| Requirement |

Financial Reporting |

Tax |

| IRS Form 970 Application to Use LIFO Inventory Method & statement attachment must be filed with federal tax return in year of adoption |

|

|

| Opening (beginning) inventories must be valued at cost for a company’s first year on LIFO |

|

|

| Ending inventories must be valued using FIFO, earliest acquisitions or average cost |

|

|

| Must be used for financial reporting & tax purposes for all periods beginning in year of election |

|

|

| Financial reporting LIFO election scope must be equal to or greater than Tax scope (i.e. goods on LIFO for tax purposes can not be greater than what is on LIFO for financial reporting) |

|

|

| Prior lower of cost or market writedowns must be restored through income over a three-year period |

|

(a) Authorization — A taxpayer may use the method provided in subsection (b) (whether or not such method has been prescribed under section 471) in inventorying goods specified in an application to use such method filed at such time and in such manner as the Secretary may prescribe. The change to, and the use of, such method shall be in accordance with such regulations as the Secretary may prescribe as necessary in order that the use of such method may clearly reflect income.

(b) Method Applicable — In inventorying goods specified in the application described in subsection (a), the taxpayer shall:

(1) — Treat those remaining on hand at the close of the taxable year as being: First, those included in the opening inventory of the taxable year (in the order of acquisition) to the extent thereof; and second, those acquired in the taxable year;

(2) — Inventory them at cost; and

(3) — Treat those included in the opening inventory of the taxable year in which such method is first used as having been acquired at the same time and determine their cost by the average cost method.

(c) Condition — Subsection (a) shall apply only if the taxpayer establishes to the satisfaction of the Secretary that the taxpayer has used no procedure other than that specified in paragraphs (1) and (3) of subsection (b) in inventorying such goods to ascertain the income, profit, or loss of the first taxable year for which the method described in subsection (b) is to be used, for the purpose of a report or statement covering such taxable year—

(1) — to shareholders, partners, or other proprietors, or to beneficiaries, or

(2) — for credit purposes.

(d) 3-Year Averaging For Increases In Inventory Value — The beginning inventory for the first taxable year for which the method described in subsection (b) is used shall be valued at cost. Any change in the inventory amount resulting from the application of the preceding sentence shall be taken into account ratably in each of the 3 taxable years beginning with the first taxable year for which the method described in subsection (b) is first used.

(e) Subsequent Inventories — If a taxpayer, having complied with subsection (a), uses the method described in subsection (b) for any taxable year, then such method shall be used in all subsequent taxable years unless—

(1) — with the approval of the Secretary a change to a different method is authorized; or,

(2) — the Secretary determines that the taxpayer has used for any such subsequent taxable year some procedure other than that specified in paragraph (1) of subsection (b) in inventorying the goods specified in the application to ascertain the income, profit, or loss of such subsequent taxable year for the purpose of a report or statement covering such taxable year (A) to shareholders, partners, or other proprietors, or beneficiaries, or (B) for credit purposes; and requires a change to a method different from that prescribed in subsection (b) beginning with such subsequent taxable year or any taxable year thereafter.

If paragraph (1) or (2) of this subsection applies, the change to, and the use of, the different method shall be in accordance with such regulations as the Secretary may prescribe as necessary in order that the use of such method may clearly reflect income.

(f) Use Of Government Price Indexes In Pricing Inventory — The Secretary shall prescribe regulations permitting the use of suitable published governmental indexes in such manner and circumstances as determined by the Secretary for purposes of the method described in subsection (b).

(g) Conformity Rules Applied On Controlled Group Basis

(1) In General — Except as otherwise provided in regulations, all members of the same group of financially related corporations shall be treated as 1 taxpayer for purposes of subsections (c) and (e)(2).

(2) Group Of Financially Related Corporations — For purposes of paragraph (1), the term “group of financially related corporations” means—

(A) — any affiliated group as defined in section 1504 determined by substituting “50 percent” for “80 percent” each place it appears in section 1504(a) and without regard to section 1504(b), and

(B) — any other group of corporations which consolidate or combine for purposes of financial statements.

(a) Any taxpayer permitted or required to take inventories pursuant to the provisions of section 471, and pursuant to the provisions of §§ 1.471-1 to 1.471-9, inclusive, may elect with respect to those goods specified in his application and properly subject to inventory to compute his opening and closing inventories in accordance with the method provided by section 472, this section, and § 1.472-2. Under this last-in, first-out (LIFO) inventory method, the taxpayer is permitted to treat those goods remaining on hand at the close of the taxable year as being:

1. Those included in the opening inventory of the taxable year, in the order of acquisition and to the extent thereof, and

2. Those acquired during the taxable year.

3. The LIFO inventory method is not dependent upon the character of the business in which the taxpayer is engaged, or upon the identity or want of identity through commingling of any of the goods on hand, and may be adopted by the taxpayer as of the close of any taxable year.

(b) If the LIFO inventory method is used by a taxpayer who regularly and consistently, in a manner similar to hedging on a futures market, matches purchases with sales, then firm purchases and sales contracts (i.e., those not legally subject to cancellation by either party) entered into at fixed prices on or before the date of the inventory may be included in purchases or sales, as the case may be, for the purpose of determining the cost of goods sold and the resulting profit or loss, provided that this practice is regularly and consistently adhered to by the taxpayer and provided that, in the opinion of the Commissioner, income is clearly reflected thereby.

(c) A manufacturer or processor who has adopted the LIFO inventory method as to a class of goods may elect to have such method apply to the raw materials only (including those included in goods in process and in finished goods) expressed in terms of appropriate units. If such method is adopted, the adjustments are confined to costs of the raw material in the inventory and the cost of the raw material in goods in process and in finished goods produced by such manufacturer or processor and reflected in the inventory. The provisions of this paragraph may be illustrated by the following examples:

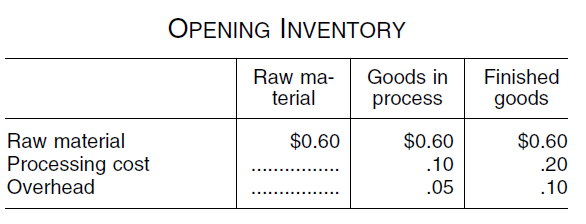

Example (1) Assume that the opening inventory had 10 units of raw material, 10 units of goods in process, and 10 units of finished goods, and that the raw material cost was 6 cents a unit, the processing cost 2 cents a unit, and overhead cost 1 cent a unit. For the purposes of this example, it is assumed that the entire amount of goods in process was 50 percent processed.

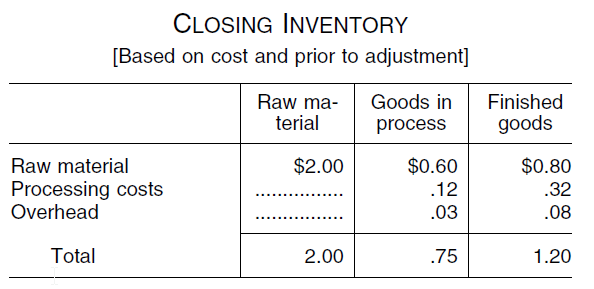

In the closing inventory there are 20 units of raw material, 6 units of goods in process, and 8 units of finished goods and the costs were: Raw material 10 cents, processing cost 4 cents, and overhead 1 cent.

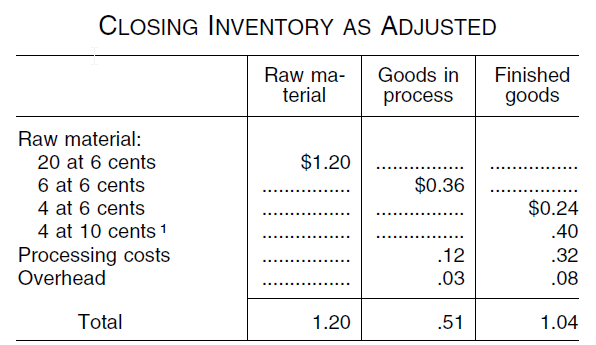

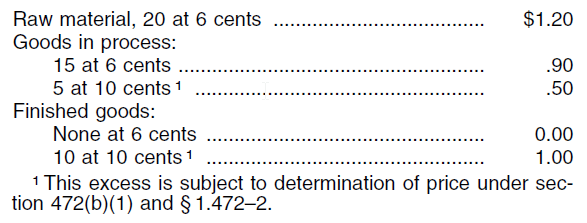

There were 30 units of raw material in the opening inventory and 34 units in the closing inventory. The adjustment to the closing inventory would be as follows:

Example (2) Assume that the opening inventory had 5 units of raw material, 10 units of goods in process, and 20 units of finished goods, with the same prices as in Example 1, and that the closing inventory had 20 units of raw material, 20 units of goods in process, and 10 units of finished goods, with raw material costs as in the closing inventory in Example 1. The adjusted closing inventory would be as follows in so far as the raw material is concerned:

The 20 units of raw material in the raw state plus 15 units of raw material in goods in process make up the 35 units of raw material that were contained in the opening inventory.

(d) For the purposes of this section, raw material in the opening inventory must be compared with similar raw material in the closing inventory. There may be several types of raw materials, depending upon the character, quality, or price, and each type of raw material in the opening inventory must be compared with a similar type in the closing inventory.

