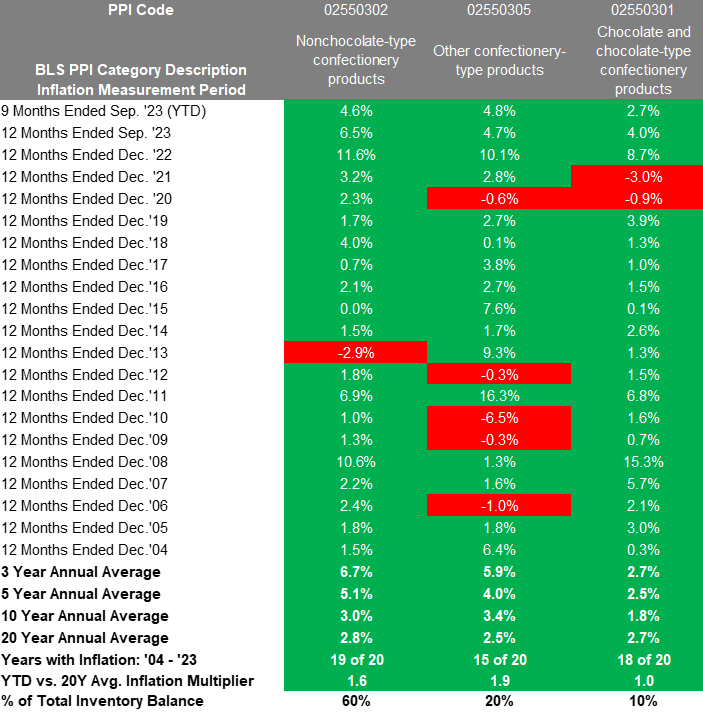

| 02550302 | Nonchocolate-type confectionery products | 4.6% | 6.5% | 11.6% | 6.7% | 5.1% | 3.0% | 2.8% | 19 of 20 | 95% | 1.62 |

| 02550305 | Other confectionery-type products | 4.8% | 4.7% | 10.1% | 5.9% | 4.0% | 3.4% | 2.5% | 13 of 18 | 72% | 1.95 |

| 026 | Beverages and beverage materials | 4.2% | 5.7% | 10.2% | 6.3% | 4.4% | 2.7% | 2.7% | 20 of 20 | 100% | 1.58 |

| 026104 | Wines, brandy, and brandy spirits | 2.2% | 8.1% | 8.7% | 4.6% | 3.4% | 2.1% | 1.9% | 18 of 20 | 90% | 1.18 |

| 0262 | Soft drinks | 6.5% | 5.0% | 12.3% | 9.3% | 6.8% | 4.0% | 3.1% | 20 of 20 | 100% | 2.07 |

| 02620609 | Soft drinks, non-carbonated | 9.5% | 2.4% | 7.0% | 8.2% | 5.8% | 2.7% | 3.2% | 16 of 20 | 80% | 2.98 |

| 0263 | Packaged beverage materials | 7.8% | 18.2% | 18.8% | 9.5% | 5.7% | 2.8% | 3.4% | 14 of 20 | 70% | 2.29 |

| 026301 | Coffee (whole bean, ground, & instant) | 7.2% | 18.7% | 20.5% | 9.8% | 5.9% | 2.9% | 3.6% | 14 of 20 | 70% | 2.01 |

| 026303 | Tea in consumer packages, exc. canned ice tea | 14.0% | 15.9% | 7.0% | 7.5% | 4.2% | 2.4% | 2.4% | 17 of 20 | 85% | 5.79 |

| 0264 | Other beverage materials | 5.9% | 6.3% | 14.1% | 10.8% | 8.0% | 4.6% | 3.8% | 18 of 20 | 90% | 1.57 |

| 0285 | Frozen specialty food | 2.6% | 4.3% | 16.7% | 7.5% | 4.3% | 2.2% | 2.2% | 14 of 20 | 70% | 1.19 |

| 02850109 | Frozen cakes, pies, and other pastries | 5.6% | 7.2% | 13.0% | 6.8% | 5.0% | 2.9% | 3.4% | 18 of 20 | 90% | 1.66 |

| 02850111 | Frozen dinners (beef, pork, and poultry pies) and nationality foods, incl. frozen pizza | 1.9% | 4.0% | 14.1% | 6.7% | 3.2% | 1.4% | 1.4% | 12 of 20 | 60% | 1.32 |

| 028601 | Prepared sauces, excluding tomato-based sauces and sauces comprised of 20 percent or more meat | 11.0% | 12.9% | 12.8% | 8.8% | 5.7% | 3.1% | 2.7% | 17 of 20 | 85% | 4.08 |

| 02890148 | Dry mix food preparations | 2.0% | 4.0% | 7.3% | 3.9% | 2.8% | 1.9% | 1.7% | 15 of 20 | 75% | 1.19 |

| 02890172 | Chips (potato, corn, etc.) | 10.3% | 14.0% | 15.7% | 10.9% | 7.4% | 3.5% | 3.9% | 18 of 20 | 90% | 2.66 |

| 029402 | Pet food | 6.4% | 7.3% | 14.1% | 9.5% | 6.5% | 3.6% | 4.2% | 19 of 20 | 95% | 1.53 |

| 0337 | Greige broadwoven fabrics | 3.5% | 1.9% | 8.4% | 7.1% | 4.4% | 2.3% | 2.4% | 14 of 20 | 70% | 1.45 |

| 0346 | Coated fabrics, not rubberized | 3.5% | 3.3% | 13.4% | 8.1% | 5.4% | 3.1% | 3.2% | 17 of 20 | 85% | 1.11 |

| 038 | Apparel & other fabricated textile prods | 2.2% | 3.2% | 5.2% | 4.9% | 3.1% | 2.2% | 1.8% | 18 of 20 | 90% | 1.23 |

| 0381 | Apparel | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.02 |

| 038104 | Miscellaneous apparel and accessories | 3.7% | 4.1% | 7.3% | 5.8% | 4.3% | 3.0% | 2.6% | 19 of 20 | 95% | 1.41 |

| 0383 | Industrial and other fabricated products | 3.8% | 5.1% | 6.4% | 7.5% | 5.2% | 3.0% | 2.6% | 18 of 20 | 90% | 1.43 |

| 03830351 | All other fabricated textile products, excluding trimming and findings | 3.9% | 5.8% | 5.7% | 7.3% | 4.9% | 2.7% | 2.1% | 16 of 20 | 80% | 1.86 |

| 04 | Hides, skins, leather, and related products | 2.0% | 2.7% | 3.2% | 7.1% | 0.2% | -1.9% | 0.5% | 12 of 20 | 60% | 4.12 |

| 043 | Footwear | 1.4% | 5.8% | 11.1% | 6.1% | 4.2% | 3.0% | 2.7% | 18 of 20 | 90% | 2.13 |

| 0431 | Men's nonathletic footwear | 2.0% | 8.3% | 13.8% | 7.4% | 4.9% | 3.3% | 3.0% | 20 of 20 | 100% | 2.73 |

| 044 | Other leather and related products | 4.9% | 5.1% | 4.2% | 4.1% | 2.9% | 2.4% | 2.0% | 20 of 20 | 100% | 2.41 |

| 0441 | Luggage and small leather goods | 6.8% | 6.9% | 2.5% | 3.4% | 2.4% | 2.1% | 1.9% | 18 of 20 | 90% | 3.54 |

| 0445 | Leather and leather-like goods, n.e.c. | 2.7% | 3.1% | 6.3% | 4.9% | 3.4% | 3.0% | 2.3% | 20 of 20 | 100% | 1.18 |

| 05 | Fuels and related products and power | 5.1% | -11.9% | 12.1% | 20.2% | 6.0% | 1.6% | 4.1% | 13 of 20 | 65% | 1.24 |

| 056 | Crude petroleum (domestic production) | 20.2% | -1.4% | 9.1% | 37.8% | 3.2% | -2.1% | 6.0% | 13 of 20 | 65% | 3.35 |

| 057 | Petroleum products, refined | 18.8% | -6.1% | 10.2% | 32.7% | 8.3% | 1.2% | 6.4% | 13 of 20 | 65% | 2.93 |

| 0571 | Gasoline | 37.1% | 7.1% | -5.5% | 32.3% | 6.1% | 0.0% | 5.1% | 12 of 20 | 60% | 7.23 |

| 0572 | Kerosene and jet fuels | 13.6% | -7.2% | 37.2% | 43.1% | 8.3% | 1.2% | 7.9% | 14 of 20 | 70% | 1.73 |

| 0637 | Biological products, including diagnostics | 4.8% | 5.1% | 0.5% | 5.1% | 4.3% | 2.8% | 3.0% | 19 of 20 | 95% | 1.59 |

| 063807 | Vitamin, nutrient, and hematinic preparations | 3.6% | 4.4% | 5.3% | 3.3% | 2.2% | 2.5% | 2.1% | 19 of 20 | 95% | 1.70 |

| 0671 | Soaps and detergents | 8.2% | 10.4% | 11.7% | 8.7% | 5.4% | 2.9% | 3.0% | 17 of 20 | 85% | 2.73 |

| 0672 | Polish and other sanitation goods | 2.2% | 2.6% | 6.3% | 4.5% | 3.7% | 3.1% | 2.5% | 18 of 20 | 90% | 1.02 |

| 0675 | Cosmetics and other toilet preparations | 4.5% | 5.3% | 6.4% | 4.1% | 2.8% | 2.0% | 1.5% | 17 of 20 | 85% | 2.95 |

| 067503 | Perfumes, toilet waters, and colognes | 3.0% | 4.1% | 3.9% | 4.1% | 2.1% | 1.6% | 1.0% | 14 of 18 | 78% | 2.90 |

| 067505 | Dentifrices | 7.6% | 7.6% | 6.4% | 4.7% | 4.8% | 2.8% | 2.4% | 11 of 15 | 73% | 3.10 |

| 067514 | Creams, lotions and oils, excluding shaving, hair, and deodorant | 5.4% | 7.1% | 7.5% | 4.4% | 3.0% | 1.5% | 1.4% | 17 of 20 | 85% | 3.82 |

| 067515 | Other cosmetics and toilet preparations | 4.6% | 4.6% | 4.8% | 4.0% | 2.5% | 1.9% | 1.0% | 14 of 20 | 70% | 4.73 |

| 0712 | Tires, tubes, tread, & repair materials | 2.3% | 4.3% | 15.2% | 8.4% | 5.4% | 2.3% | 3.5% | 15 of 20 | 75% | 1.24 |

| 0723 | Laminated plastic sheets, rods, and tubes | 4.1% | 3.4% | 12.9% | 8.2% | 5.4% | 3.3% | 2.9% | 17 of 19 | 89% | 1.43 |

| 07290197 | All other reinforced and fiberglass plastics products | 7.4% | 10.0% | 15.7% | 12.0% | 7.6% | 4.1% | 4.4% | 18 of 20 | 90% | 1.69 |

| 08210112 | Wood window units | 4.5% | 2.1% | 17.6% | 10.5% | 8.1% | 5.6% | 4.0% | 19 of 20 | 95% | 1.13 |

| 0849 | Miscellaneous wood products | 4.2% | 0.7% | 6.8% | 5.6% | 3.5% | 2.7% | 2.0% | 17 of 20 | 85% | 2.07 |

| 104103 | Transportation equipment hardware | 3.6% | 4.8% | 2.4% | 11.0% | 6.9% | 3.6% | 2.5% | 12 of 20 | 60% | 1.42 |

| 1042 | Hand and edge tools | 2.7% | 4.5% | 7.7% | 5.2% | 4.3% | 2.5% | 2.6% | 19 of 20 | 95% | 1.03 |

| 10540218 | Lavatory and sink fittings | 3.7% | 4.2% | 11.0% | 6.1% | 5.8% | 3.8% | 3.4% | 18 of 19 | 95% | 1.08 |

| 106 | Heating equipment | 1.2% | 4.7% | 10.8% | 11.0% | 7.6% | 4.8% | 4.4% | 20 of 20 | 100% | 1.06 |

| 1061 | Steam and hot water equipment | 8.9% | 9.7% | 12.7% | 12.2% | 7.9% | 4.8% | 4.9% | 19 of 20 | 95% | 1.84 |

| 1063 | Other heating equipment, non-electric, including parts | 3.5% | 10.8% | 15.6% | 12.0% | 8.8% | 5.1% | 4.1% | 20 of 20 | 100% | 2.64 |

| 1079 | Prefabricated metal buildings | 7.1% | 2.9% | -4.0% | 15.6% | 8.7% | 6.7% | 6.7% | 15 of 20 | 75% | 1.06 |

| 1081 | Bolts, nuts, screws, rivets, and washers | 4.3% | 6.6% | 15.1% | 11.9% | 9.6% | 5.1% | 4.4% | 18 of 20 | 90% | 1.49 |

| 108102 | Externally threaded fasteners, except aircraft types | 6.6% | 4.1% | 11.7% | 10.6% | 8.9% | 4.9% | 4.3% | 17 of 20 | 85% | 1.53 |

