What is the IPIC Method?

Dollar-value LIFO method users are allowed to use an internal or external inflation measurement source to calculate inflation. Here’s an overview of these two methods:

- Internal indexes

- Current period’s quantities are double extended against current & prior period unit costs (prior period unit costs are used if the link-chain method is used; base period unit costs are used if the double-extension method is used)

- The quotient of the sum of the current & prior/base period extensions becomes the current year inflation index.

- External indexes (also known as the Inventory Price Index Computation or IPIC method)

- Current period’s product mix is assigned Bureau of Labor Statistics Consumer/Producer Price Index (BLS CPI/PPI) categories

- BLS category inflation indexes are calculated by taking the quotient of the current & prior year BLS CPI/PPI

- Harmonic dollars weighted quotients by BLS category is calculated by taking the quotient of each BLS CPI/PPI’s current year extended cost and its BLS category inflation index

- The quotient of the sum of the current period extensions and the harmonic dollars weighted quotients becomes the current year inflation index

Why Do Companies Use the IPIC Method?

In cases where adequate due diligence is performed in the year of LIFO election to compare inflation measurement source alternatives, most companies will use the alternative that yields the highest LIFO reserve in the election year. With that being said, since the IPIC method is a safe harbor method, companies can change to the IPIC method under automatic change procedures for tax purposes (change is applied prospectively beginning in the year of change, meaning no retrospective accounting or prior period adjustments are required for tax purposes; no user’s fee is required since it’s an automatic change). Because of this, a commonly employed strategy for companies who initially elect LIFO using an internal index is to change to the IPIC method in the first year where the IPIC inflation is higher than an internal index since a favorable tax benefit will be created in the year of change. Conversely, it is much less common for companies to switch to an internal index method after making an initial LIFO election using the IPIC method because this change requires advanced approval from the IRS (which entails the IRS Form would need to be filed by or before the end of the tax year, and a $12K IRS Users fee is required for non-automatic change requests).

The most common reasons why companies use the IPIC method are as follows:

- Tax deferral maximization: Often creates more inflation than actual internal product costs or internal index inflation for the following reasons:

- BLS PPI inflation will be greater than internal index inflation on goods that were imported or purchased for resale products sourced from abroad because BLS PPI only measures U.S. or domestic production & domestically produced goods inflation rates have historically been materially higher than imported goods

- When the IPIC method is used, new items are given preexisting item inflation since BLS only measures price changes on preexisting items (or they reconstruct the cost on any newly-introduced item). With internal indexes, new items’ prior year costs are often set to equal to its current year cost since reconstruction is often burdensome/subjective & IRS Regs. prohibit new items from being excluded from the inflation calculation. As a result, during periods of inflation, new items will reduce the overall current year inflation rate when internal indexes are used. This becomes more pronounced when there’s high item turnover and/or high inflation.

- Much quicker, simpler means of performing interim estimates than internal indexes

- Minimize IRS scrutiny upon audit or reduce audit risk

- IPIC method is IRS safe harbor method, which affords taxpayers less scrutiny from IRS upon audit compared to taxpayers using internal indexes since inflation calculation relies on external government indexes & internal indexes rely on the taxpayer’s accounting records/systems

- Switch to IPIC method from internal indexes to IPIC method provides audit protection from prior period calculation errors

- Can also provide a safe harbor for companies with LIFO books & records audit risk. See IRS LIFO Records Practice Unit

- Simplify LIFO calculation & reduce volatility

- IPIC method can simplify inflation calculation for manufacturers because:

- Reduces reliance on accounting information systems & appropriate allocation of item cost components such as materials, labor & overhead since inflation is measured using BLS PPI, not current & prior/base period item/unit costs

- Inflation for work in process inventories are calculated by assigning the applicable finished goods PPI code to the WIP items

- IPIC method can reduce volatility because BLS surveys thousands of producers & eliminates extreme cost fluctuations that could occur within any single company

- Automatic approval to change to IPIC method & is applied on a cutoff basis

- Affords audit protection from LIFO reserve overstatements since change is applied beginning in year of change & built from pre-change LIFO reserve

- Only means of automatically changing from double-extension to link-chain (double-extension = current vs. base year cost comparison; link-chain = current vs. prior year cost comparison; advanced approval change to switch from double-extension to link-chain internal index)

How Predominant is the Use of the IPIC Method?