(e) In the cotton textile industry there may be different raw materials depending upon marked differences in length of staple, in color or grade of the cotton. But where different staple lengths or grades of cotton are being used at different times in the same mill to produce the same class of goods, such differences would not necessarily require the classification into different raw materials.

(f) As to the pork packing industry a live hog is considered as being composed of various raw materials, different cuts of a hog varying markedly in price and use. Generally a hog is processed into approximately 10 primal cuts and several miscellaneous articles. However, due to similarity in price and use, these may be grouped into fewer classifications, each group being classed as one raw material.

(g) When the finished product contains two or more different raw materials as in the case of cotton and rayon mixtures, each raw material is treated separately and adjustments made accordingly.

(h) Upon written notice addressed to the Commissioner of Internal Revenue, Attention T:R, Washington, D.C. 20224 by the taxpayer, a taxpayer who has heretofore adopted the LIFO inventory method in respect of any goods may adopt the method authorized in this section and limit the election to the raw material including raw materials entering into goods in process and in finished goods. If this method is adopted as to any specific goods, it must be used exclusively for such goods for any prior taxable year (not closed by agreement) to which the prior election applies and for all subsequent taxable years, unless permission to change is granted by the Commissioner.

(i) The election may also be limited to that phase in the manufacturing process where a product is produced that is recognized generally as a salable product as, for example, in the textile industry where one phase of the process is the production of yarn. Since yarn is generally recognized as a salable product, the election may be limited to that portion of the process when yarn is produced. In the case of copper and brass processors, the election may be limited to the production of bars, plates, sheets, etc., although these may be further processed into other products.

(j) The election may also apply to any one raw material, when two or more raw materials enter into the composition of the finished product; for example, in the case of cotton and rayon yarn, the taxpayer may elect to inventory the cotton only. However, a taxpayer who has previously made an election to use the LIFO inventory method may not later elect to exclude any raw materials that were covered by such previous election.

(k) If a taxpayer using the retail method of pricing inventories, authorized by § 1.471-8, elects to use in connection therewith the LIFO inventory method authorized by section 472 and this section, the apparent cost of the goods on hand at the end of the year, determined pursuant to § 1.471-8, shall be adjusted to the extent of price changes therein taking place after the close of the preceding taxable year. The amount of any apparent inventory increase or decrease to be eliminated in this adjustment shall be determined by reference to acceptable price indexes established to the satisfaction of the Commissioner. Price indexes prepared by the United States Bureau of Labor Statistics which are applicable to the goods in question will be considered acceptable to the Commissioner. Price indexes which are based upon inadequate records, or which are not subject to complete and detailed audit within the Internal Revenue Service, will not be approved.

(l) If a taxpayer uses consistently the so-called “dollar-value” method of pricing inventories, or any other method of computation established to the satisfaction of the Commissioner as reasonably adaptable to the purpose and intent of section 472 and this section, and if such taxpayer elects under section 472 to use the LIFO inventory method authorized by such section, the taxpayer’s opening and closing inventories shall be determined under section 472 by the use of the appropriate adaptation. See § 1.472-8 for rules relating to the use of the dollar-value method.

Except as otherwise provided in § 1.472-1 with respect to raw material computations, with respect to retail inventory computations, and with respect to other methods of computation established to the satisfaction of the Commissioner as reasonably adapted to the purpose and intent of section 472, and in § 1.472-8 with respect to the “dollar-value” method, the adoption and use of the LIFO inventory method is subject to the following requirements:

(a) The taxpayer shall file an application to use such method specifying with particularity the goods to which it is to be applied.

(b) The inventory shall be taken at cost regardless of market value.

(c) Goods of the specified type included in the opening inventory of the taxable year for which the method is first used shall be considered as having been acquired at the same time and at a unit cost equal to the actual cost of the aggregate divided by the number of units on hand. The actual cost of the aggregate shall be determined pursuant to the inventory method employed by the taxpayer under the regulations applicable to the prior taxable year with the exception that restoration shall be made with respect to any writedown to market values resulting from the pricing of former inventories.

(d) Goods of the specified type on hand as of the close of the taxable year in excess of what were on hand as of the beginning of the taxable year shall be included in the closing inventory, regardless of identification with specific invoices and regardless of specific cost accounting records, at costs determined pursuant to the provisions of subparagraph (1) or (2) of this paragraph, dependent upon the character of the transactions in which the taxpayer is engaged:

(i) In the case of a taxpayer engaged in the purchase and sale of merchandise, such as a retail grocer or druggist, or engaged in the initial production of merchandise and its sale without processing, such as a miner selling his ore output without smelting or refining, such costs shall be determined –

(a) By reference to the actual cost of the goods most recently purchased or produced;

(b) By reference to the actual cost of the goods purchased or produced during the taxable year in the order of acquisition;

(c) By application of an average unit cost equal to the aggregate cost of all of the goods purchased or produced throughout the taxable year divided by the total number of units so purchased or produced, the goods reflected in such inventory increase being considered for the purposes of section 472 as having been acquired all at the same time; or

(d) Pursuant to any other proper method which, in the opinion of the Commissioner, clearly reflects income.

(ii) Whichever of the several methods of valuing the inventory increase is adopted by the taxpayer and approved by the Commissioner shall be consistently adhered to in all subsequent taxable years so long as the LIFO inventory method is used by the taxpayer.

(iii) The application of subdivisions (i) and (ii) of this subparagraph may be illustrated by the following examples:

Example 1.

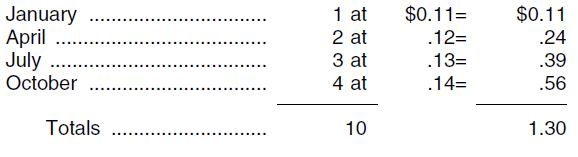

Suppose that the taxpayer adopts the LIFO inventory method for the taxable year 1957 with an opening inventory of 10 units at 10 cents per unit, that it makes 1957 purchases of 10 units as follows:

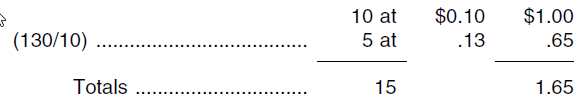

and that it has a 1957 closing inventory of 15 units. This closing inventory, depending upon the taxpayer’s method of valuing inventory increases, will be computed as follows:

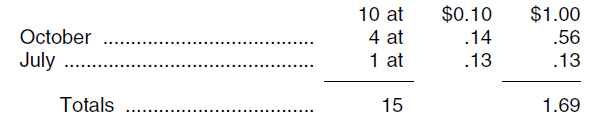

(a) Most recent purchases –

(b) In order of acquisitions –

or

(c) At an annual average –

Example 2.

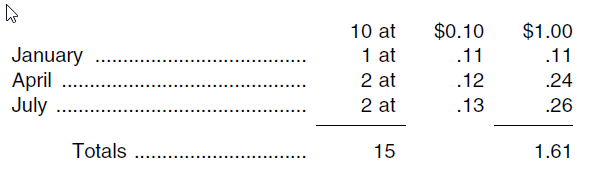

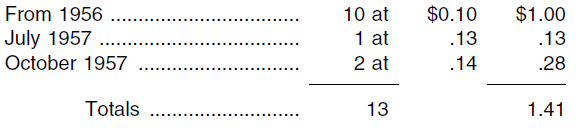

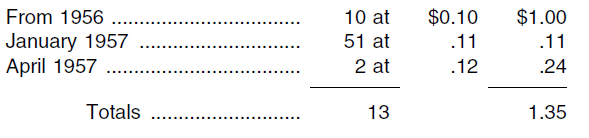

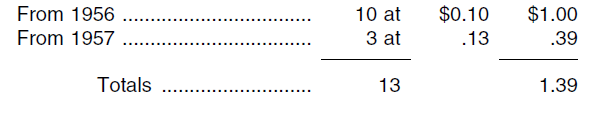

Suppose that the taxpayer’s closing inventory for 1958, the year following that involved in Example 1 of this subdivision, reflects an inventory decrease for the year, and not an increase; suppose that there is, accordingly, a 1958 closing inventory of 13 units. Inasmuch as the decreased closing inventory will be determined wholly by reference to the 15 units reflected in the opening inventory for the year, and will be taken “in the order of acquisition” pursuant to section 472 (b) (1), and inasmuch as the character of the taxpayer’s opening inventory for 1958 will be dependent upon its method of valuing its 5-unit inventory increase for 1957, the closing inventory for 1958 will be computed as follows:

(a) In case the increase for 1957 was taken by reference to the most recent purchases –

or

(b) In case the increase for 1957 was taken in the order of acquisition –

or

(c) In case the increase for 1957 was taken on the basis of an average –

(2) In the case of a taxpayer engaged in manufacturing, fabricating, processing, or otherwise producing merchandise, such costs shall be determined:

(i) In the case of raw materials purchased or initially produced by the taxpayer, in the manner elected by the taxpayer under subparagraph (1) of this paragraph to the same extent as if the taxpayer were engaged in purchase and sale transactions; and

(ii) In the case of goods in process, regardless of the stage to which the manufacture, fabricating, or processing may have advanced, and in the case of finished goods, pursuant to any proper method which, in the opinion of the Commissioner, clearly reflects income.