| 1083 | Lighting fixtures | 2.9% | 4.0% | 7.0% | 6.0% | 5.0% | 3.1% | 2.5% | 20 of 20 | 100% | 1.16 |

| 108905 | Other metal products | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.04 |

| 11 | Machinery and equipment | 3.1% | 4.4% | 9.1% | 6.4% | 4.5% | 2.6% | 1.8% | 17 of 20 | 85% | 1.72 |

| 111409 | Parts for farm machinery, for sale separately | 3.2% | 3.8% | 8.1% | 11.2% | 7.0% | 3.9% | 3.2% | 17 of 20 | 85% | 1.01 |

| 112 | Construction machinery and equipment | 5.8% | 6.1% | 8.7% | 8.2% | 6.4% | 3.6% | 3.4% | 20 of 20 | 100% | 1.71 |

| 112A | Tractors and attachments, ex. parts | 7.4% | 6.0% | 5.1% | 7.4% | 6.4% | 3.3% | 3.2% | 19 of 20 | 95% | 2.32 |

| 112A03 | Construction machinery for mounting (excluding parts, winches, snow clearing attachments) | 10.1% | 10.1% | 7.9% | 9.0% | 6.3% | 3.6% | 3.2% | 18 of 20 | 90% | 3.14 |

| 112A04 | Tractor shovel loaders (skid steer, wheel, crawler, and integral design backhoes) | 5.4% | 5.5% | 10.0% | 7.6% | 6.8% | 3.4% | 3.3% | 19 of 20 | 95% | 1.64 |

| 112B | Power cranes, draglines, & shovels (excavators) (incl. surface mining equipment) (excl. parts) | 8.3% | 8.8% | 11.1% | 9.3% | 7.5% | 3.6% | 3.0% | 19 of 20 | 95% | 2.78 |

| 112B05 | Power cranes, draglines, & shovels (excavators) (incl. surface mining equip.) (excluding parts) | 8.3% | 8.8% | 11.1% | 9.3% | 7.5% | 3.6% | 3.0% | 19 of 20 | 95% | 2.78 |

| 112C | Mixers, pavers, and related equipment (excluding parts) | 8.9% | 10.3% | 15.6% | 13.4% | 9.8% | 5.6% | 4.0% | 18 of 20 | 90% | 2.20 |

| 112D | Off-highway, equipment, ex. parts | 6.6% | 7.7% | 10.3% | 8.0% | 6.8% | 3.3% | 3.6% | 20 of 20 | 100% | 1.81 |

| 113 | Metalworking machinery and equipment | 4.4% | 5.8% | 8.1% | 6.7% | 4.5% | 2.8% | 2.4% | 19 of 20 | 95% | 1.84 |

| 1132 | Power-driven handtools, including parts and attachments | 11.6% | 11.6% | 6.1% | 9.6% | 6.2% | 4.0% | 2.5% | 18 of 20 | 90% | 4.60 |

| 113302 | Resistance welders, components, accessories, and electrodes | 3.5% | 3.5% | 9.2% | 6.8% | 4.6% | 2.3% | 3.2% | 16 of 20 | 80% | 1.10 |

| 113304 | Gas welding and cutting equipment, parts, attachments, and accessories | 4.5% | 4.5% | 8.2% | 5.9% | 3.9% | 2.1% | 2.4% | 17 of 20 | 85% | 1.90 |

| 113306 | Other welding equipment, components, and accessories (excluding arc, resistance, and gas) | 2.4% | 2.4% | 9.6% | 5.9% | 4.2% | 2.9% | 2.3% | 19 of 20 | 95% | 1.05 |

| 1134 | Industrial process furnaces and ovens | 5.2% | 5.8% | 11.3% | 8.4% | 6.1% | 3.7% | 2.8% | 19 of 20 | 95% | 1.82 |

| 1135 | Cutting tools and accessories | 2.7% | 4.6% | 6.2% | 4.4% | 3.4% | 2.3% | 2.2% | 20 of 20 | 100% | 1.24 |

| 113501 | Small cutting tools | 2.5% | 4.5% | 5.5% | 3.7% | 2.9% | 2.1% | 2.2% | 18 of 19 | 95% | 1.14 |

| 113505 | Other machine tool attachments and accessories | 7.4% | 10.6% | 10.5% | 9.3% | 6.7% | 4.1% | 2.9% | 17 of 19 | 89% | 2.51 |

| 1136 | Abrasive products | 2.1% | 5.9% | 9.6% | 8.0% | 5.6% | 3.6% | 3.3% | 20 of 20 | 100% | 1.78 |

| 1137 | Metal cutting machine tools | 2.9% | 4.1% | 3.3% | 3.8% | 3.0% | 1.8% | 2.2% | 19 of 20 | 95% | 1.34 |

| 1138 | Metal forming machine tools | 12.4% | 12.4% | 5.3% | 7.0% | 5.6% | 3.2% | 2.9% | 18 of 20 | 90% | 4.29 |

| 1139 | Tools, dies, jigs, fixtures & ind. molds | 4.2% | 5.5% | 7.9% | 6.0% | 3.7% | 2.0% | 1.4% | 15 of 20 | 75% | 3.04 |

| 113901 | Special tools, dies, jigs, and fixtures | 2.5% | 3.0% | 5.5% | 4.9% | 3.5% | 2.0% | 1.4% | 16 of 20 | 80% | 1.78 |

| 113903 | Industrial molds and mold boxes | 6.9% | 9.3% | 11.2% | 7.8% | 4.0% | 2.0% | 1.4% | 14 of 20 | 70% | 4.96 |

| 113A | Metalworking machinery n. e. c. | 8.5% | 8.5% | 8.1% | 6.6% | 4.2% | 2.9% | 2.2% | 17 of 18 | 94% | 3.84 |

| 114 | General purpose machinery and equipment | 4.8% | 6.0% | 13.4% | 9.6% | 6.7% | 4.2% | 3.8% | 20 of 20 | 100% | 1.26 |

| 1141 | Pumps, compressors, and equipment | 5.8% | 7.1% | 16.0% | 9.8% | 6.5% | 4.2% | 4.0% | 20 of 20 | 100% | 1.46 |

| 1142 | Elevators, escalators, and other lifts | 5.3% | 5.9% | 5.0% | 8.9% | 6.5% | 4.2% | 2.9% | 17 of 20 | 85% | 1.79 |

| 1143 | Fluid power equipment | 10.1% | 10.6% | 11.4% | 10.1% | 7.1% | 4.1% | 4.0% | 20 of 20 | 100% | 2.54 |

| 114301 | Fluid power pumps and parts | 4.0% | 4.9% | 7.9% | 5.7% | 4.1% | 2.5% | 2.9% | 20 of 20 | 100% | 1.37 |

| 114304 | Fluid power hose and tube fittings | 35.1% | 35.0% | 15.9% | 19.3% | 12.4% | 6.4% | 5.4% | 19 of 20 | 95% | 6.54 |

| 1144 | Industrial material handling equipment | 2.8% | 4.7% | 9.6% | 9.0% | 6.2% | 4.1% | 3.9% | 19 of 20 | 95% | 1.21 |

| 11440216 | Bulk material handling conveyors and conveying systems | 7.5% | 8.9% | 13.6% | 13.7% | 9.6% | 5.6% | 4.2% | 19 of 20 | 95% | 1.79 |

| 11440357 | Work trucks not fitted with lifting & handling equipment, electric or non-electric | 4.1% | 4.5% | 10.4% | 10.2% | 6.5% | 4.1% | 3.8% | 10 of 12 | 83% | 1.07 |

| 1145 | Mechanical power transmission equipment | 2.5% | 5.1% | 15.2% | 8.6% | 6.2% | 3.6% | 3.9% | 18 of 20 | 90% | 1.31 |

| 1146 | Scales and balances | 4.0% | 6.6% | 10.1% | 8.9% | 6.4% | 4.8% | 3.5% | 20 of 20 | 100% | 1.15 |

| 1147 | Air purification equipment and industrial and commercial fans and blowers | 2.1% | 3.1% | 10.3% | 7.6% | 5.5% | 3.8% | 3.3% | 19 of 20 | 95% | 1.00 |

| 1148 | Air conditioning and refrigeration equip | 4.0% | 4.3% | 19.3% | 12.6% | 8.7% | 5.2% | 3.9% | 19 of 20 | 95% | 1.02 |

| 1149 | Miscellaneous general purpose equipment | 4.2% | 5.6% | 10.9% | 7.8% | 5.6% | 3.6% | 3.9% | 20 of 20 | 100% | 1.10 |

| 114902 | Metal valves, except fluid power | 3.3% | 5.8% | 14.9% | 7.9% | 6.0% | 4.3% | 4.9% | 20 of 20 | 100% | 1.20 |

| 114908 | Filters and strainers | 16.2% | 15.6% | 5.8% | 10.9% | 7.0% | 3.9% | 3.8% | 19 of 20 | 95% | 4.28 |

| 114911 | Other miscellaneous general purpose equipment | 2.8% | 3.7% | 7.4% | 5.2% | 4.0% | 2.5% | 2.5% | 19 of 20 | 95% | 1.12 |

| 116 | Special industry machinery and equipment | 3.3% | 5.9% | 11.1% | 9.0% | 6.0% | 3.6% | 2.5% | 19 of 20 | 95% | 1.30 |

| 1161 | Food products machinery | 3.4% | 5.2% | 10.5% | 7.4% | 5.4% | 3.7% | 3.6% | 20 of 20 | 100% | 1.45 |

| 116104 | Commercial food products machinery (except packaging and cooking equipment) | 3.5% | 6.0% | 10.3% | 7.1% | 5.0% | 3.4% | 3.1% | 19 of 20 | 95% | 1.12 |

| 1163 | Sawmill and woodworking machinery | 6.8% | 7.4% | 10.6% | 9.0% | 6.3% | 5.5% | 3.8% | 19 of 20 | 95% | 1.81 |

| 1164 | Paper industries machinery | 4.4% | 4.9% | 9.8% | 6.6% | 4.6% | 2.8% | 2.5% | 20 of 20 | 100% | 1.78 |

| 1166 | Other special industry machinery | 3.1% | 6.9% | 11.5% | 11.0% | 7.4% | 4.0% | 2.1% | 16 of 20 | 80% | 1.45 |

| 116606 | Miscellaneous special industry machinery | 3.4% | 7.7% | 12.4% | 12.5% | 8.3% | 4.5% | 2.0% | 14 of 20 | 70% | 1.72 |

| 1167 | Packing, packaging, and bottling machinery and parts | 7.1% | 10.0% | 9.8% | 9.4% | 5.2% | 4.0% | 3.3% | 19 of 20 | 95% | 2.15 |

| 117 | Electrical machinery and equipment | 1.3% | 2.1% | 7.1% | 4.4% | 3.1% | 1.7% | 0.8% | 12 of 20 | 60% | 1.61 |

| 1171 | Wiring devices | 4.5% | 5.9% | 11.2% | 14.7% | 9.5% | 4.9% | 4.5% | 18 of 20 | 90% | 1.00 |

| 117101 | Current-carrying wiring devices | 24.2% | 25.5% | 6.9% | 13.7% | 8.4% | 4.2% | 3.7% | 18 of 20 | 90% | 6.49 |

| 11710143 | Current-carrying switches for electrical circuitry (including vehicular switches) | 4.4% | 5.2% | 6.1% | 6.1% | 4.0% | 4.2% | 3.3% | 16 of 20 | 80% | 1.34 |

| 11710144 | Current-carrying wire connectors for electrical circuitry | 4.0% | 5.2% | 9.2% | 8.2% | 5.4% | 2.5% | 2.9% | 17 of 20 | 85% | 1.35 |

| 1172 | Integrating and measuring instruments | 3.6% | 4.4% | 4.4% | 2.6% | 1.8% | 0.8% | 1.1% | 14 of 20 | 70% | 3.41 |

| 1173 | Motors, generators, motor generator sets | 5.3% | 5.6% | 10.9% | 9.5% | 6.2% | 3.4% | 3.5% | 18 of 20 | 90% | 1.53 |

| 1175 | Switchgear, switchboard, industrial controls equipment | 3.3% | 6.7% | 20.4% | 11.2% | 7.5% | 4.1% | 3.6% | 18 of 20 | 90% | 1.84 |

| 1176 | Communications and related equipment and miscellaneous electronic systems & equipment | 1.8% | 1.7% | 4.3% | 3.2% | 3.3% | 2.0% | 1.1% | 16 of 20 | 80% | 1.60 |

| 117822 | Switches, mechanical (electronic applications) | 7.4% | 0.3% | 14.3% | 8.2% | 6.3% | 3.5% | 2.4% | 18 of 20 | 90% | 3.02 |

| 117824 | Connectors for electronic circuitry | 4.1% | 7.1% | 15.5% | 7.7% | 5.8% | 3.3% | 2.6% | 19 of 20 | 95% | 1.55 |

| 118 | Miscellaneous instruments | 4.5% | 6.4% | 9.6% | 5.9% | 4.2% | 2.9% | 2.3% | 20 of 20 | 100% | 1.93 |

| 1181 | Automatic environmental controls for monitoring residential, commercial, and appliance use | 5.5% | 6.5% | 4.8% | 6.0% | 4.1% | 2.7% | 2.1% | 18 of 20 | 90% | 2.69 |