Although publicly traded companies are not required to disclose the specifics of their LIFO methods used, the majority of LIFOPro’s clients use the IPIC method. Furthermore, many companies use the IPIC method for both financial reporting (book) and tax purposes to minimize administrative burden and allow for conformity in book & tax LIFO methods. In certain cases where companies wish to minimize their book LIFO reserve and maximize their tax LIFO reserve, a strategy is sometimes employed to use an internal inflation measurement source for financial reporting purposes and the IPIC method for tax purposes (if the IPIC method has historically been and is also expected to create more inflation than internal indexes). Under such a strategy, the financial reporting impact of LIFO is minimized and the tax benefit is maximized. See LIFOPro’s blog to learn more about this strategy: Why Companies Use Different Book & Tax LIFO Methods

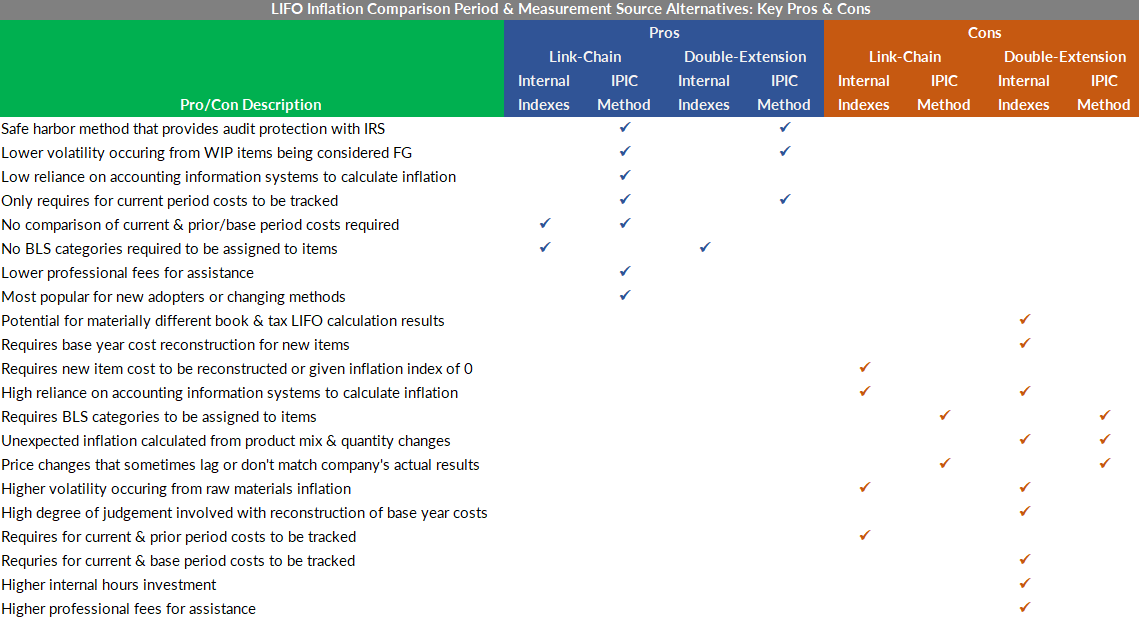

Comparing the Pros and Cons of Inflation Measurement Source Alternatives

Pro Forma IPIC LIFO Case Studies

LIFOPro offers free pro forma IPIC LIFO Case Studies to compare the difference between using an internal vs. external index. Included in your free case study is as follows:

- Current year internal index calculation using company’s actual costs

- Current year external index calculation using Bureau of Labor Statistics Consumer/Producer Price Indexes

- 20 year pro forma IPIC calculation using current period’s product mix & inventory balances

- Current year & 20 year comparative results

- Recommendations regarding the most beneficial tax LIFO method to utilize

Get your free IPIC LIFO Case Study today, or contact LIFOPro to learn more!

Request a Free IPIC LIFO Case Study

IPIC LIFO Guide