(e) LIFO conformity requirement –

(1)In general. The taxpayer must establish to the satisfaction of the Commissioner that the taxpayer, in ascertaining the income, profit, or loss for the taxable year for which the LIFO inventory method is first used, or for any subsequent taxable year, for credit purposes or for purposes of reports to shareholders, partners, or other proprietors, or to beneficiaries, has not used any inventory method other than that referred to in § 1.472-1 or at variance with the requirement referred to in § 1.472-2(c). See paragraph (e)(2) of this section for rules relating to the meaning of the term “taxable year” as used in this paragraph. The following are not considered at variance with the requirement of this paragraph:

(i) The taxpayer’s use of an inventory method other than LIFO for purposes of ascertaining information reported as a supplement to or explanation of the taxpayer’s primary presentation of the taxpayer’s income, profit, or loss for a taxable year in credit statements or financial reports (including preliminary and unaudited financial reports). See paragraph (e)(3) of this section for rules relating to the reporting of supplemental and explanatory information ascertained by the use of an inventory method other than LIFO.

(ii) The taxpayer’s use of an inventory method other than LIFO to ascertain the value of the taxpayer’s inventory of goods on hand for purposes of reporting the value of such inventories as assets. See paragraph (e)(4) of this section for rules relating to such disclosures.

(iii) The taxpayer’s use of an inventory method other than LIFO for purposes of ascertaining information reported in internal management reports. See paragraph (e)(5) of this section for rules relating to such reports.

(iv) The taxpayer’s use of an inventory method other than LIFO for purposes of issuing reports or credit statements covering a period of operations that is less than the whole of a taxable year for which the LIFO method is used for Federal income tax purposes. See paragraph (e)(6) of this section for rules relating to series of interim reports.

(v) The taxpayer’s use of the lower of LIFO cost or market method to value LIFO inventories for purposes of financial reports and credit statements. However, except as provided in paragraph (e)(7) of this section, a taxpayer may not use market value in lieu of cost to value inventories for purposes of financial reports or credit statements.

(vi) The taxpayer’s use of a costing method or accounting method to ascertain income, profit, or loss for credit purposes or for purposes of financial reports if such costing method or accounting method is neither inconsistent with the inventory method referred to in § 1.472-1 nor at variance with the requirement referred to in § 1.472-2(c), regardless of whether such costing method or accounting method is used by the taxpayer for Federal income tax purposes. See paragraph (e)(8) of this section for examples of such costing methods and accounting methods.

(vii) For credit purposes or for purposes of financial reports, the taxpayer’s treatment of inventories, after such inventories have been acquired in a transaction to which section 351 applies from a transferor that used the LIFO method with respect to such inventories, as if such inventories had the same acquisition dates and costs as in the hands of the transferor.

(viii) For credit purposes or for purposes of financial reports relating to a taxable year, the taxpayer’s determination of income, profit, or loss for the taxable year by valuing inventories in accordance with the procedures described in section 472(b) (1) and (3), notwithstanding that such valuation differs from the valuation of inventories for Federal income tax purposes because the taxpayer either –

(A) Adopted such procedures for credit or financial reporting purposes beginning with an accounting period other than the taxable year for which the LIFO method was first used by the taxpayer for Federal income tax purposes, or

(B) With respect to such inventories treated a business combination for credit or financial reporting purposes in a manner different from the treatment of the business combination for Federal income tax purposes.

(2)One-year periods other than a taxable year. The rules of this paragraph relating to the determination of income, profit, or loss for a taxable year and credit statements or financial reports that cover a taxable year also apply to the determination of income, profit, or loss for a one-year period other than a taxable year and credit statements or financial reports that cover a one-year period other than a taxable year, but only if the one-year period both begins and ends in a taxable year or years for which the taxpayer uses the LIFO method for Federal income tax purposes. For example, the requirements of paragraph (e)(1) of this section apply to a taxpayer’s determination of income for purposes of a credit statement that covers a 52-week fiscal year beginning and ending in a taxable year for which the taxpayer uses the LIFO method for Federal income tax purposes. Similarly, in the case of a calendar year taxpayer, the requirements of paragraph (e)(1) of this section apply to the taxpayer’s determination of income for purposes of a credit statement that covers the period October 1, 1981, through September 30, 1982, if the taxpayer uses the LIFO method for Federal income tax purposes in taxable years 1981 and 1982. However, the Commissioner will waive any violation of the requirements of this paragraph in the case of a credit statement or financial report that covers a one-year period other than a taxable year if the report was issued before January 22, 1981.

(3)Supplemental and explanatory information –

(i)Face of the income statement. Information reported on the face of a taxpayer’s financial income statement for a taxable year is not considered a supplement to or explanation of the taxpayer’s primary presentation of the taxpayer’s income, profit, or loss for the taxable year in credit statements or financial reports. For purposes of paragraph (e)(3) of this section, the face of an income statement does not include notes to the income statement presented on the same page as the income statement, but only if all notes to the financial income statement are presented together.

(ii)Notes to the income statement. Information reported in notes to a taxpayer’s financial income statement is considered a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss for the period covered by the income statement if all notes to the financial income statement are presented together and if they accompany the income statement in a single report. If notes to an income statement are issued in a report that does not include the income statement, the question of whether the information reported therein is supplemental or explanatory is determined under the rules in paragraph (e)(3)(iv) of this section.

(iii)Appendices and supplements to the income statement. Information reported in an appendix or supplement to a taxpayer’s financial income statement is considered a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss for the period covered by the income statement if the appendix or supplement accompanies the income statement in a single report and the information reported in the appendix or supplement is clearly identified as a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss as reported on the face of the taxpayer’s income statement. If an appendix or supplement to an income statement is issued in a report that does not include the income statement, the question of whether the information reported therein is supplemental or explanatory is determined under the rules in paragraph (e)(3)(iv) of this section. For purposes of paragraph (e)(3)(iii) of this section, an appendix or supplement to an income statement includes written statements, schedules, and reports that are labelled supplements or appendices to the income statement. However, sections of an annual report such as those labelled “President’s Letter”, “Management’s Analysis”, “Statement of Changes in Financial Position”, “Summary of Key Figures”, and similar sections are reports described in paragraph (e)(3)(iv) of this section and are not considered “supplements or appendices to an income statement” within the meaning of paragraph (e)(3)(iii) of this section, regardless of whether such sections are also labelled as supplements or appendices. For purposes of paragraph (e)(3)(iii) of this section, information is considered to be clearly identified as a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss as reported on the face of the taxpayer’s income statement if the information either –

(A) Is reported in an appendix or supplement that contains a general statement identifying all such supplemental or explanatory information;

(B) Is identified specifically as supplemental or explanatory by a statement immediately preceding or following the disclosure of the information;

(C) Is disclosed in the context of making a comparison to corresponding information disclosed both on the face of the taxpayer’s income statement and in the supplement or appendix; or

(D) Is a disclosure of the effect on an item reported on the face of the taxpayer’s income statement of having used the LIFO method.

For example, a restatement of cost of goods sold based on an inventory method other than LIFO is considered to be clearly identified as supplemental or explanatory information if the supplement or appendix containing the restatement contains a general statement that all information based on such inventory method is reported in the appendix or supplement as a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss as reported on the face of the taxpayer’s income statement.

(iv)Other reports; in general. The rules of paragraph (e)(3) (iv), (v), and (vi) of this section apply to the following types of reports: news releases; letters to shareholders, partners, or other proprietors or beneficiaries; oral statements at press conferences, shareholders’ meetings or securities analysts’ meetings; sections of an annual report such as those labelled “President’s Letter”, “Management’s Analysis”, “Statement of Changes in Financial Position”, “Summary of Key Figures”, and similar sections; and reports other than a taxpayer’s income statement or accompanying notes, appendices, or supplements. Information disclosed in such a report is considered a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss for the period covered by an income statement if the supplemental or explanatory information is clearly identified as a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss as reported on the face of the taxpayer’s income statement and the specific item of information being explained or supplemented, such as the cost of goods sold, net income, or earnings per share ascertained using the LIFO method, is also reported in the other report.

(v)Other reports; disclosure of non-LIFO income. For purposes of paragraph (e)(3)(iv) of this section, supplemental or explanatory information is considered to have been clearly identified as such if it would be considered to have been clearly identified as such under the rules of paragraph (e)(3)(iii) of this section, relating to information reported in supplements or appendices to an income statement. For example, if at a securities analysts’ meeting the following question is asked, “What would the reported earnings per share for the year have been if the FIFO method had been used to value inventories?”, it would be permissible to respond “Reported earnings per share for the year were $6.00. If the company had used the FIFO method to value inventories this year and had computed earnings based upon the following assumptions, earnings per share would have been $8.20. FIFO earnings are based on the following assumptions:

“(A) The use of the same effective tax rate as used in computing LIFO earnings, and

“(B) All other conditions and assumptions remain the same, including –

“(1) The use of the LIFO method for Federal income tax purposes and

“(2) The investment of the tax savings resulting from such use of the LIFO method, the income from which is included in both LIFO and FIFO “earnings.”