| 1182 | Industrial process control instruments | 3.0% | 5.9% | 13.7% | 6.5% | 4.5% | 3.0% | 2.8% | 20 of 20 | 100% | 1.05 |

| 1184 | Fluid meters and counting devices | 9.0% | 8.6% | 10.3% | 8.4% | 5.6% | 4.2% | 3.4% | 20 of 20 | 100% | 2.62 |

| 1185 | Engineering and scientific instruments | 3.4% | 7.4% | 7.7% | 5.4% | 4.3% | 3.3% | 2.7% | 20 of 20 | 100% | 1.28 |

| 1186 | Measuring instruments and lenses | 4.2% | 4.7% | 6.6% | 4.3% | 3.2% | 2.2% | 1.7% | 19 of 20 | 95% | 2.52 |

| 1189 | Measuring & controlling devices, n.e.c. | 4.5% | 8.2% | 12.7% | 6.6% | 4.5% | 2.9% | 1.8% | 16 of 20 | 80% | 2.53 |

| 119 | Miscellaneous machinery | 4.0% | 5.5% | 6.5% | 4.9% | 3.6% | 2.0% | 2.3% | 17 of 20 | 85% | 1.74 |

| 1192 | Mining machinery and equipment | 5.7% | 7.8% | 11.5% | 11.0% | 8.9% | 5.1% | 5.1% | 20 of 20 | 100% | 1.12 |

| 1194 | Internal combustion engines | 6.1% | 6.6% | 7.0% | 5.0% | 3.4% | 1.8% | 1.6% | 17 of 20 | 85% | 3.91 |

| 1195 | Machine shop products | 3.5% | 4.1% | 4.9% | 4.4% | 3.3% | 2.0% | 2.3% | 19 of 20 | 95% | 1.52 |

| 1197 | Turbines and turbine generator sets | 5.5% | 6.0% | 2.2% | 3.9% | 3.9% | 1.7% | 2.5% | 14 of 19 | 74% | 2.22 |

| 1212 | Wood household furniture | 7.0% | 6.5% | 7.2% | 8.6% | 5.7% | 3.6% | 3.0% | 20 of 20 | 100% | 2.34 |

| 1221 | Wood office furniture and store fixtures | 2.9% | 4.0% | 11.8% | 8.4% | 5.7% | 3.6% | 2.7% | 20 of 20 | 100% | 1.08 |

| 1224 | Commercial furniture and fixtures, n.e.c. | 2.2% | 5.3% | 13.6% | 10.4% | 7.8% | 4.7% | 3.4% | 18 of 20 | 90% | 1.57 |

| 124101 | Household cooking appliances | 4.3% | 6.9% | 13.2% | 10.7% | 7.5% | 3.7% | 2.7% | 16 of 20 | 80% | 1.56 |

| 1245 | Portable residential lighting fixtures, including parts and accessories | 5.1% | 5.7% | 8.3% | 7.8% | 7.1% | 4.5% | 3.5% | 17 of 20 | 85% | 1.47 |

| 1257 | Speakers and commercial sound equipment | 2.2% | 2.5% | 7.1% | 6.4% | 4.3% | 2.2% | 15 of 20 | 75% | 1.00 | |

| 126 | Other household durable goods | 1.8% | 3.6% | 6.9% | 6.6% | 4.4% | 2.8% | 2.2% | 20 of 20 | 100% | 1.67 |

| 1265 | Mirrors (decorated and undecorated) | 9.4% | 3.6% | 6.9% | 5.5% | 3.3% | 2.8% | 2.1% | 14 of 18 | 78% | 4.58 |

| 13 | Nonmetallic mineral products | 4.9% | 5.9% | 13.2% | 8.7% | 6.0% | 4.2% | 4.1% | 19 of 20 | 95% | 1.21 |

| 1313 | Other finished glassware | 4.2% | 4.0% | 4.9% | 4.7% | 3.5% | 3.0% | 1.7% | 16 of 20 | 80% | 2.41 |

| 132 | Concrete ingredients and related products | 8.6% | 8.9% | 12.2% | 8.3% | 6.4% | 5.1% | 4.6% | 19 of 20 | 95% | 1.86 |

| 132101 | Construction sand, gravel and crushed stone | 8.5% | 8.3% | 11.9% | 8.1% | 6.6% | 5.1% | 4.9% | 20 of 20 | 100% | 1.74 |

| 1322 | Cement, hydraulic | 9.0% | 10.7% | 13.0% | 8.7% | 5.9% | 5.4% | 4.1% | 18 of 20 | 90% | 2.20 |

| 133 | Concrete products | 6.8% | 9.0% | 14.9% | 9.8% | 7.1% | 5.3% | 4.5% | 18 of 20 | 90% | 1.49 |

| 1331 | Concrete block and brick | 7.7% | 7.8% | 13.7% | 8.8% | 6.8% | 4.6% | 3.8% | 18 of 20 | 90% | 2.01 |

| 133111 | Structural concrete block | 9.4% | 9.4% | 14.6% | 9.4% | 7.5% | 4.8% | 4.0% | 18 of 20 | 90% | 2.36 |

| 133121 | Decorative concrete block | 8.2% | 9.0% | 11.5% | 7.8% | 6.2% | 4.1% | 4.0% | 19 of 20 | 95% | 2.08 |

| 133131 | Concrete brick | 7.8% | 7.6% | 11.2% | 8.2% | 6.3% | 5.1% | 4.0% | 18 of 20 | 90% | 1.95 |

| 133141 | Concrete pavers | 6.0% | 5.9% | 14.4% | 9.3% | 6.5% | 4.6% | 3.6% | 17 of 20 | 85% | 1.68 |

| 1332 | Concrete pipe | 13.6% | 19.4% | 19.9% | 15.2% | 10.5% | 6.2% | 4.6% | 16 of 20 | 80% | 2.97 |

| 1333 | Ready-mix concrete | 6.7% | 9.5% | 13.2% | 8.5% | 6.3% | 5.2% | 4.6% | 18 of 20 | 90% | 1.47 |

| 1334 | Precast concrete products | 5.9% | 7.3% | 13.3% | 10.7% | 7.9% | 5.5% | 4.6% | 19 of 20 | 95% | 1.29 |

| 134 | Clay construction products ex. refractories | 3.9% | 7.1% | 9.0% | 6.3% | 4.2% | 2.8% | 2.1% | 16 of 20 | 80% | 1.89 |

| 1344 | Clay floor and wall tile, glazed and unglazed | 8.5% | 7.6% | 3.4% | 5.4% | 3.3% | 2.0% | 1.5% | 16 of 20 | 80% | 5.84 |

| 1345 | Structural clay products, n.e.c. | 5.7% | 8.9% | 8.4% | 6.6% | 4.2% | 4.3% | 3.7% | 19 of 20 | 95% | 1.53 |

| 1353 | Nonclay refractories | 4.1% | 5.0% | 17.4% | 7.6% | 6.2% | 4.0% | 3.8% | 18 of 20 | 90% | 1.08 |

| 138 | Glass containers | 7.8% | 9.6% | 12.8% | 9.0% | 6.3% | 3.8% | 3.4% | 20 of 20 | 100% | 2.28 |

| 139202 | Mineral wool for industrial, equipment, and appliance insulation | 5.4% | 8.1% | 11.4% | 8.7% | 6.1% | 3.0% | 3.0% | 16 of 20 | 80% | 1.81 |

| 13980212 | Molded packing and sealing devices | 2.7% | 4.2% | 11.9% | 6.2% | 4.1% | 2.6% | 2.3% | 16 of 19 | 84% | 1.19 |

| 1399 | Nonmetallic minerals and products, n.e.c. | 7.6% | 7.4% | 9.7% | 6.9% | 4.0% | 3.0% | 3.7% | 18 of 20 | 90% | 2.05 |

| 13990209 | Ground or treated minerals and earths | 4.9% | 4.5% | 9.7% | 5.9% | 3.7% | 2.8% | 4.1% | 19 of 20 | 95% | 1.21 |

| 13990211 | Dimension stone mining and quarrying | 23.7% | 23.7% | 8.2% | 10.5% | 6.8% | 3.9% | 3.4% | 15 of 18 | 83% | 7.00 |

| 141104 | Motorcycles, including three-wheel motorbikes, motorscooters, mopeds, and parts | 2.9% | 5.4% | 2.8% | 1.9% | 1.3% | 1.7% | 0.9% | 11 of 15 | 73% | 3.45 |

| 1412 | Motor vehicles parts | 1.2% | 1.1% | 3.7% | 3.4% | 2.1% | 1.2% | 1.2% | 16 of 20 | 80% | 1.05 |

| 1413 | Truck and bus bodies | 2.6% | 4.5% | 16.0% | 8.9% | 6.6% | 4.1% | 3.5% | 19 of 20 | 95% | 1.27 |

| 142 | Aircraft and aircraft equipment | 3.0% | 3.8% | 4.4% | 3.1% | 2.4% | 1.8% | 2.4% | 19 of 20 | 95% | 1.28 |

| 1421 | Aircraft | 3.1% | 4.0% | 5.2% | 3.3% | 2.6% | 1.9% | 2.6% | 19 of 20 | 95% | 1.19 |

| 142102 | Civilian aircraft | 4.3% | 5.7% | 6.4% | 4.5% | 3.7% | 2.6% | 3.0% | 19 of 20 | 95% | 1.42 |

| 1425 | Other aircraft parts and equipment | 3.9% | 4.5% | 2.7% | 2.7% | 2.2% | 1.6% | 1.7% | 18 of 20 | 90% | 2.31 |

| 1432 | Boats | 2.8% | 4.1% | 11.4% | 7.4% | 5.9% | 4.1% | 3.4% | 20 of 20 | 100% | 1.2 |

| 143202 | Inboard motorboats, including commercial and military (except sailboats and lifeboats) | 4.0% | 6.3% | 11.4% | 7.1% | 5.4% | 3.9% | 3.2% | 19 of 20 | 95% | 1.3 |

| 143203 | Inboard-outdrive boats, including commercial and military (except sailboats and lifeboats) | 3.3% | 3.3% | 7.7% | 5.2% | 4.8% | 3.5% | 2.7% | 18 of 20 | 90% | 1.2 |

| 143204 | All other boats (excluding military and commercial) | 7.5% | 7.5% | 5.1% | 7.4% | 5.0% | 3.3% | 2.5% | 15 of 18 | 83% | 3.0 |

| 149 | Transportation equipment, n.e.c. | 2.6% | 1.9% | 5.0% | 6.0% | 4.1% | 2.6% | 2.0% | 17 of 20 | 85% | 1.3 |

| 149111 | Other transportation equipment, incl. golf carts, vehicle trailers, and all-terrain vehicles | 2.6% | 1.9% | 5.0% | 6.0% | 4.1% | 2.6% | 2.0% | 17 of 20 | 85% | 1.3 |

| 15 | Miscellaneous products | 4.0% | 5.4% | 8.9% | 6.6% | 5.3% | 3.6% | 3.3% | 20 of 20 | 100% | 1.2 |

| 151 | Toys, sporting goods, small arms, etc. | 3.6% | 7.3% | 11.5% | 8.3% | 5.7% | 3.3% | 2.4% | 17 of 20 | 85% | 1.5 |

| 1511 | Toys, games, and children's vehicles | 1.1% | 2.3% | 4.5% | 3.8% | 2.7% | 1.8% | 1.9% | 18 of 20 | 90% | 1.2 |

| 1512 | Sporting and athletic goods | 5.9% | 12.3% | 18.6% | 13.1% | 8.8% | 4.7% | 2.7% | 15 of 20 | 75% | 2.2 |

| 152 | Tobacco products, incl. stemmed & redried | 8.1% | 10.2% | 11.2% | 9.9% | 8.5% | 6.9% | 5.6% | 19 of 20 | 95% | 1.4 |

| 1521 | Cigarettes, excluding electronic | 8.9% | 11.1% | 11.9% | 10.7% | 9.2% | 7.3% | 5.9% | 20 of 20 | 100% | 1.5 |

| 154 | Photographic equipment and supplies | 6.8% | 4.9% | 6.6% | 6.7% | 5.5% | 3.0% | 2.5% | 14 of 20 | 70% | 2.7 |

| 156 | Medical, surgical & personal aid devices | 1.9% | 2.9% | 4.3% | 2.4% | 2.0% | 1.4% | 1.3% | 20 of 20 | 100% | 1.4 |

| 156201 | Surgical and medical instruments | 1.2% | 2.3% | 3.7% | 1.4% | 1.2% | 0.9% | 0.6% | 14 of 20 | 70% | 1.9 |

| 1563 | Medical and surgical appliances and supplies | 2.0% | 2.7% | 4.6% | 3.2% | 2.4% | 1.4% | 1.3% | 18 of 20 | 90% | 1.5 |

| 157 | Other industrial safety equipment | 3.1% | 6.9% | 11.4% | 7.2% | 5.4% | 2.9% | 2.3% | 18 of 20 | 90% | 1.3 |

| 1571 | Personal safety equipment and clothing | 3.1% | 6.9% | 11.4% | 7.2% | 5.4% | 2.9% | 2.3% | 18 of 20 | 90% | 1.3 |

| 159404 | Costume jewelry and novelties | 7.1% | 7.1% | 5.7% | 5.6% | 5.1% | 3.4% | 2.6% | 19 of 20 | 95% | 2.8 |

| 1595 | Pens, pencils, and marking devices | 3.4% | 3.4% | 7.0% | 5.2% | 3.6% | 2.6% | 1.9% | 20 of 20 | 100% | 1.8 |

| 159A | Miscellaneous products, n.e.c. | 2.9% | 3.7% | 16.0% | 10.6% | 8.0% | 4.5% | 3.1% | 17 of 20 | 85% | 1.2 |

| 159A04 | Signs and advertising displays | 3.5% | 6.6% | 16.4% | 9.1% | 5.9% | 3.7% | 2.5% | 18 of 20 | 90% | 1.4 |

| SS45011* | New cars | 1.3% | 1.7% | 6.2% | 6.7% | 4.3% | 2.0% | 1.4% | 12 of 20 | 60% | 1.0 |

| SS45021* | New trucks | 2.0% | 2.8% | 6.0% | 7.0% | 4.3% | 2.4% | 1.4% | 14 of 20 | 70% | 1.4 |

| * Represents a Consumer Price Index (CPI) category; all other codes listed above are Producer Price Indexes |

| NAICS/IRS PBA Code | NAICS PBA Industry Description | 9M Ended Sep. '23 (YTD) | 12M Ended Sep. '23 | 12M Ended Dec. '22 | 3Y Annual Avg. | 5Y Annual Avg. | 10Y Annual Avg. | 20Y Annual Avg. | 20Y Annual Avg. | Inflation Frequency '04 - '23 | YTD vs. 20Y Average Inflation Multiplier |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 311110 | Animal food mfg. | 6.4% | 7.3% | 14.1% | 9.5% | 6.5% | 3.6% | 4.2% | 19 of 20 | 95% | 1.5 |

| 311111 | Dog and cat food manufacturing | 7.1% | 8.2% | 14.3% | 9.4% | 6.5% | 3.8% | 4.2% | 19 of 20 | 95% | 1.7 |

| 311200 | Grain & oilseed milling | 2.1% | 4.3% | 15.3% | 8.7% | 5.6% | 2.9% | 3.4% | 16 of 20 | 80% | 1.3 |

| 311230 | Breakfast cereal manufacturing | 6.5% | 9.3% | 13.0% | 10.4% | 6.6% | 2.6% | 3.3% | 15 of 20 | 75% | 2.0 |

| 311300 | Sugar & confectionery product mfg. | 6.6% | 6.8% | 8.8% | 6.4% | 4.2% | 2.2% | 3.0% | 16 of 20 | 80% | 2.2 |

| 311313 | Beet sugar manufacturing | 9.1% | 12.6% | 14.3% | 11.1% | 9.2% | 4.6% | 3.8% | 13 of 20 | 65% | 2.4 |

| 311314 | Cane sugar manufacturing | 7.7% | 13.3% | 8.8% | 8.2% | 6.5% | 3.2% | 3.3% | 14 of 20 | 70% | 2.3 |

| 311340 | Nonchocolate confectionery manufacturing | 4.6% | 6.5% | 11.6% | 6.7% | 5.1% | 3.0% | 2.8% | 19 of 20 | 95% | 1.6 |

| 311351 | Chocolate and confectionery mfg. from cacao | 2.7% | 4.0% | 8.7% | 2.7% | 2.5% | 1.8% | 2.8% | 19 of 20 | 95% | 1.5 |

| 311352 | Confectionery mfg. from purchased chocolate | 2.7% | 4.0% | 8.7% | 2.7% | 2.5% | 1.8% | 2.8% | 19 of 20 | 95% | 1.5 |

| 311400 | Fruit & vegetable preserving & speciality food mfg. | 9.1% | 12.9% | 18.2% | 11.1% | 6.9% | 4.2% | 4.0% | 17 of 20 | 85% | 2.3 |

| 311411 | Frozen fruit and vegetable manufacturing | 9.1% | 12.9% | 18.2% | 11.1% | 6.9% | 4.2% | 4.0% | 17 of 20 | 85% | 2.3 |

| 311412 | Frozen specialty food manufacturing | 2.6% | 4.3% | 16.7% | 7.5% | 4.3% | 2.2% | 2.2% | 14 of 20 | 70% | 1.2 |

| 311421 | Fruit and vegetable canning | 10.8% | 12.6% | 14.9% | 10.0% | 5.6% | 3.9% | 3.9% | 16 of 20 | 80% | 2.8 |

| 311423 | Dried and dehydrated food manufacturing | 7.6% | 11.8% | 12.0% | 8.3% | 5.3% | 3.7% | 3.5% | 17 of 20 | 85% | 2.2 |

| 311610 | Animal slaughtering & processing | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.3 |

| 311611 | Animal, except poultry, slaughtering | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.3 |

| 311612 | Meat processed from carcasses | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.3 |

| 311613 | Rendering and meat byproduct processing | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.3 |

| 311800 | Bakeries, tortilla & dry pasta mfg. | 2.1% | 4.3% | 15.3% | 8.7% | 5.6% | 2.9% | 3.4% | 16 of 20 | 80% | 1.3 |

| 311812 | Commercial bakeries | 3.1% | 5.2% | 14.2% | 6.9% | 4.6% | 2.9% | 3.1% | 19 of 20 | 95% | 1.0 |

| 311813 | Frozen cakes and other pastries manufacturing | 5.6% | 7.2% | 13.0% | 6.8% | 5.0% | 2.9% | 3.4% | 18 of 20 | 90% | 1.7 |

| 311821 | Cookie and cracker manufacturing | 2.8% | 2.8% | 7.5% | 3.9% | 2.8% | 1.4% | 1.8% | 16 of 20 | 80% | 1.6 |

| 311824 | Dry pasta, dough, and flour mixes manufacturing from purchased flour | 2.1% | 4.3% | 15.3% | 8.7% | 5.6% | 2.9% | 3.4% | 16 of 20 | 80% | 1.3 |

| 311919 | Other snack food manufacturing | 10.3% | 14.0% | 15.7% | 10.9% | 7.4% | 3.5% | 3.9% | 18 of 20 | 90% | 2.7 |

| 311920 | Coffee and tea manufacturing | 7.8% | 18.2% | 18.8% | 9.5% | 5.7% | 2.8% | 3.4% | 14 of 20 | 70% | 2.3 |

| 312000 | Beverage & tobacco product mfg. | 8.1% | 10.2% | 11.2% | 9.9% | 8.5% | 6.9% | 5.6% | 19 of 20 | 95% | 1.4 |

| 312111 | Soft drink manufacturing | 6.5% | 5.0% | 12.3% | 9.3% | 6.8% | 4.0% | 3.1% | 20 of 20 | 100% | 2.1 |

| 312112 | Bottled water manufacturing | 4.8% | 7.2% | 18.2% | 9.8% | 6.8% | 2.4% | 2.7% | 11 of 20 | 55% | 1.8 |

| 312113 | Ice manufacturing | 4.5% | 19.4% | 29.8% | 11.7% | 7.7% | 4.5% | 3.8% | 17 of 20 | 85% | 1.2 |

| 312130 | Wineries | 2.2% | 8.1% | 8.7% | 4.6% | 3.4% | 2.1% | 1.9% | 18 of 20 | 90% | 1.2 |

| 312230 | Tobacco manufacturing | 8.9% | 11.1% | 11.9% | 10.7% | 9.2% | 7.3% | 5.9% | 20 of 20 | 100% | 1.5 |

| 313320 | Fabric coating mills | 3.5% | 3.3% | 13.4% | 8.1% | 5.4% | 3.1% | 3.2% | 17 of 20 | 85% | 1.1 |

| 314910 | Textile bag and canvas mills | 3.8% | 5.1% | 6.4% | 7.5% | 5.2% | 3.0% | 2.6% | 18 of 20 | 90% | 1.4 |

| 314994 | Rope, twine, tire cord, and tire fabric mills | 7.0% | 5.7% | 2.8% | 10.5% | 6.1% | 3.0% | 8 of 11 | 73% | 2.3 | |

| 314999 | All other miscellaneous textile product mills | 3.8% | 6.1% | 12.2% | 7.5% | 4.9% | 5 of 5 | 100% | 1.3 | ||

| 315000 | Apparel mfg. | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 315110 | Hosiery and sock mills | 1.7% | 1.7% | 4.6% | 2.6% | 1.7% | 1.4% | 1.2% | 16 of 20 | 80% | 1.4 |

| 315190 | Other apparel knitting mills | 1.7% | 1.7% | 4.6% | 2.6% | 1.7% | 1.4% | 1.2% | 16 of 20 | 80% | 1.4 |

| 315210 | Cut and sew apparel contractors | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 315220 | Men's and boys' cut and sew apparel manufacturing | 1.9% | 3.1% | 11.9% | 5.3% | 3.7% | 2.0% | 1.2% | 15 of 20 | 75% | 1.6 |

| 315280 | Other cut and sew apparel manufacturing | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 315990 | Accessories and other apparel manufacturing | 3.7% | 4.1% | 7.3% | 5.8% | 4.3% | 3.0% | 2.6% | 19 of 20 | 95% | 1.4 |

| 316110 | Leather & hide tanning & finishing | 2.0% | 2.7% | 3.2% | 7.1% | 0.2% | -1.9% | 0.5% | 12 of 20 | 60% | 4.1 |

| 316990 | Other leather & allied product mfg. | 2.7% | 3.1% | 6.3% | 4.9% | 3.4% | 3.0% | 2.3% | 20 of 20 | 100% | 1.2 |

| 316998 | All other leather and allied good mfg. | 2.7% | 3.1% | 6.3% | 4.9% | 3.4% | 3.0% | 2.3% | 20 of 20 | 100% | 1.2 |

| 321219 | Reconstituted wood product manufacturing | 3.9% | -0.3% | 3.0% | 4.0% | 2.5% | 1.9% | 14 of 16 | 88% | 2.1 | |

| 321999 | Miscellaneous wood product manufacturing | 3.9% | -0.3% | 3.0% | 4.0% | 2.5% | 1.9% | 14 of 16 | 88% | 2.1 | |

| 322212 | Folding paperboard box manufacturing | 2.8% | 6.5% | 22.0% | 11.4% | 8.0% | 4.0% | 14 of 19 | 74% | 1.7 | |

| 323100 | Printing & related support activities | 2.8% | 4.3% | 14.3% | 9.1% | 6.2% | 3.4% | 13 of 14 | 93% | 1.3 | |

| 323113 | Commercial screen printing | 3.0% | 6.6% | 16.2% | 9.1% | 5.2% | 1.8% | 9 of 15 | 60% | 1.7 | |

| 323117 | Books printing | 4.5% | 7.8% | 23.9% | 13.2% | 8.9% | 4.9% | 12 of 16 | 75% | 1.6 | |

| 323120 | Support activities for printing | 2.8% | 4.3% | 14.3% | 9.1% | 6.2% | 3.4% | 13 of 14 | 93% | 1.3 | |

| 324100 | Petroleum & coal products mfg. | 5.1% | -11.9% | 12.1% | 20.2% | 6.0% | 1.6% | 4.1% | 13 of 20 | 65% | 1.2 |

| 324110 | Petroleum refineries | 18.8% | -6.1% | 10.2% | 32.7% | 8.3% | 1.2% | 6.4% | 13 of 20 | 65% | 2.9 |

| 325413 | In-vitro diagnostic substance manufacturing | 4.8% | 5.1% | 0.5% | 5.1% | 4.3% | 2.8% | 3.0% | 19 of 20 | 95% | 1.6 |

| 325414 | Other biological product manufacturing | 4.8% | 5.1% | 0.5% | 5.1% | 4.3% | 2.8% | 3.0% | 19 of 20 | 95% | 1.6 |

| 325611 | Soap and other detergent manufacturing | 8.2% | 10.4% | 11.7% | 8.7% | 5.4% | 2.9% | 3.0% | 17 of 20 | 85% | 2.7 |

| 325620 | Toilet preparation manufacturing | 4.5% | 5.3% | 6.4% | 4.1% | 2.8% | 2.0% | 1.5% | 17 of 20 | 85% | 2.9 |

| 325992 | Photographic film and chemical manufacturing | 10.9% | 7.6% | 8.3% | 9.0% | 7.7% | 4.4% | 5 of 9 | 56% | 2.5 | |

| 326130 | Laminated plastics plate, sheet (except packaging), and shape manufacturing | 4.1% | 3.4% | 12.9% | 8.2% | 5.4% | 3.3% | 2.9% | 17 of 19 | 89% | 1.4 |

| 326211 | Tire manufacturing, except retreading | 2.3% | 4.3% | 15.2% | 8.4% | 5.4% | 2.3% | 3.5% | 15 of 20 | 75% | 1.2 |

| 326291 | Rubber product mfg. for mechanical use | 8.7% | 8.9% | 10.3% | 7.7% | 4.7% | 2.2% | 15 of 19 | 79% | 3.9 | |