(vi)Other reports; disclosure of effect on income. For purposes of paragraph (e)(3)(iv) of this section, if the only supplement to or explanation of a specific item is the effect on the item of having used LIFO instead of a method other than LIFO to value inventories, it is not necessary to also report the specific item. For example, if at a shareholders’ meeting the question is asked, “What was the effect on reported earnings per share of not having used FIFO to value inventories?”, it would be permissible to respond “If earnings would have been computed on the basis of the following assumptions, the use of LIFO instead of FIFO to value inventories would have decreased reported earnings per share by $2.20. FIFO earnings are based on the following assumptions:

“(A) The use of the same effective tax rate as used in computing LIFO earnings, and

“(B) All other conditions and assumptions remain the same, including –

“(1) The use of the LIFO method for Federal income tax purposes and

“(2) The investment of the tax savings resulting from such use of the LIFO method, the income from which is included in both LIFO and FIFO earnings.”

(4)Inventory asset value disclosures. Under paragraph (e)(1)(ii) of this section, the use of an inventory method other than LIFO to ascertain the value of the taxpayer’s inventories for purposes of reporting the value of the inventories as assets is not considered the ascertainment of income, profit, or loss and therefore is not considered at variance with the requirement of paragraph (e)(1) of this section. Therefore, a taxpayer may disclose the value of inventories on a balance sheet using a method other than LIFO to identify the inventories, and such a disclosure will not be considered at variance with the requirement of paragraph (e)(1) of this section. However, the disclosure of income, profit, or loss for a taxable year on a balance sheet issued to creditors, shareholders, partners, other proprietors, or beneficiaries is considered at variance with the requirement of paragraph (e)(1) of this section if such income information is ascertained using an inventory method other than LIFO and such income information is for a taxable year for which the LIFO method is used for Federal income tax purposes. Therefore, a balance sheet that discloses the net worth of a taxpayer, determined as if income had been ascertained using an inventory method other than LIFO, may be at variance with the requirement of paragraph (e)(1) of this section if the disclosure of net worth is made in a manner that also discloses income, profit, or loss for a taxable year.

However, a disclosure of income, profit, or loss using an inventory method other than LIFO is not considered at variance with the requirement of paragraph (e)(1) of this section if the disclosure is made in the form of either a footnote to the balance sheet or a parenthetical disclosure on the face of the balance sheet. In addition, an income disclosure is not considered at variance with the requirement of paragraph (e)(1) of this section if the disclosure is made on the face of a supplemental balance sheet labelled as a supplement to the taxpayer’s primary presentation of financial position, but only if, consistent with the rules of paragraph (e)(3) of this section, such a disclosure is clearly identified as a supplement to or explanation of the taxpayer’s primary presentation of financial income as reported on the face of the taxpayer’s income statement.

(5)Internal management reports. [Reserved]

(6)Series of interim reports. For purposes of paragraph (e)(1)(iv) of this section, a series of credit statements or financial reports is considered a single statement or report covering a period of operations if the statements or reports in the series are prepared using a single inventory method and can be combined to disclose the income, profit, or loss for the period. However, the Commissioner will waive any violation of the requirement of this paragraph in the case of a series of interim reports issued before February 6, 1978, that cover a taxable year, or a series of interim reports issued before January 22, 1981 that cover a one-year period other than a taxable year.

(7)Market value. The Commissioner will waive any violation of the requirement of this paragraph in the case of a taxpayer’s use of market value in lieu of cost for a credit statement or financial report issued before January 22, 1981. However, the special rule of this (7) applies only to a taxpayer’s use of market value in lieu of cost and does not apply to the use of a method of valuation such as market value in lieu of cost but not more than FIFO cost.

(8)Use of different methods. The following are examples of costing methods and accounting methods that are neither inconsistent with the inventory method referred to in § 1.472-1 nor at variance with the requirement of § 1.472-2(c) and which, under paragraph (e)(1)(vi) of this section, may be used to ascertain income, profit, or loss for credit purposes or for purposes of financial reports regardless of whether such method is also used by the taxpayer for Federal income tax purposes:

(i) Any method relating to the determination of which costs are includible in the computation of the cost of inventory under the full absorption inventory method.

(ii) Any method of establishing pools for inventory under the dollar-value LIFO inventory method.

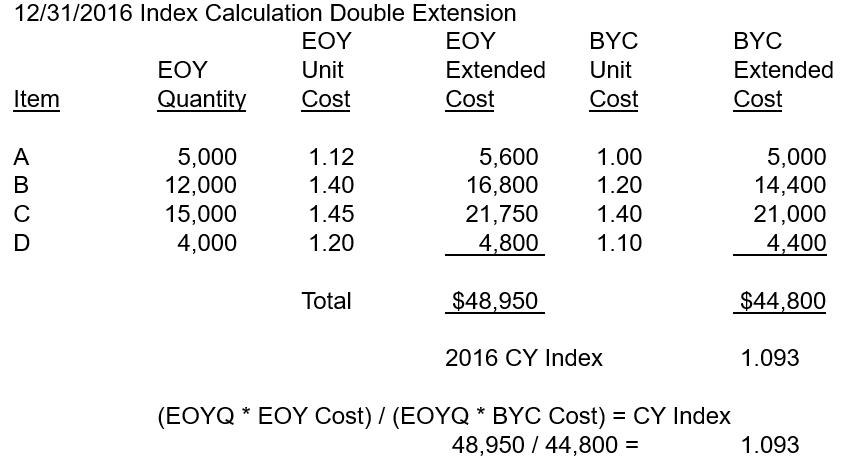

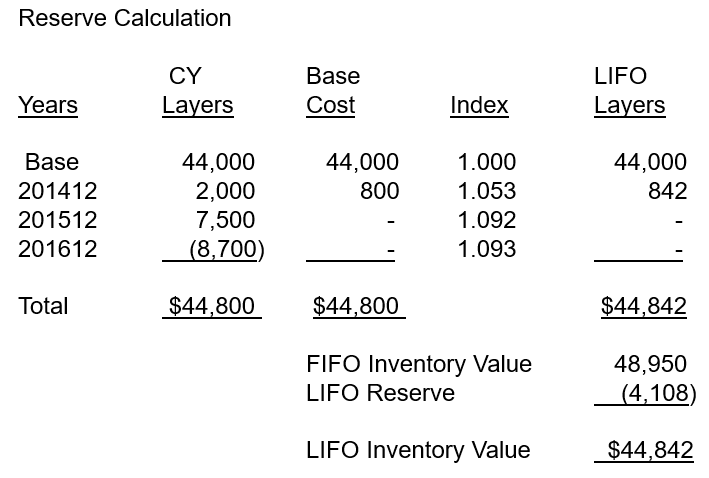

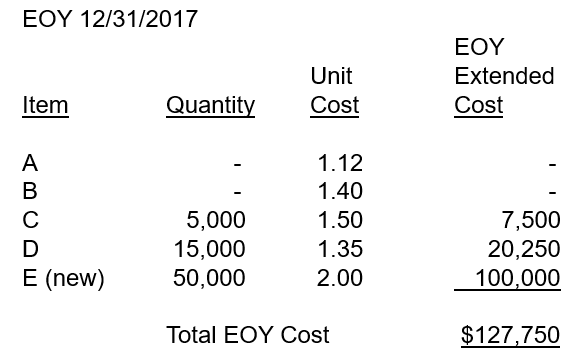

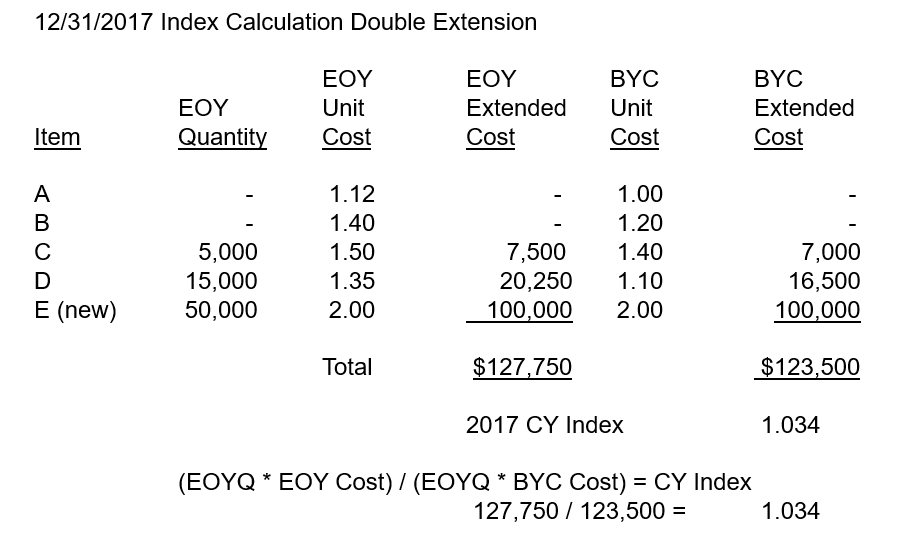

(iii) Any method of determining the LIFO value of a dollar-value inventory pool, such as the double-extension method, the index method, and the link chain method.

(iv) Any method of determining or selecting a price index to be used with the index or link chain method of valuing inventory pools under the dollar-value LIFO inventory method.

(v) Any method permitted under § 1.472-8 for determining the current-year cost of closing inventory for purposes of using the dollar-value LIFO inventory method.