| 327100 | Clay product & refractory mfg. | 4.9% | 5.9% | 13.2% | 8.7% | 6.0% | 4.2% | 4.1% | 19 of 20 | 95% | 1.2 |

| 327120 | Clay building material and refractories mfg. | 4.9% | 5.9% | 13.2% | 8.7% | 6.0% | 4.2% | 4.1% | 19 of 20 | 95% | 1.2 |

| 327212 | Other pressed and blown glass and glassware | 4.2% | 4.0% | 4.9% | 4.7% | 3.5% | 3.0% | 1.7% | 16 of 20 | 80% | 2.4 |

| 327213 | Glass container manufacturing | 7.8% | 9.6% | 12.8% | 9.0% | 6.3% | 3.8% | 3.4% | 20 of 20 | 100% | 2.3 |

| 327215 | Glass product mfg. made of purchased glass | 4.2% | 4.0% | 4.9% | 4.7% | 3.5% | 3.0% | 1.7% | 16 of 20 | 80% | 2.4 |

| 327300 | Cement & concrete product mfg. | 8.6% | 8.9% | 12.2% | 8.3% | 6.4% | 5.1% | 4.6% | 19 of 20 | 95% | 1.9 |

| 327310 | Cement manufacturing | 9.0% | 10.7% | 13.0% | 8.7% | 5.9% | 5.4% | 4.1% | 18 of 20 | 90% | 2.2 |

| 327320 | Ready-mix concrete manufacturing | 4.3% | 4.6% | 10.7% | 6.3% | 4.3% | 3.0% | 3.1% | 19 of 20 | 95% | 1.4 |

| 327331 | Concrete block and brick manufacturing | 7.7% | 7.8% | 13.7% | 8.8% | 6.8% | 4.6% | 3.8% | 18 of 20 | 90% | 2.0 |

| 327332 | Concrete pipe manufacturing | 13.6% | 19.4% | 19.9% | 15.2% | 10.5% | 6.2% | 4.6% | 16 of 20 | 80% | 3.0 |

| 327390 | Other concrete product manufacturing | 6.8% | 9.0% | 14.9% | 9.8% | 7.1% | 5.3% | 4.5% | 18 of 20 | 90% | 1.5 |

| 327400 | Lime & gypsum product mfg. | 8.6% | 8.9% | 12.2% | 8.3% | 6.4% | 5.1% | 4.6% | 19 of 20 | 95% | 1.9 |

| 327900 | Other nonmetallic mineral product mfg. | 4.3% | 4.6% | 10.7% | 6.3% | 4.3% | 3.0% | 3.1% | 19 of 20 | 95% | 1.4 |

| 327910 | Abrasive product manufacturing | 2.1% | 5.9% | 9.6% | 8.0% | 5.6% | 3.6% | 3.3% | 20 of 20 | 100% | 1.8 |

| 327992 | Ground or treated minerals and earths mfg. | 4.9% | 4.5% | 9.7% | 5.9% | 3.7% | 2.8% | 4.1% | 19 of 20 | 95% | 1.2 |

| 327999 | All other miscellaneous nonmetallic mineral product manufacturing | 7.6% | 7.4% | 9.7% | 6.9% | 4.0% | 3.0% | 3.7% | 18 of 20 | 90% | 2.0 |

| 331491 | Nonferrous metal (except copper and aluminum) rolling, drawing, and extruding | 5.4% | 3.7% | 0.0% | 8.8% | 3.0% | 2.8% | 4.4% | 12 of 20 | 60% | 1.2 |

| 331513 | Steel foundries, except investment | 2.7% | 5.8% | 14.4% | 4.5% | 3.6% | 2.2% | 3.6% | 18 of 20 | 90% | 1.6 |

| 332112 | Nonferrous forging | 4.2% | 2.7% | 7.9% | 6.2% | 4.8% | 2.4% | 1.7% | 10 of 19 | 53% | 2.5 |

| 332117 | Powder metallurgy part mfg | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 332216 | Saw blade, handsaw, and hand and edge tool mfg | 2.7% | 4.5% | 7.7% | 5.2% | 4.3% | 2.5% | 2.6% | 19 of 20 | 95% | 1.0 |

| 332311 | Prefabricated metal buildings and components mfg | 7.1% | 2.9% | -4.0% | 15.6% | 8.7% | 6.7% | 6.7% | 15 of 20 | 75% | 1.1 |

| 332410 | Power boiler and heat exchanger mfg | 8.9% | 9.7% | 12.7% | 12.2% | 7.9% | 4.8% | 4.9% | 19 of 20 | 95% | 1.8 |

| 332613 | Spring mfg | 8.6% | 8.5% | 27.0% | 19.5% | 11.8% | 6.9% | 5.3% | 15 of 20 | 75% | 1.6 |

| 332710 | Machine shops | 3.5% | 4.1% | 4.9% | 4.4% | 3.3% | 2.0% | 2.3% | 19 of 20 | 95% | 1.5 |

| 332721 | Precision turned product mfg | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 332722 | Bolt, nut, screw, rivet, and washer mfg | 4.3% | 6.6% | 15.1% | 11.9% | 9.6% | 5.1% | 4.4% | 18 of 20 | 90% | 1.5 |

| 332811 | Metal heat treating | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 332812 | Metal coating and nonprecious engraving | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 332813 | Electroplating, anodizing and coloring metal | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 332911 | Industrial valve mfg | 3.3% | 5.8% | 14.9% | 7.9% | 6.0% | 4.3% | 4.9% | 20 of 20 | 100% | 1.2 |

| 332912 | Fluid power valve and hose fitting mfg | 10.1% | 10.6% | 11.4% | 10.1% | 7.1% | 4.1% | 4.0% | 20 of 20 | 100% | 2.5 |

| 332996 | Fabricated pipe and pipe fitting mfg | 5.3% | 3.5% | -0.4% | 11.0% | 6.4% | 3.6% | 7 of 12 | 58% | 1.5 | |

| 332999 | Miscellaneous fabricated metal product mfg | 2.0% | 2.5% | 5.5% | 5.9% | 4.0% | 1.9% | 1.9% | 16 of 20 | 80% | 1.0 |

| 333000 | Machinery mfg. | 3.1% | 4.4% | 9.1% | 6.4% | 4.5% | 2.6% | 1.8% | 17 of 20 | 85% | 1.7 |

| 333120 | Construction machinery mfg | 5.8% | 6.1% | 8.7% | 8.2% | 6.4% | 3.6% | 3.4% | 20 of 20 | 100% | 1.7 |

| 333131 | Mining machinery and equipment mfg | 5.7% | 7.8% | 11.5% | 11.0% | 8.9% | 5.1% | 5.1% | 20 of 20 | 100% | 1.1 |

| 333132 | Oil and gas field machinery and equipment mfg | 1.9% | 7.4% | 9.6% | 4.9% | 3.1% | 1.7% | 3.0% | 15 of 20 | 75% | 2.5 |

| 333241 | Food product machinery mfg | 3.4% | 5.2% | 10.5% | 7.4% | 5.4% | 3.7% | 3.6% | 20 of 20 | 100% | 1.4 |

| 333243 | Sawmill, woodworking and paper machinery mfg | 6.8% | 7.4% | 10.6% | 9.0% | 6.3% | 5.5% | 18 of 19 | 95% | 1.3 | |

| 333249 | Other industrial machinery mfg | 3.1% | 6.9% | 11.5% | 11.0% | 7.4% | 4.0% | 2.1% | 16 of 20 | 80% | 1.4 |

| 333314 | Optical instrument and lens mfg | 5.7% | 6.4% | 5.5% | 4.5% | 3.5% | 2.1% | 1.9% | 17 of 20 | 85% | 3.0 |

| 333316 | Photographic and photocopying equipment mfg | 6.8% | 4.9% | 6.6% | 6.7% | 5.5% | 3.0% | 2.5% | 14 of 20 | 70% | 2.7 |

| 333415 | Air-conditioning, refrigeration, and forced air heating equipment mfg | 4.0% | 4.3% | 19.3% | 12.6% | 8.7% | 5.2% | 3.9% | 19 of 20 | 95% | 1.0 |

| 333511 | Industrial mold mfg | 6.9% | 9.3% | 11.2% | 7.8% | 4.0% | 2.0% | 1.4% | 14 of 20 | 70% | 5.0 |

| 333514 | Special tool, die, jig, and fixture mfg | 2.5% | 3.0% | 5.5% | 4.8% | 3.5% | 2.0% | 10 of 13 | 77% | 1.2 | |

| 333515 | Cutting tool and machine tool accessory mfg | 2.7% | 4.6% | 6.2% | 4.4% | 3.4% | 2.3% | 2.2% | 20 of 20 | 100% | 1.2 |

| 333517 | Machine tool mfg | 4.4% | 5.8% | 8.1% | 6.7% | 4.5% | 2.8% | 2.4% | 19 of 20 | 95% | 1.8 |

| 333519 | Rolling mill and other metalworking machinery mfg | 4.4% | 5.8% | 8.1% | 6.7% | 4.5% | 2.8% | 2.4% | 19 of 20 | 95% | 1.8 |

| 333611 | Turbine and turbine generator set units mfg | 5.5% | 6.0% | 2.2% | 3.9% | 3.9% | 1.7% | 2.5% | 14 of 19 | 74% | 2.2 |

| 333613 | Mechanical power transmission equipment mfg | 3.2% | 4.2% | 14.3% | 8.9% | 6.8% | 3.7% | 4.0% | 19 of 20 | 95% | 1.1 |

| 333618 | Other engine equipment mfg | 6.1% | 6.6% | 7.0% | 5.0% | 3.4% | 1.8% | 1.6% | 17 of 20 | 85% | 3.9 |

| 333912 | Air and gas compressor mfg | 3.8% | 5.4% | 21.2% | 11.2% | 8.1% | 5.1% | 17 of 18 | 94% | 1.1 | |

| 333914 | Measuring, dispensing, and other pumping equipment mfg | 5.8% | 7.1% | 16.0% | 9.8% | 6.5% | 4.2% | 4.0% | 20 of 20 | 100% | 1.5 |

| 333921 | Elevator and moving stairway mfg | 5.3% | 5.9% | 5.0% | 8.9% | 6.5% | 4.2% | 2.9% | 17 of 20 | 85% | 1.8 |

| 333924 | Industrial truck, trailer, and stacker mfg | 2.8% | 5.9% | 10.2% | 8.7% | 5.9% | 4.1% | 4.0% | 20 of 20 | 100% | 1.5 |

| 333991 | Power-driven handtool mfg | 11.6% | 11.6% | 6.1% | 9.6% | 6.2% | 4.0% | 2.5% | 18 of 20 | 90% | 4.6 |

| 333993 | Packaging machinery mfg | 7.1% | 10.0% | 9.8% | 9.4% | 5.2% | 4.0% | 3.3% | 19 of 20 | 95% | 2.2 |

| 333994 | Industrial process furnace and oven mfg | 5.2% | 5.8% | 11.3% | 8.4% | 6.1% | 3.7% | 2.8% | 19 of 20 | 95% | 1.8 |

| 333996 | Fluid power pump and motor mfg | 4.0% | 4.9% | 7.9% | 5.7% | 4.1% | 2.5% | 2.9% | 20 of 20 | 100% | 1.4 |

| 333997 | Scale and balance mfg | 4.0% | 6.6% | 10.1% | 8.9% | 6.4% | 4.8% | 3.5% | 20 of 20 | 100% | 1.1 |

| 333999 | All other miscellaneous general purpose machinery mfg | 2.8% | 3.7% | 7.4% | 5.2% | 4.0% | 2.5% | 2.5% | 19 of 20 | 95% | 1.1 |

| 334412 | Bare printed circuit board mfg | 6.1% | 4.5% | 4.7% | 5.3% | 3.3% | 1.9% | 1.3% | 10 of 17 | 59% | 4.8 |

| 334417 | Electronic connector mfg | 4.1% | 7.1% | 15.5% | 7.8% | 5.8% | 3.3% | 11 of 12 | 92% | 1.2 | |

| 334419 | Other electronic component mfg | 3.9% | 4.0% | 5.4% | 5.1% | 5.7% | 3.4% | 2.8% | 15 of 20 | 75% | 1.4 |

| 334512 | Automatic environmental control mfg | 5.5% | 6.5% | 4.8% | 6.0% | 4.1% | 2.7% | 2.1% | 18 of 20 | 90% | 2.7 |

| 334513 | Industrial process variable instruments | 3.0% | 5.9% | 13.7% | 6.5% | 4.5% | 3.0% | 2.8% | 20 of 20 | 100% | 1.0 |

| 334514 | Totalizing fluid meters and counting devices | 9.0% | 8.6% | 10.3% | 8.4% | 5.6% | 4.2% | 3.4% | 20 of 20 | 100% | 2.6 |

| 334515 | Electricity and signal testing instruments mfg | 3.6% | 4.4% | 4.4% | 2.6% | 1.8% | 0.8% | 1.1% | 14 of 20 | 70% | 3.4 |

| 334516 | Analytical laboratory instrument mfg | 3.4% | 7.4% | 7.7% | 5.4% | 4.3% | 3.3% | 2.7% | 20 of 20 | 100% | 1.3 |

| 334517 | Irradiation apparatus mfg | 0.8% | 2.6% | 8.1% | 2.1% | 1.1% | 0.5% | 0.5% | 11 of 19 | 58% | 1.7 |

| 334519 | Other measuring and controlling device mfg | 4.5% | 8.2% | 12.7% | 6.6% | 4.5% | 2.9% | 1.8% | 16 of 20 | 80% | 2.5 |

| 335000 | Electrical equipment, appliance & component mfg. | 1.3% | 2.1% | 7.1% | 4.4% | 3.1% | 1.7% | 0.8% | 12 of 20 | 60% | 1.6 |

| 335122 | Nonresidential electric lighting fixture mfg | 2.5% | 5.0% | 7.4% | 6.6% | 5.7% | 3.4% | 2.8% | 16 of 20 | 80% | 1.8 |

| 335129 | Other lighting equipment mfg | 3.8% | 3.8% | 7.6% | 5.2% | 4.0% | 2.5% | 2.1% | 19 of 20 | 95% | 1.9 |

| 335312 | Motor and generator mfg | 5.3% | 5.6% | 10.9% | 9.5% | 6.2% | 3.4% | 3.5% | 18 of 20 | 90% | 1.5 |

| 335313 | Switchgear and switchboard apparatus mfg | 3.3% | 6.7% | 20.4% | 11.2% | 7.5% | 4.1% | 3.6% | 18 of 20 | 90% | 1.8 |

| 335314 | Relay and industrial control mfg | 1.9% | 7.5% | 18.8% | 9.3% | 6.1% | 3.7% | 3.5% | 20 of 20 | 100% | 2.1 |

| 335929 | Other communication and energy wire mfg | 4.5% | 6.5% | 7.7% | 11.6% | 7.9% | 3.9% | 9 of 12 | 75% | 1.1 | |

| 335931 | Current-carrying wiring device mfg | 24.2% | 25.5% | 6.9% | 13.7% | 8.4% | 4.2% | 3.7% | 18 of 20 | 90% | 6.5 |

| 336120 | Heavy duty truck mfg | 1.7% | 2.1% | 1.9% | 1.7% | 1.5% | 1.7% | 17 of 17 | 100% | 1.0 | |

| 336211 | Motor vehicle body mfg | 2.6% | 4.5% | 16.0% | 8.9% | 6.6% | 4.1% | 3.5% | 19 of 20 | 95% | 1.3 |

| 336340 | Motor vehicle brake system mfg | 3.7% | 1.9% | 9.7% | 8.8% | 5.5% | 2.9% | 1.2% | 14 of 20 | 70% | 3.2 |

| 336350 | Motor vehicle transmission and power train parts manufacturing | 1.3% | 1.0% | 4.3% | 2.7% | 1.9% | 1.0% | 1.2% | 15 of 20 | 75% | 1.1 |

| 336390 | Other motor vehicle parts mfg | 1.2% | 1.1% | 3.7% | 3.4% | 2.1% | 1.2% | 15 of 19 | 79% | 1.1 | |

| 336411 | Aircraft mfg | 3.1% | 4.0% | 5.2% | 3.3% | 2.6% | 1.9% | 2.6% | 19 of 20 | 95% | 1.2 |

| 336413 | Other aircraft parts and equipment mfg | 3.9% | 4.5% | 2.7% | 2.7% | 2.2% | 1.6% | 1.7% | 18 of 20 | 90% | 2.3 |

| 336612 | Boat building | 2.8% | 4.1% | 11.4% | 7.4% | 5.9% | 4.1% | 3.4% | 20 of 20 | 100% | 1.2 |

| 336991 | Motorcycle, bicycle, and parts mfg | 2.9% | 5.4% | 2.8% | 1.9% | 1.3% | 1.7% | 0.9% | 11 of 15 | 73% | 3.4 |

| 336999 | All other transportation equipment mfg | 2.6% | 1.9% | 5.0% | 6.0% | 4.1% | 2.6% | 2.0% | 17 of 20 | 85% | 1.3 |

| 337122 | Nonupholstered wood household furniture mfg | 7.0% | 6.5% | 7.2% | 8.6% | 5.7% | 3.6% | 3.0% | 20 of 20 | 100% | 2.3 |

| 337127 | Institutional furniture mfg | 2.5% | 7.1% | 12.6% | 9.0% | 6.8% | 4.3% | 13 of 13 | 100% | 1.6 | |

| 337211 | Wood office furniture mfg | 2.9% | 4.0% | 11.8% | 8.4% | 5.7% | 3.6% | 2.7% | 20 of 20 | 100% | 1.1 |

| 337212 | Custom architectural woodwork and millwork | 4.9% | 6.2% | 10.7% | 8.9% | 5.9% | 3.7% | 10 of 11 | 91% | 1.3 | |

| 339110 | Medical equipment & supplies mfg. | 4.0% | 5.4% | 8.9% | 6.6% | 5.3% | 3.6% | 3.3% | 20 of 20 | 100% | 1.2 |

| 339112 | Surgical and medical instrument mfg | 1.2% | 2.3% | 3.7% | 1.4% | 1.2% | 0.9% | 0.6% | 14 of 20 | 70% | 1.9 |

| 339113 | Surgical appliance and supplies mfg | 2.0% | 2.7% | 4.6% | 3.2% | 2.4% | 1.4% | 1.3% | 18 of 20 | 90% | 1.5 |

| 339115 | Ophthalmic goods mfg | 5.7% | 6.4% | 5.5% | 4.5% | 3.5% | 2.1% | 1.9% | 17 of 20 | 85% | 3.0 |

| 339910 | Jewelry and silverware mfg | 2.0% | 5.2% | 9.2% | 4.1% | 4.7% | 2.1% | 3.5% | 15 of 20 | 75% | 1.5 |

| 339920 | Sporting and athletic goods mfg | 5.9% | 12.3% | 18.6% | 13.1% | 8.8% | 4.7% | 2.7% | 15 of 20 | 75% | 2.2 |

| 339940 | Office supplies, except paper, mfg | 2.5% | 2.8% | 11.7% | 6.8% | 4.5% | 3.4% | 2.0% | 17 of 19 | 89% | 1.2 |

| 339950 | Sign mfg | 3.5% | 6.6% | 16.4% | 9.1% | 5.9% | 3.7% | 2.5% | 18 of 20 | 90% | 1.4 |

| 339991 | Gasket, packing, and sealing device mfg | 2.5% | 5.1% | 9.1% | 6.3% | 4.1% | 2.6% | 2.6% | 19 of 20 | 95% | 1.9 |

| 339995 | Burial casket mfg | 3.0% | 8.4% | 6.7% | 7.1% | 5.6% | 4.4% | 4.7% | 19 of 20 | 95% | 1.8 |

| 423400 | Professional & commercial equipment & supplies | 3.1% | 4.4% | 9.1% | 6.4% | 4.5% | 2.6% | 1.8% | 17 of 20 | 85% | 1.7 |

| 423800 | Machinery and supply merchant wholesalers | 3.1% | 4.4% | 9.1% | 6.4% | 4.5% | 2.6% | 1.8% | 17 of 20 | 85% | 1.7 |

| 423900 | Miscellaneous durable goods, except recyclable material, merchant wholesalers | 4.0% | 5.4% | 8.9% | 6.6% | 5.3% | 3.6% | 3.3% | 20 of 20 | 100% | 1.2 |

| 423910 | Sporting & recreational goods & supplies | 3.6% | 7.3% | 11.5% | 8.3% | 5.7% | 3.3% | 2.4% | 17 of 20 | 85% | 1.5 |

| 423920 | Toy & hobby goods & supplies | 3.6% | 7.3% | 11.5% | 8.3% | 5.7% | 3.3% | 2.4% | 17 of 20 | 85% | 1.5 |

| 423940 | Jewelry, watch, precious stone & precious metals | 2.0% | 5.2% | 9.2% | 4.1% | 4.7% | 2.1% | 3.5% | 15 of 20 | 75% | 1.5 |

| 424300 | Apparel and piece goods merchant wholesalers | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 424700 | Petroleum and petroleum products merchant wholesalers | 18.8% | -6.1% | 10.2% | 32.7% | 8.3% | 1.2% | 6.4% | 13 of 20 | 65% | 2.9 |

| 424920 | Books, periodicals & newspapers | 2.8% | 4.3% | 14.3% | 9.1% | 6.2% | 3.4% | 13 of 14 | 93% | 1.3 | |

| 424940 | Tobacco & tobacco products | 8.1% | 10.2% | 11.2% | 9.9% | 8.5% | 6.9% | 5.6% | 19 of 20 | 95% | 1.4 |

| 424990 | Other miscellaneous nondurable goods | 18.1% | 12.8% | 22.7% | 8.1% | 6.1% | 5.3% | 9 of 10 | 90% | 3.4 | |

| 441222 | Boat dealers | 2.8% | 4.1% | 11.4% | 7.4% | 5.9% | 4.1% | 3.4% | 20 of 20 | 100% | 1.2 |

| 441300 | Automotive parts, accessories & tire stores | 1.2% | 1.1% | 3.7% | 3.4% | 2.1% | 1.2% | 1.2% | 16 of 20 | 80% | 1.0 |

| 441310 | Automotive parts and accessories stores | 1.2% | 1.1% | 3.7% | 3.4% | 2.1% | 1.2% | 1.2% | 16 of 20 | 80% | 1.0 |

| 441320 | Tire dealers | 2.2% | 4.4% | 15.3% | 8.3% | 5.4% | 2.3% | 3.5% | 15 of 20 | 75% | 1.3 |

| 444100 | Building materials and supplies dealers | 5.8% | 2.6% | 0.1% | 9.3% | 6.5% | 4.1% | 10 of 10 | 100% | 1.4 | |

| 444190 | Other building materials dealers | 18.5% | 9.7% | -11.7% | 8.9% | 9.3% | 7.3% | 3.7% | 11 of 20 | 55% | 5.0 |

| 444220 | Nursery, garden, and farm supply stores | 5.4% | 5.0% | 9.6% | 10.3% | 8.1% | 4.2% | 9 of 10 | 90% | 1.3 | |

| 445210 | Meat markets | 6.7% | -0.6% | -3.3% | 9.5% | 5.2% | 2.4% | 2.9% | 14 of 20 | 70% | 2.3 |

| 446120 | Cosmetics, beauty supplies & perfume stores | 4.5% | 5.3% | 6.4% | 4.1% | 2.8% | 2.0% | 1.5% | 17 of 20 | 85% | 2.9 |

| 446130 | Optical goods stores | 5.7% | 6.4% | 5.5% | 4.5% | 3.5% | 2.1% | 1.9% | 17 of 20 | 85% | 3.0 |

| 447100 | Gasoline stations (including convenience stores with gas) | 37.1% | 7.1% | -5.5% | 32.3% | 6.1% | 0.0% | 5.1% | 12 of 20 | 60% | 7.2 |

| 448100 | Clothing stores | 2.2% | 3.2% | 5.2% | 4.9% | 3.1% | 2.2% | 1.8% | 18 of 20 | 90% | 1.2 |

| 448110 | Men's clothing stores | 1.9% | 3.1% | 11.9% | 5.3% | 3.7% | 2.0% | 1.2% | 15 of 20 | 75% | 1.6 |

| 448140 | Family clothing stores | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 448150 | Clothing accessories stores | 2.2% | 3.9% | 15.3% | 7.2% | 5.7% | 3.4% | 11 of 12 | 92% | 1.1 | |

| 448190 | Other clothing stores | 1.2% | 1.5% | 4.9% | 3.2% | 1.8% | 1.3% | 1.2% | 16 of 20 | 80% | 1.0 |

| 448310 | Jewelry stores | 2.0% | 5.2% | 9.2% | 4.1% | 4.7% | 2.1% | 3.5% | 15 of 20 | 75% | 1.5 |

| 448320 | Luggage & leather goods stores | 6.8% | 6.9% | 2.5% | 3.4% | 2.4% | 2.1% | 1.9% | 18 of 20 | 90% | 3.5 |

| 451110 | Sporting goods stores | 5.9% | 12.3% | 18.6% | 13.1% | 8.8% | 4.7% | 2.7% | 15 of 20 | 75% | 2.2 |

| 451211 | Book stores | 2.8% | 4.3% | 14.3% | 9.1% | 6.2% | 3.4% | 13 of 14 | 93% | 1.3 | |

| 451212 | News dealers & newsstands | 2.8% | 4.3% | 14.3% | 9.1% | 6.2% | 3.4% | 13 of 14 | 93% | 1.3 | |

| 453200 | Office supplies, stationery, and gift stores | 2.5% | 2.8% | 11.7% | 6.8% | 4.5% | 3.4% | 2.0% | 17 of 19 | 89% | 1.2 |

| 453210 | Office supplies & stationery stores | 3.4% | 3.4% | 7.0% | 5.2% | 3.6% | 2.6% | 1.9% | 20 of 20 | 100% | 1.8 |