(vi) Any method permitted under § 1.472-2(d) for determining the cost of goods in excess of goods on hand at the beginning of the year for purposes of using a LIFO method other than the dollar-value LIFO method.

(vii) Any method relating to the classification of an item as inventory or a capital asset.

(viii) The use of an accounting period other than the period used for Federal income tax purposes.

(ix) The use of cost estimates.

(x) The use of actual cost of cut timber or the cost determined under section 631(a).

(xi) The use of inventory costs unreduced by any adjustment required by the application of section 108 and section 1017, relating to discharge of indebtedness.

(xii) The determination of the time when sales or purchases are accrued.

(xiii) The use of a method to allocate basis in the case of a business combination other than the method used for Federal income tax purposes.

(xiv) The treatment of transfers of inventory between affiliated corporations in a manner different from that required by § 1.1502-13.

(9)Reconciliation of LIFO inventory values. A taxpayer may be required to reconcile differences between the value of inventories maintained for credit or financial reporting purposes and for Federal income tax purposes in order to show that the taxpayer has satisfied the requirements of this paragraph.

(f) Goods of the specified type on hand as of the close of the taxable year preceding the taxable year for which this inventory method is first used shall be included in the taxpayer’s closing inventory for such preceding taxable year at cost determined in the manner prescribed in paragraph (c) of this section.

(g) The LIFO inventory method, once adopted by the taxpayer with the approval of the Commissioner, shall be adhered to in all subsequent taxable years unless –

(1) A change to a different method is approved by the Commissioner; or

(2) The Commissioner determines that the taxpayer, in ascertaining income, profit, or loss for the whole of any taxable year subsequent to his adoption of the LIFO inventory method, for credit purposes or for the purpose of reports to shareholders, partners, or other proprietors, or to beneficiaries, has used any inventory method at variance with that referred to in § 1.472-1 and requires of the taxpayer a change to a different method for such subsequent taxable year or any taxable year thereafter.

(h) The records and accounts employed by the taxpayer in keeping his books shall be maintained in conformity with the inventory method referred to in § 1.472-1; and such supplemental and detailed inventory records shall be maintained as will enable the district director readily to verify the taxpayer’s inventory computations as well as his compliance with the requirements of section 472 and §§ 1.472-1 through 1.472-7.

(i) Where the taxpayer is engaged in more than one trade or business, the Commissioner may require that if the LIFO method of valuing inventories is used with respect to goods in one trade or business the same method shall also be used with respect to similar goods in the other trades or businesses if, in the opinion of the Commissioner, the use of such method with respect to such other goods is essential to a clear reflection of income.

(a) The LIFO inventory method may be adopted and used only if the taxpayer files with his income tax return for the taxable year as of the close of which the method is first to be used a statement of his election to use such inventory method. The statement shall be made on Form 970 pursuant to the instructions printed with respect thereto and to the requirements of this section, or in such other manner as may be acceptable to the Commissioner. Such statement shall be accompanied by an analysis of all inventories of the taxpayer as of the beginning and as of the end of the taxable year for which the LIFO inventory method is proposed first to be used, and also as of the beginning of the prior taxable year. In the case of a manufacturer, this analysis shall show in detail the manner in which costs are computed with respect to raw materials, goods in process, and finished goods, segregating the products (whether in process or finished goods) into natural groups on the basis of either (1) similarity in factory processes through which they pass, or (2) similarity of raw materials used, or (3) similarity in style, shape, or use of finished products. Each group of products shall be clearly described.

(b) The taxpayer shall submit for the consideration of the Commissioner in connection with the taxpayer’s adoption or use of the LIFO inventory method such other detailed information with respect to his business or accounting system as may be at any time requested by the Commissioner.

(c) As a condition to the taxpayer’s use of the LIFO inventory method, the Commissioner may require that the method be used with respect to goods other than those specified in the taxpayer’s statement of election if, in the opinion of the Commissioner, the use of such method with respect to such other goods is essential to a clear reflection of income.

(d) Whether or not the taxpayer’s application for the adoption and use of the LIFO inventory method should be approved, and whether or not such method, once adopted, may be continued, and the propriety of all computations incidental to the use of such method, will be determined by the Commissioner in connection with the examination of the taxpayer’s income tax returns.

A taxpayer may not change to the LIFO method of taking inventories unless, at the time he files his application for the adoption of such method, he agrees to such adjustments incident to the change to or from such method, or incident to the use of such method, in the inventories of prior taxable years or otherwise, as the district director upon the examination of the taxpayer’s returns may deem necessary in order that the true income of the taxpayer will be clearly reflected for the years involved.

An election made to adopt and use the LIFO inventory method is irrevocable, and the method once adopted shall be used in all subsequent taxable years, unless the use of another method is required by the Commissioner, or authorized by him pursuant to a written application therefor filed as provided in paragraph (e) of § 1.446-1.

If the taxpayer is granted permission by the Commissioner to discontinue the use of LIFO method of taking inventories, and thereafter to use some other method, or if the taxpayer is required by the Commissioner to discontinue the use of the LIFO method by reason of the taxpayer’s failure to conform to the requirements detailed in § 1.472-2, the inventory of the specified goods for the first taxable year affected by the change and for each taxable year thereafter shall be taken –

(a) In conformity with the method used by the taxpayer under section 471 in inventorying goods not included in his LIFO inventory computations; or

(b) If the LIFO inventory method was used by the taxpayer with respect to all of his goods subject to inventory, then in conformity with the inventory method used by the taxpayer prior to his adoption of the LIFO inventory method; or

(c) If the taxpayer had not used inventories prior to his adoption of the LIFO inventory method and had no goods currently subject to inventory by a method other than the LIFO inventory method, then in conformity with such inventory method as may be selected by the taxpayer and approved by the Commissioner as resulting in a clear reflection of income; or

(d) In any event, in conformity with any inventory method to which the taxpayer may change pursuant to application approved by the Commissioner.

For additional rules in the case of certain corporate acquisitions specified in section 381(a), see section 381(c)(5) and the regulations thereunder.

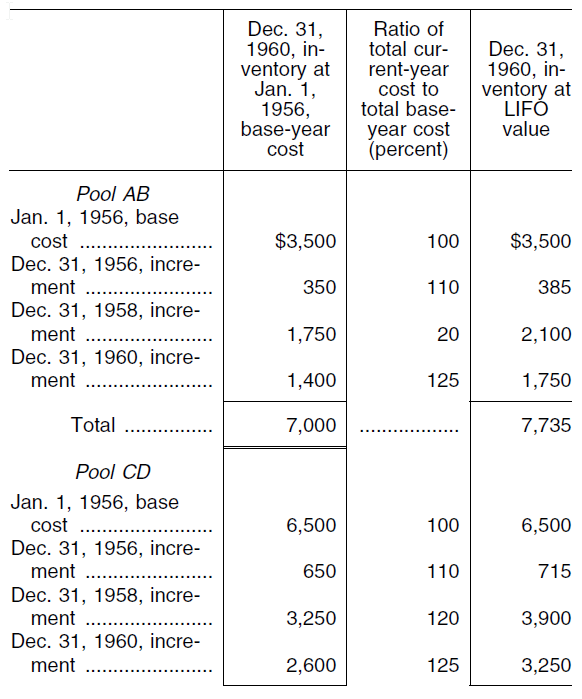

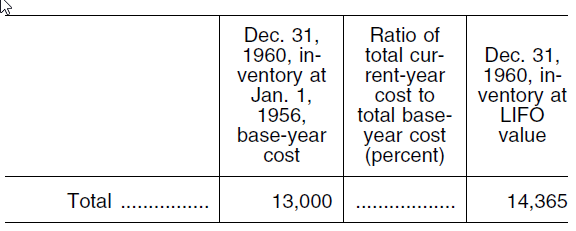

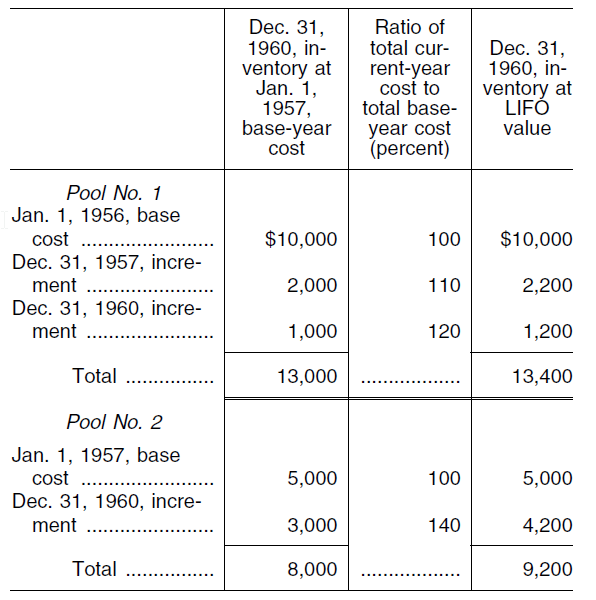

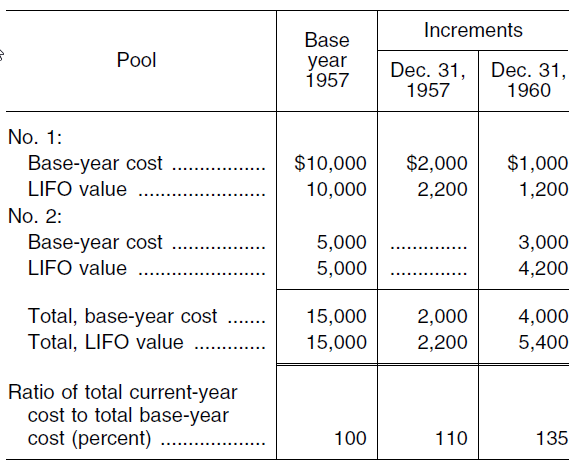

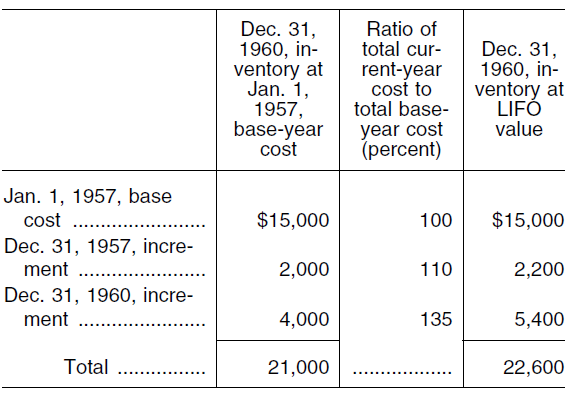

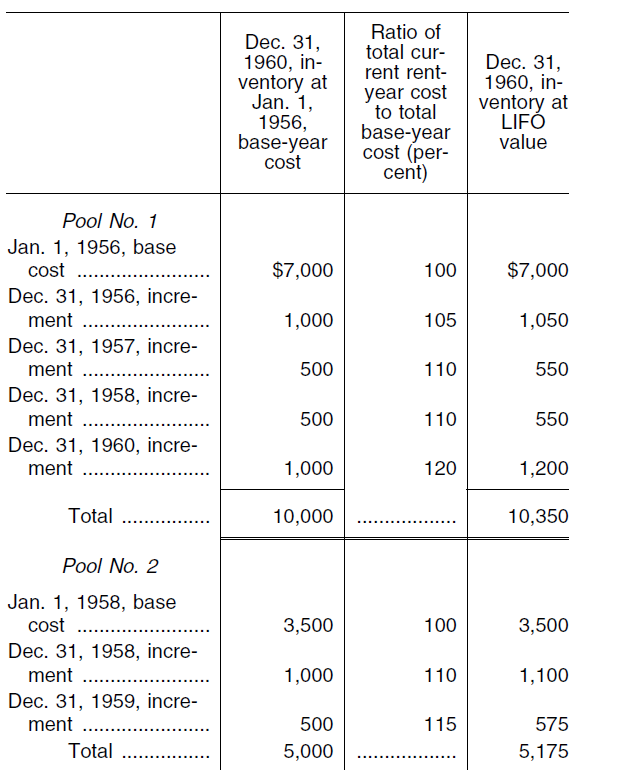

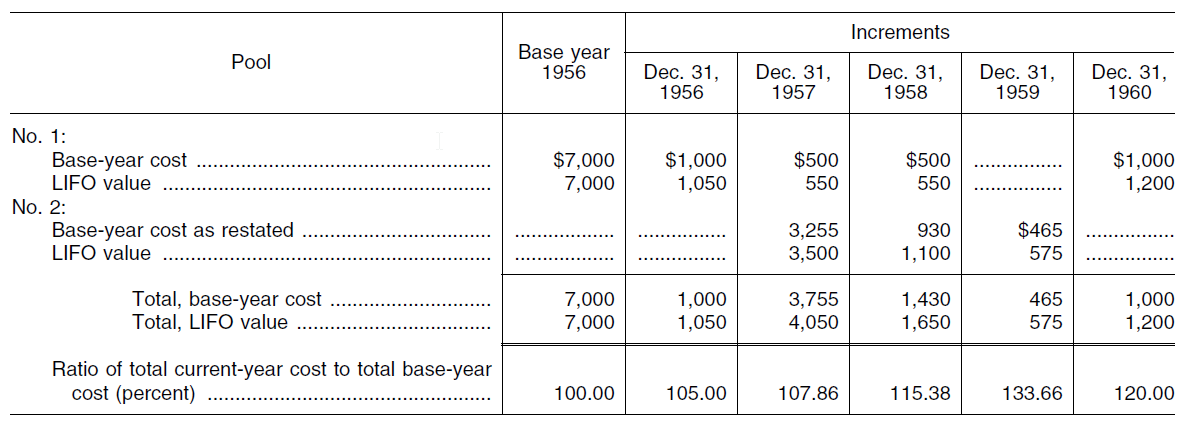

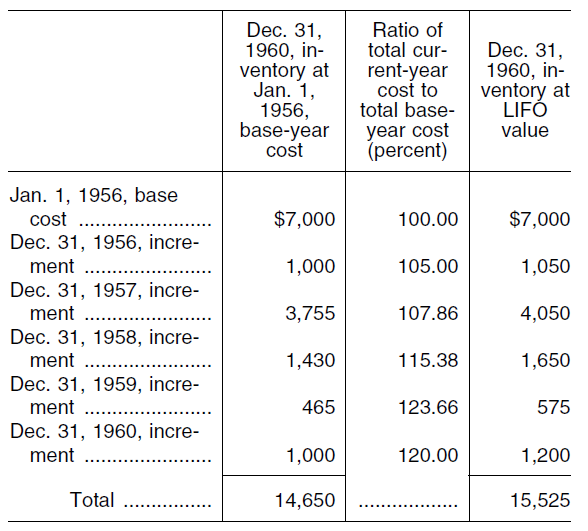

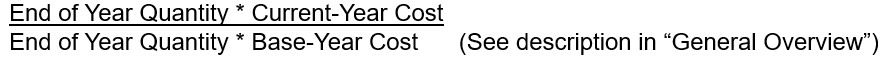

(a) Election to use dollar-value method. Any taxpayer may elect to determine the cost of his LIFO inventories under the so-called “dollar-value” LIFO method, provided such method is used consistently and clearly reflects the income of the taxpayer in accordance with the rules of this section. The dollar-value method of valuing LIFO inventories is a method of determining cost by using “base-year” cost expressed in terms of total dollars rather than the quantity and price of specific goods as the unit of measurement. Under such method the goods contained in the inventory are grouped into a pool or pools as described in paragraphs (b) and (c) of this section. The term “base-year cost” is the aggregate of the cost (determined as of the beginning of the taxable year for which the LIFO method is first adopted, i.e., the base date) of all items in a pool. The taxable year for which the LIFO method is first adopted with respect to any item in the pool is the “base year” for that pool, except as provided in paragraph (g)(3) of this section. Liquidations and increments of items contained in the pool shall be reflected only in terms of a net liquidation or increment for the pool as a whole. Fluctuations may occur in quantities of various items within the pool, new items which properly fall within the pool may be added, and old items may disappear from the pool, all without necessarily effecting a change in the dollar value of the pool as a whole. An increment in the LIFO inventory occurs when the end of the year inventory for any pool expressed in terms of base-year cost is in excess of the beginning of the year inventory for that pool expressed in terms of base-year cost. In determining the inventory value for a pool, the increment, if any, is adjusted for changing unit costs or values by reference to a percentage, relative to base-year-cost, determined for the pool as a whole. See paragraph (e) of this section. See also paragraph (f) of this section for rules relating to the change to the dollar-value LIFO method from another LIFO method.

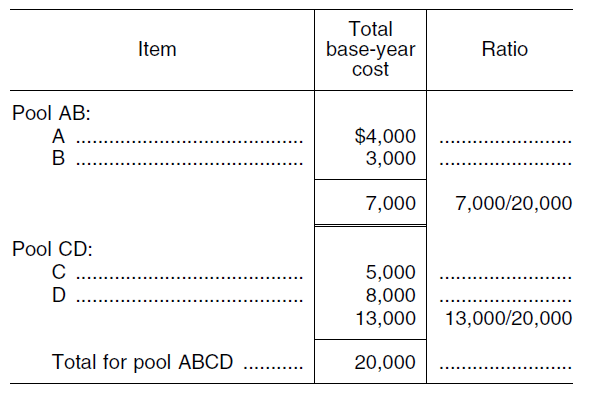

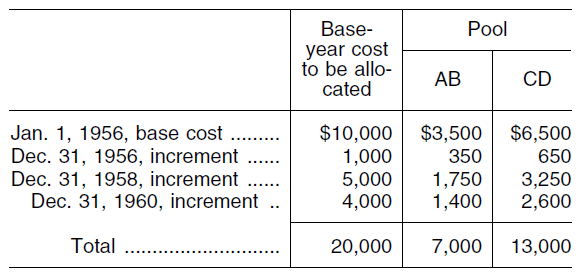

(b) Principles for establishing pools of manufacturers and processors –

(1)Natural business unit pools. A pool shall consist of all items entering into the entire inventory investment for a natural business unit of a business enterprise, unless the taxpayer elects to use the multiple pooling method provided in subparagraph (3) of this paragraph. Thus, if a business enterprise is composed of only one natural business unit, one pool shall be used for all of its inventories, including raw materials, goods in process, and finished goods. If, however, a business enterprise is actually composed of more than one natural business unit, more than one pool is required. Where similar types of goods are inventoried in two or more natural business units of the taxpayer, the Commissioner may apportion or allocate such goods among the various natural business units, if he determines that such apportionment or allocation is necessary in order to clearly reflect the income of such taxpayer. Where a manufacturer or processor is also engaged in the wholesaling or retailing of goods purchased from others, any pooling of the LIFO inventory of such purchased goods for the wholesaling or retailing operations shall be determined in accordance with the rules of paragraph (c) of this section.