| 453910 | Pet & pet supplies stores | 6.4% | 7.3% | 14.1% | 9.5% | 6.5% | 3.6% | 4.2% | 19 of 20 | 95% | 1.5 |

| 454310 | Fuel dealers | 37.1% | 7.1% | -5.5% | 32.3% | 6.1% | 0.0% | 5.1% | 12 of 20 | 60% | 7.2 |

| Section | Slide(s) |

| About Us | 3 |

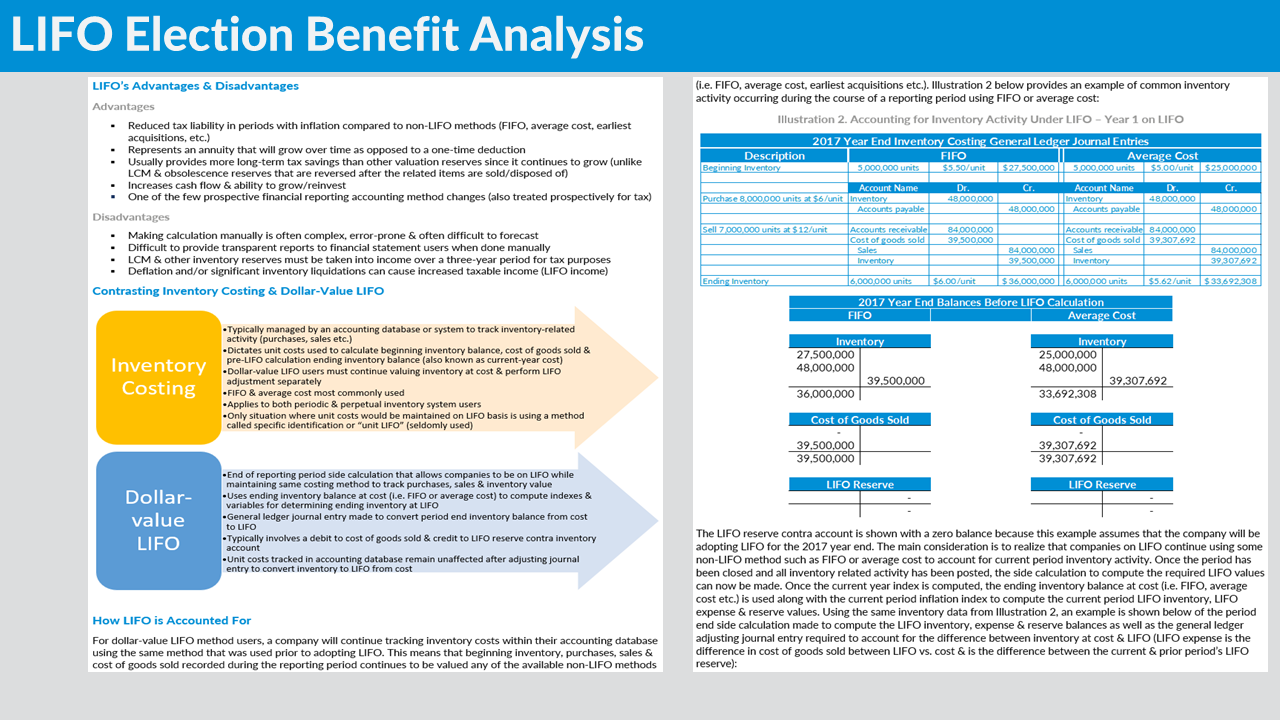

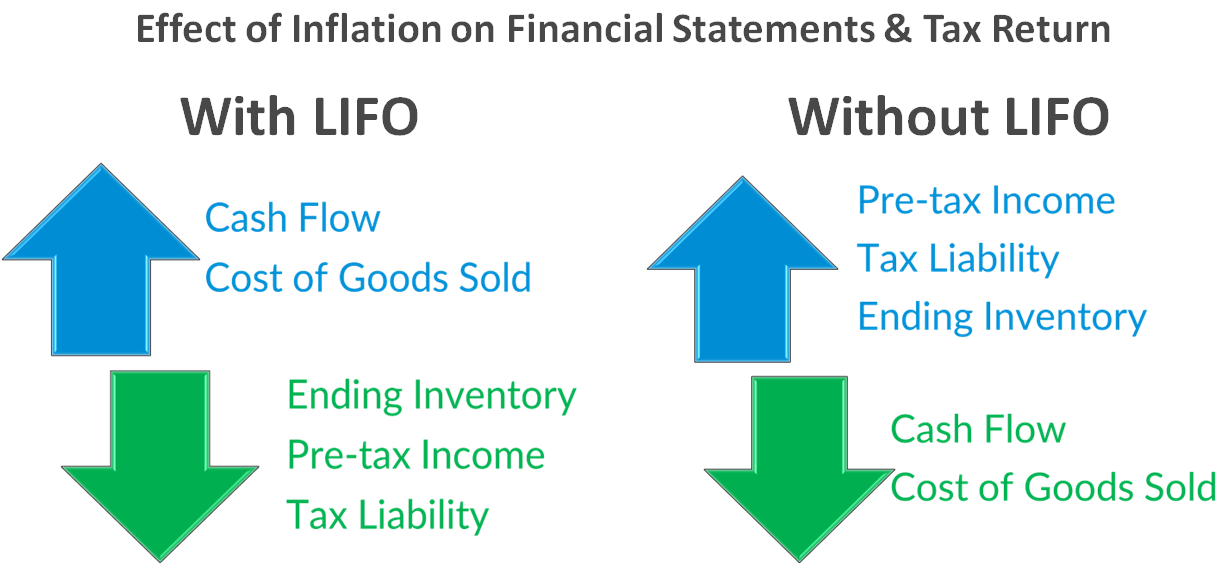

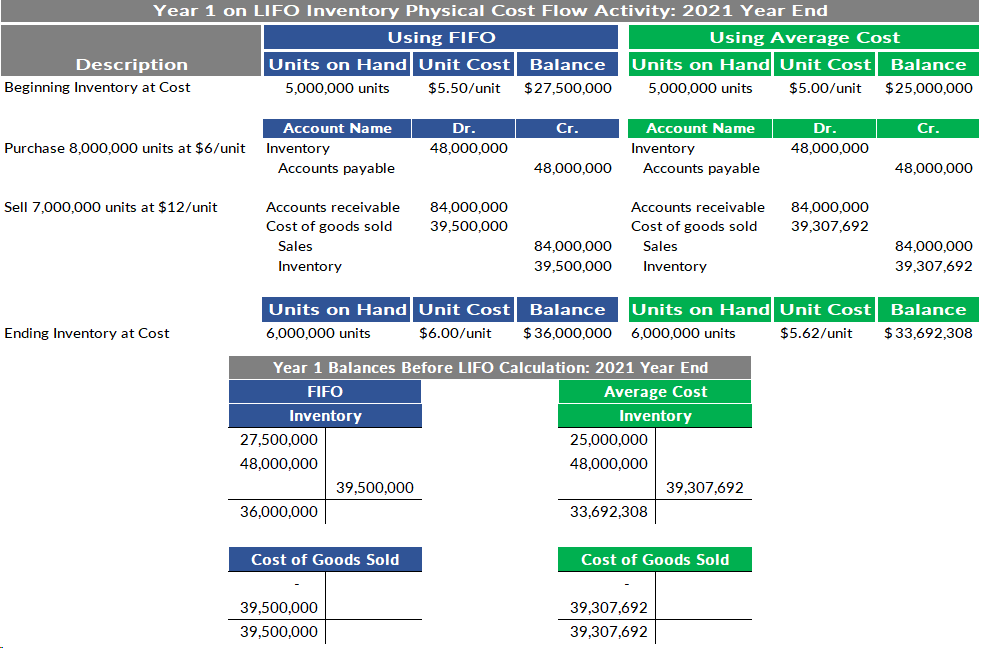

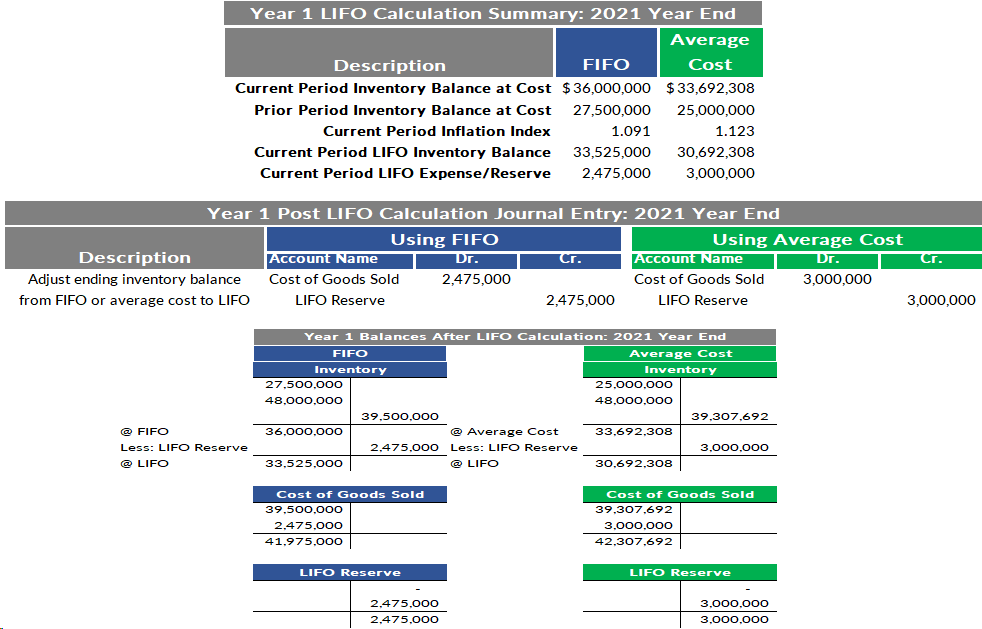

| How LIFO Works | 4 |

| Why Use LIFO? | 5 – 6 |

| Common Misconceptions | 7 – 8 |

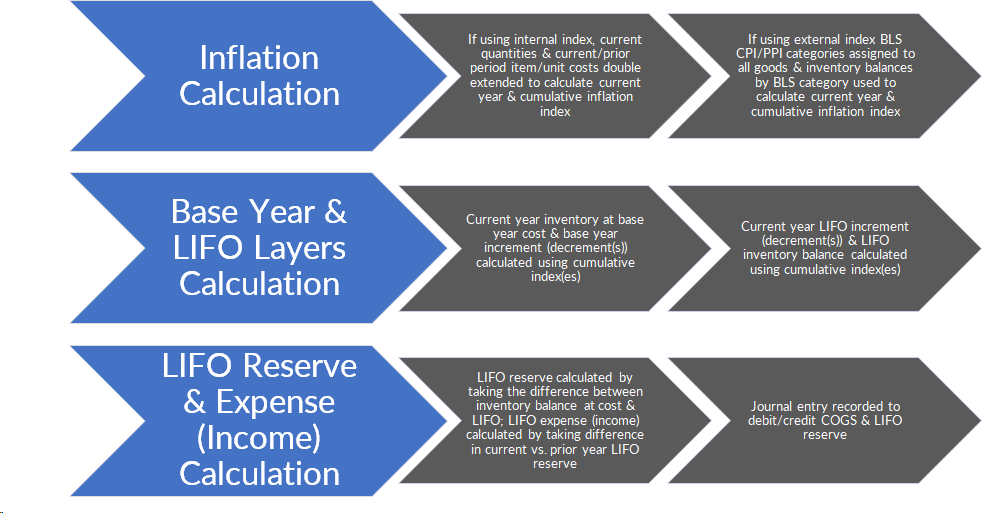

| Dollar-value LIFO | 9 – 11 |

| Top 2023 LIFO Election Opportunities | 12 – 16 |

| Top 2023 LIFO Planning Strategies | 17 – 20 |

| Why Perform Analysis or Review? | 21 |

| Complimentary Offerings | 22 |

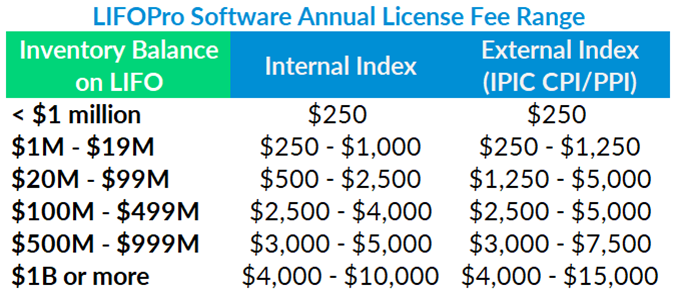

| Why Use LIFO Software or Outsource LIFO? | 23 |

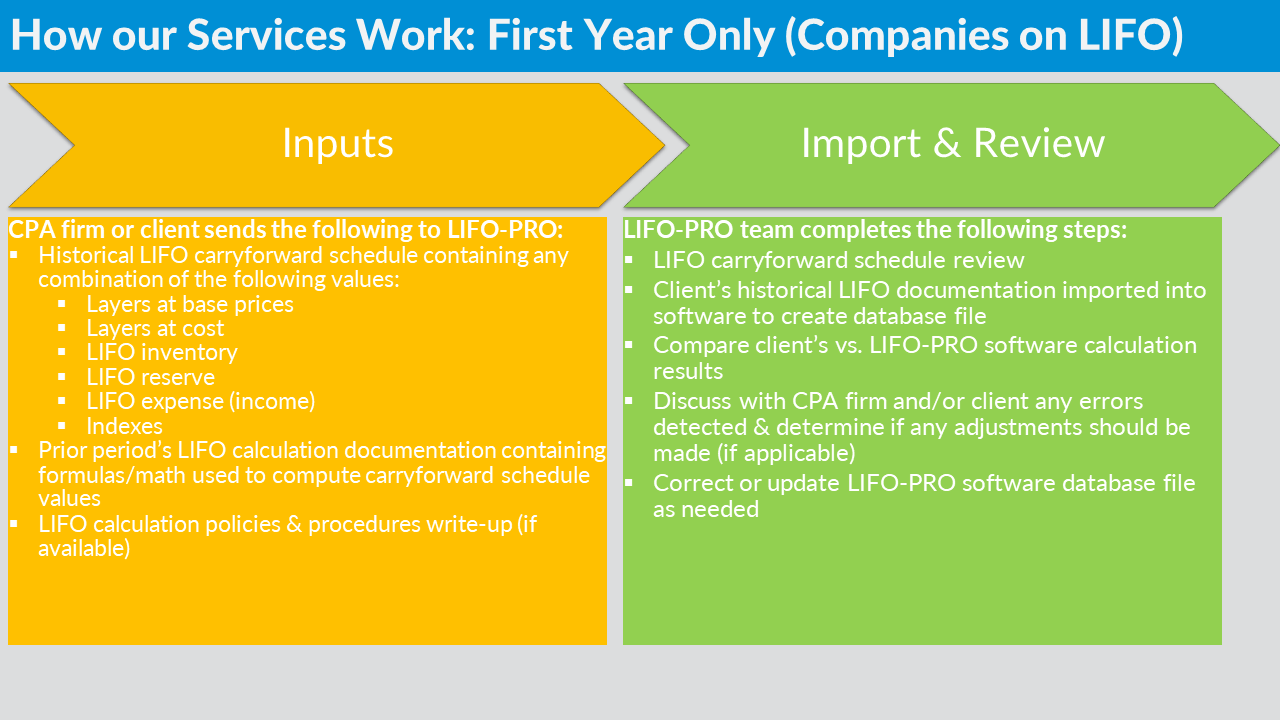

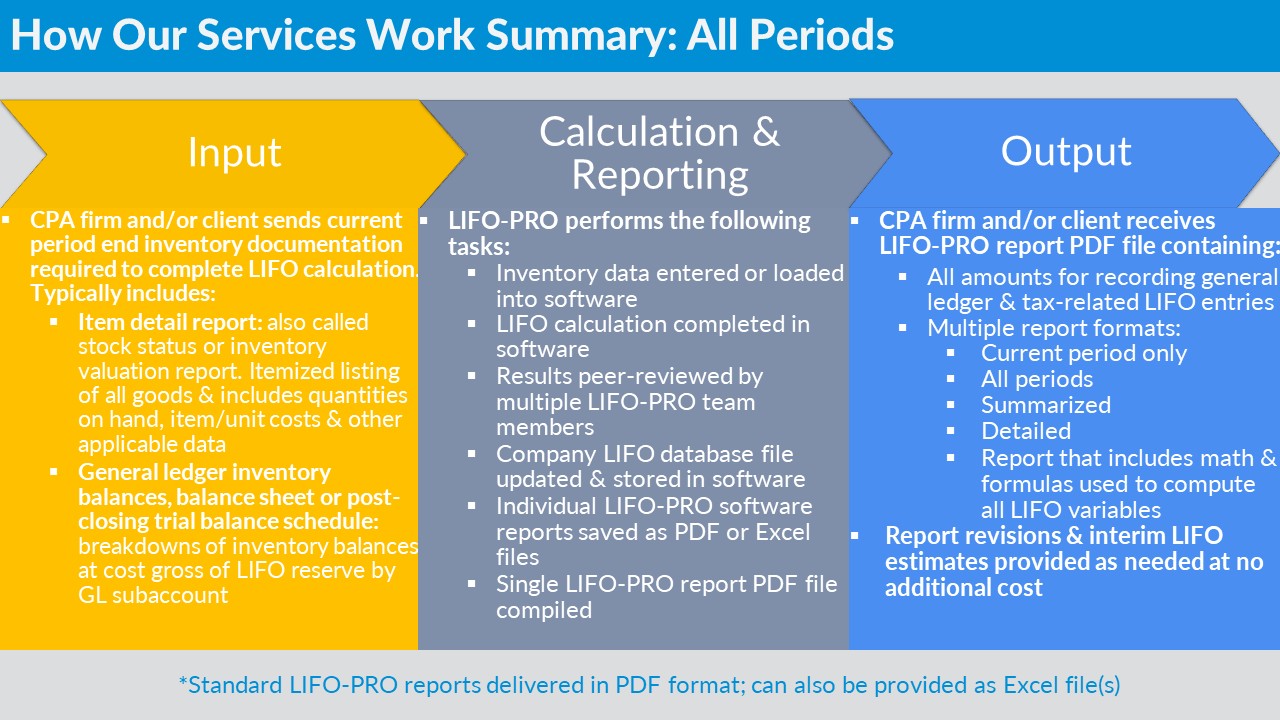

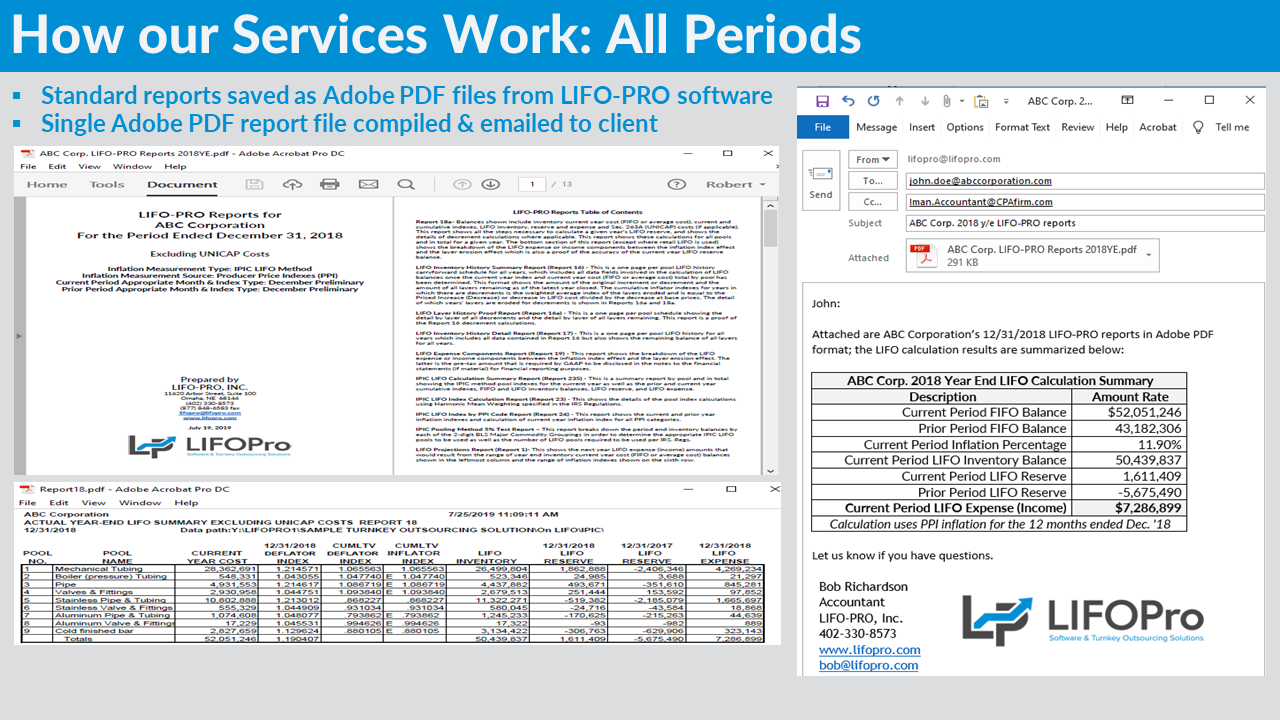

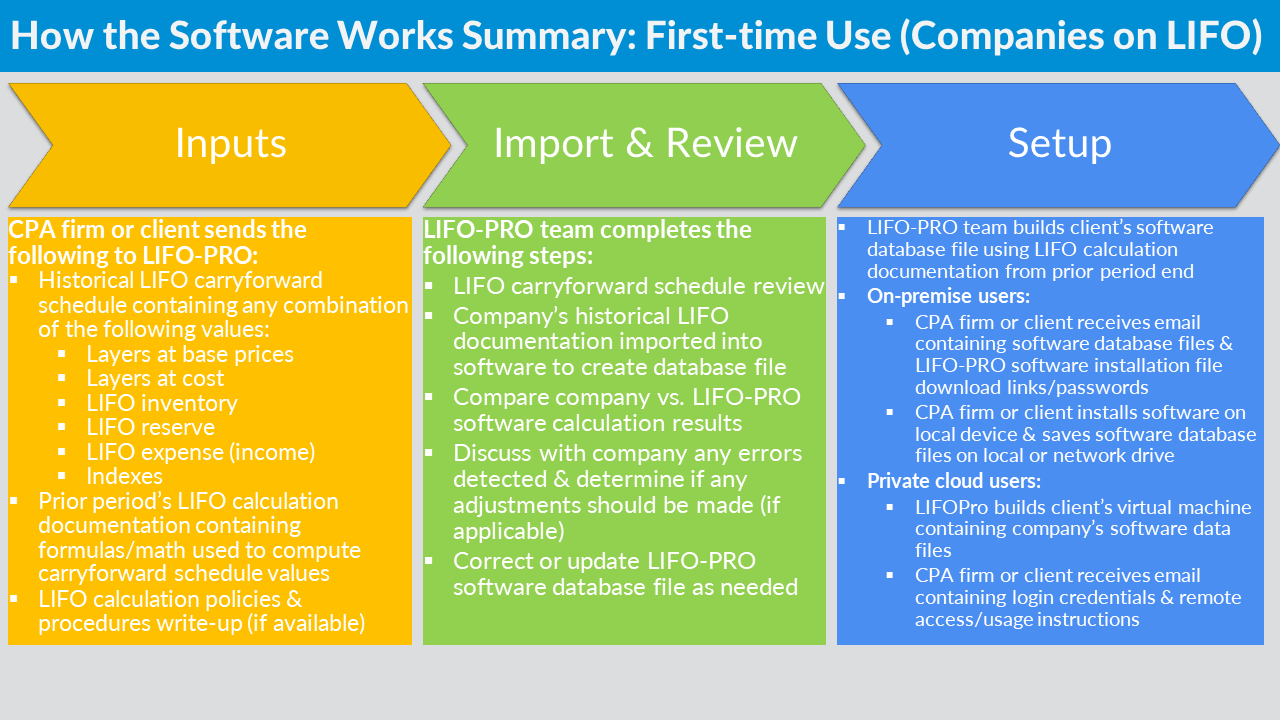

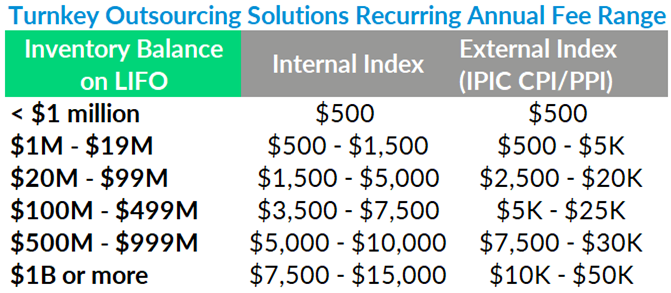

| Turnkey Outsourcing Solutions | 24 – 27 |

| Key Takeaways | 28 |

| Actionable Items | 29 |

| Resources | 30 |

LIFOPro's 2023 Top LIFO Election Locks Blog

LIFOPro’s 2023 Good LIFO Election Candidates & Client ID Tool

LIFOPro makes it simple for companies to quickly obtain accurate estimates of the projected tax savings from electing LIFO this year. Get your complimentary analysis PDF report & turnkey outsourcing solutions fee quote within one week of submitting your request!

Learn MorePlug in your client's inventory balance, tax rate & year to date inflation rate to quickly estimate the projected tax savings from LIFO this year. Use LIFOPro's online inflation table to easily identify year to date inflation rates.

Learn MoreHave a phone call or WebEx with the LIFO-PRO team to get started today or learn more about our offerings. Schedule online using our easy-to use booking tool.

Schedule Call or DemoRequest a complimentary LIFO Calculation, Methods & Best Practices Review Report, cost estimate or complete our online NDA at our Request Forms page.

Request Forms PageTrial the software for 90 days. Get a complimentary review. Request a cost estimate. Use our simple request form to get your complimentary offering today!

Sign up today to receive industry news & promotional offers from LIFO-PRO