(2)Definition of natural business unit.

(i) Whether an enterprise is composed of more than one natural business unit is a matter of fact to be determined from all the circumstances. The natural business divisions adopted by the taxpayer for internal management purposes, the existence of separate and distinct production facilities and processes, and the maintenance of separate profit and loss records with respect to separate operations are important considerations in determining what is a business unit, unless such divisions, facilities, or accounting records are set up merely because of differences in geographical location. In the case of a manufacturer or processor, a natural business unit ordinarily consists of the entire productive activity of the enterprise within one product line or within two or more related product lines including (to the extent engaged in by the enterprise) the obtaining of materials, the processing of materials, and the selling of manufactured or processed goods. Thus, in the case of a manufacturer or processor, the maintenance and operation of a raw material warehouse does not generally constitute, of itself, a natural business unit. If the taxpayer maintains and operates a supplier unit the production of which is both sold to others and transferred to a different unit of the taxpayer to be used as a component part of another product, the supplier unit will ordinarily constitute a separate and distinct natural business unit. Ordinarily, a processing plant would not in itself be considered a natural business unit if the production of the plant, although saleable at this stage, is not sold to others, but is transferred to another plant of the enterprise, not operated as a separate division, for further processing or incorporation into another product. On the other hand, if the production of a manufacturing or processing plant is transferred to a separate and distinct division of the taxpayer, which constitutes a natural business unit, the supplier unit itself will ordinarily be considered a natural business unit. However, the mere fact that a portion of the production of a manufacturing or processing plant may be sold to others at a certain stage of processing with the remainder of the production being further processed or incorporated into another product will not of itself be determinative that the activities devoted to the production of the portion sold constitute a separate business unit. Where a manufacturer or processor is also engaged in the wholesaling or retailing of goods purchased from others, the wholesaling or retailing operations with respect to such purchased goods shall not be considered a part of any manufacturing or processing unit.

(ii) The rules of this subparagraph may be illustrated by the following examples:

Example 1.

A corporation manufactures, in one division, automatic clothes washers and driers of both commercial and domestic grade as well as electric ranges, mangles, and dishwashers. The corporation manufactures, in another division, radios and television sets. The manufacturing facilities and processes used in manufacturing the radios and television sets are distinct from those used in manufacturing the automatic clothes washers, etc. Under these circumstances, the enterprise would consist of two business units and two pools would be appropriate, one consisting of all of the LIFO inventories entering into the manufacture of clothes washers and driers, electric ranges, mangles, and dishwashers and the other consisting of all of the LIFO inventories entering into the production of radio and television sets.

Example 2.

A taxpayer produces plastics in one of its plants. Substantial amounts of the production are sold as plastics. The remainder of the production is shipped to a second plant of the taxpayer for the production of plastic toys which are sold to customers. The taxpayer operates his plastics plant and toy plant as separate divisions. Because of the different product lines and the separate divisions the taxpayer has two natural business units.

Example 3.

A taxpayer is engaged in the manufacture of paper. At one stage of processing, uncoated paper is produced. Substantial amounts of uncoated paper are sold at this stage of processing. The remainder of the uncoated paper is transferred to the taxpayer’s finishing mill where coated paper is produced and sold. This taxpayer has only one natural business unit since coated and uncoated paper are within the same product line.

(3)Multiple pools –

(i)Principles for establishing multiple pools.

(a) A taxpayer may elect to establish multiple pools for inventory items which are not within a natural business unit as to which the taxpayer has adopted the natural business unit method of pooling as provided in subparagraph (1) of this paragraph. Each such pool shall ordinarily consist of a group of inventory items which are substantially similar. In determining whether such similarity exists, consideration shall be given to all the facts and circumstances. The formulation of detailed rules for selection of pools applicable to all taxpayers is not feasible. Important considerations to be taken into account include, for example, whether there is substantial similarity in the types of raw materials used or in the processing operations applied; whether the raw materials used are readily interchangeable; whether there is similarity in the use of the products; whether the groupings are consistently followed for purposes of internal accounting and management; and whether the groupings follow customary business practice in the taxpayer’s industry. The selection of pools in each case must also take into consideration such factors as the nature of the inventory items subject to the dollar-value LIFO method and the significance of such items to the taxpayer’s business operations. Where similar types of goods are inventoried in natural business units and multiple pools of the taxpayer, the Commissioner may apportion or allocate such goods among the natural business units and the multiple pools, if he determines that such apportionment or allocation is necessary in order to clearly reflect the income of the taxpayer.

(b) Raw materials which are substantially similar shall be pooled together in accordance with the principles of this subparagraph. However, inventories of raw or unprocessed materials of an unlike nature may not be placed into one pool, even though such materials become part of otherwise identical finished products.

(c) Finished goods and goods-in-process in the inventory shall be placed into pools classified by major classes or types of goods. The same class or type of finished goods and goods-in-process shall ordinarily be included in the same pool. Where the material content of a class of finished goods and goods-in-process included in a pool has been changed, for example, to conform with current trends in an industry, a separate pool of finished goods and goods-in-process will not ordinarily be required unless the change in material content results in a substantial change in the finished goods.

(d) The requirement that pools be established by major types of materials or major classes of goods is not to be construed so as to preclude the establishment of a miscellaneous pool. Since a taxpayer may elect the dollar-value LIFO method with respect to all or any designated goods in his inventory, there may be a number of such inventory items covered in the election. A miscellaneous pool shall consist only of items which are relatively insignificant in dollar value by comparison with other inventory items in the particular trade or business and which are not properly includible as part of another pool.

(ii)Raw materials content pools. The dollar-value method of pricing LIFO inventories may be used in conjunction with the raw materials content method authorized in § 1.472-1. Raw materials (including the raw material content of finished goods and goods-in-process) which are substantially similar shall be pooled together in accordance with the principles of subdivision (i) of this subparagraph. However, inventories of materials of an unlike nature may not be placed into one pool, even though such materials become part of otherwise identical finished products.

(4)IPIC method pools. A manufacturer or processor that elects to use the inventory price index computation method described in paragraph (e)(3) of this section (IPIC method) for a trade or business may elect to establish dollar-value pools for those items accounted for using the IPIC method based on the 2-digit commodity codes (i.e., major commodity groups) in Table 6 (Producer price indexes and percent changes for commodity groupings and individual items, not seasonally adjusted) of the “PPI Detailed Report” published monthly by the United States Bureau of Labor Statistics (available from New Orders, Superintendent of Documents, PO Box 371954, Pittsburgh, PA 15250-7954). A taxpayer electing to establish dollar-value pools under this paragraph (b)(4) may combine IPIC pools that comprise less than 5 percent of the total current-year cost of all dollar-value pools to form a single miscellaneous IPIC pool. A taxpayer electing to establish dollar-value pools under this paragraph (b)(4) may combine a miscellaneous IPIC pool that comprises less than 5 percent of the total current-year cost of all dollar-value pools with the largest IPIC pool. Each of these 5 percent rules is a method of accounting. A taxpayer may not change to, or cease using, either 5 percent rule without obtaining the Commissioner’s prior consent. Whether a specific IPIC pool or the miscellaneous IPIC pool satisfies the applicable 5 percent rule must be determined in the year of adoption or year of change (whichever is applicable) and redetermined every third taxable year. Any change in pooling required or permitted as a result of a 5 percent rule is a change in method of accounting. A taxpayer must secure the consent of the Commissioner pursuant to § 1.446-1(e) before combining or separating pools and must combine or separate its IPIC pools in accordance with paragraph (g)(2) of this section.

(c) Principles for establishing pools for wholesalers, retailers, etc –

(1)In general. Items of inventory in the hands of wholesalers, retailers, jobbers, and distributors shall be placed into pools by major lines, types, or classes of goods. In determining such groupings, customary business classifications of the particular trade in which the taxpayer is engaged is an important consideration. An example of such customary business classification is the department in the department store. In such case, practices are relatively uniform throughout the trade, and departmental grouping is peculiarly adapted to the customs and needs of the business. However, in appropriate cases, the principles set forth in paragraphs (b) (1) and (2) of this section, relating to pooling by natural business units, may be used, with permission of the Commissioner, by wholesalers, retailers, jobbers, or distributors. Where a wholesaler or retailer is also engaged in the manufacturing or processing of goods, the pooling of the LIFO inventory for the manufacturing or processing operations shall be determined in accordance with the rules of paragraph (b) of this section.

(2)IPIC method pools. A retailer that elects to use the inventory price index computation method described in paragraph (e)(3) of this section (IPIC method) for a trade or business may elect to establish dollar-value pools for those items accounted for using the IPIC method based on either the general expenditure categories (i.e., major groups) in Table 3 (Consumer Price Index for all Urban Consumers (CPI-U): U.S. city average, detailed expenditure categories) of the “CPI Detailed Report” or the 2-digit commodity codes (i.e., major commodity groups) in Table 6 (Producer price indexes and percent changes for commodity groupings and individual items, not seasonally adjusted) of the “PPI Detailed Report.” A wholesaler, jobber, or distributor that elects to use the IPIC method for a trade or business may elect to establish dollar-value pools for any group of goods accounted for using the IPIC method and included within one of the 2-digit commodity codes (i.e., major commodity groups) in Table 6 (Producer price indexes and percent changes for commodity groupings and individual items, not seasonally adjusted) of the “PPI Detailed Report.” The “CPI Detailed Report” and the “PPI Detailed Report” are published monthly by the United States Bureau of Labor Statistics (BLS) (available from New Orders, Superintendent of Documents, P.O. Box 371954, Pittsburgh, PA 15250-7954). A taxpayer electing to establish dollar-value pools under this paragraph (c)(2) may combine IPIC pools that comprise less than 5 percent of the total current-year cost of all dollar-value pools to form a single miscellaneous IPIC pool. A taxpayer electing to establish pools under this paragraph (c)(2) may combine a miscellaneous IPIC pool that comprises less than 5 percent of the total current-year cost of all dollar-value pools with the largest IPIC pool. Each of these 5 percent rules is a method of accounting. Thus, a taxpayer may not change to, or cease using, either 5 percent rule without obtaining the Commissioner’s prior consent. Whether a specific IPIC pool or the miscellaneous IPIC pool satisfies the applicable 5 percent rule must be determined in the year of adoption or year of change (whichever is applicable) and redetermined every third taxable year. Any change in pooling required or permitted under a 5 percent rule is a change in method of accounting. A taxpayer must secure the consent of the Commissioner pursuant to section 1.446-1(e) before combining or separating pools and must combine or separate its IPIC pools in accordance with paragraph (g)(2) of this section.

(d) Determination of appropriateness of pools. Whether the number and the composition of the pools used by the taxpayer is appropriate, as well as the propriety of all computations incidental to the use of such pools, will be determined in connection with the examination of the taxpayer’s income tax returns. Adequate records must be maintained to support the base-year unit cost as well as the current-year unit cost for all items priced on the dollar-value LIFO inventory method, regardless of the method authorized by paragraph (e) of this section which is used in computing the LIFO value of the dollar-value pool. The pool or pools selected must be used for the year of adoption and for all subsequent taxable years unless a change is required by the Commissioner in order to clearly reflect income, or unless permission to change is granted by the Commissioner as provided in paragraph (e) of § 1.446-1. However, see paragraph (h) of this section for authorization to change the method of pooling in certain specified cases.

(e) Methods of computation of the LIFO value of a dollar-value pool –

(1)Methods authorized. A taxpayer may ordinarily use only the so-called “double-extension” method for computing the base-year and current-year cost of a dollar-value inventory pool. Where the use of the double-extension method is impractical, because of technological changes, the extensive variety of items, or extreme fluctuations in the variety of the items, in a dollar-value pool, the taxpayer may use an index method for computing all or part of the LIFO value of the pool. An index may be computed by double-extending a representative portion of the inventory in a pool or by the use of other sound and consistent statistical methods. The index used must be appropriate to the inventory pool to which it is to be applied. The appropriateness of the method of computing the index and the accuracy, reliability, and suitability of the use of such index must be demonstrated to the satisfaction of the district director in connection with the examination of the taxpayer’s income tax returns. The use of any so-called “link-chain” method will be approved for taxable years beginning after December 31, 1960, only in those cases where the taxpayer can demonstrate to the satisfaction of the district director that the use of either an index method or the double-extension method would be impractical or unsuitable in view of the nature of the pool. A taxpayer using either an index or link-chain method shall attach to his income tax return for the first taxable year beginning after December 31, 1960, for which the index or link-chain method is used, a statement describing the particular link-chain method or the method used in computing the index. The statement shall be in sufficient detail to facilitate the determination as to whether the method used meets the standards set forth in this subparagraph. In addition, a copy of the statement shall be filed with the Commissioner of Internal Revenue, Attention: T:R, Washington, D.C. 20224. The taxpayer shall submit such other information as may be requested with respect to such index or link-chain method. Adequate records must be maintained by the taxpayer to support the appropriateness, accuracy, and reliability of an index or link-chain method. A taxpayer may request the Commissioner to approve the appropriateness of an index or link-chain method for the first taxable year beginning after December 31, 1960, for which it is used. Such request must be submitted within 90 days after the beginning of the first taxable year beginning after December 31, 1960, in which the taxpayer desires to use the index or link-chain method, or on or before May 1, 1961, whichever is later. A taxpayer entitled to use the retail method of pricing LIFO inventories authorized by paragraph (k) of § 1.472-1 may use retail price indexes prepared by the United States Bureau of Labor Statistics. Any method of computing the LIFO value of a dollar-value pool must be used for the year of adoption and all subsequent taxable years, unless the taxpayer obtains the consent of the Commissioner in accordance with paragraph (e) of § 1.446-1 to use a different method.

(2)Double-extension method.

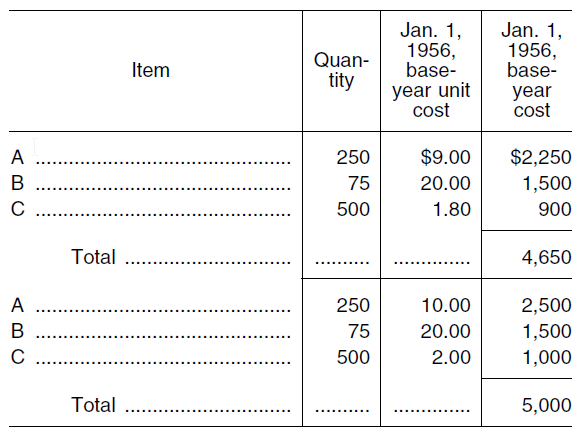

(i) Under the double-extension method the quantity of each item in the inventory pool at the close of the taxable year is extended at both base-year unit cost and current-year unit cost. The respective extensions at the two costs are then each totaled. The first total gives the amount of the current inventory in terms of base-year cost and the second total gives the amount of such inventory in terms of current-year cost.

(ii) The total current-year cost of items making up a pool may be determined –

(a) By reference to the actual cost of the goods most recently purchased or produced;

(b) By reference to the actual cost of the goods purchased or produced during the taxable year in the order of acquisition;

(c) By application of an average unit cost equal to the aggregate cost of all of the goods purchased or produced throughout the taxable year divided by the total number of units so purchased or produced; or

(d) Pursuant to any other proper method which, in the opinion of the Commissioner, clearly reflects income.

(iii) Under the double-extension method a base-year unit cost must be ascertained for each item entering a pool for the first time subsequent to the beginning of the base year. In such a case, the base-year unit cost of the entering item shall be the current-year cost of that item unless the taxpayer is able to reconstruct or otherwise establish a different cost. If the entering item is a product or raw material not in existence on the base date, its cost may be reconstructed, that is, the taxpayer using reasonable means may determine what the cost of the item would have been had it been in existence in the base year. If the item was in existence on the base date but not stocked by the taxpayer, he may establish, by using available data or records, what the cost of the item would have been to the taxpayer had he stocked the item. If the base-year unit cost of the entering item is either reconstructed or otherwise established to the satisfaction of the Commissioner, such cost may be used as the base-year unit cost in applying the double-extension method. If the taxpayer does not reconstruct or establish to the satisfaction of the Commissioner a base-year unit cost, but does reconstruct or establish to the satisfaction of the Commissioner the cost of the item at some year subsequent to the base year, he may use the earliest cost which he does reconstruct or establish as the base-year unit cost.

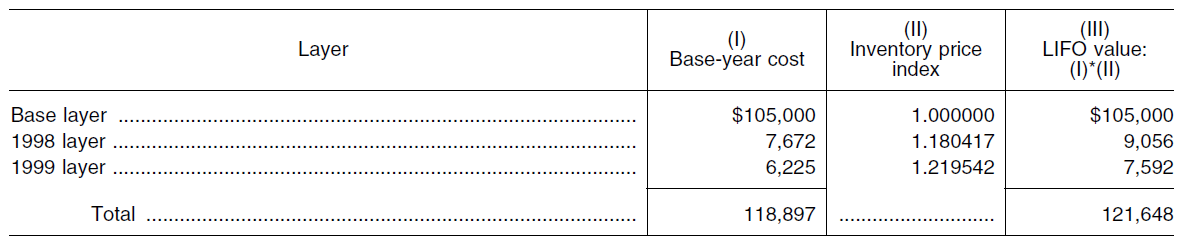

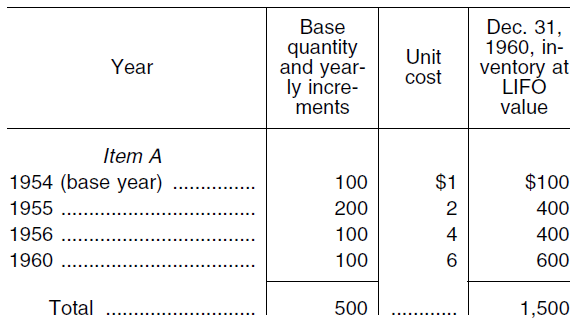

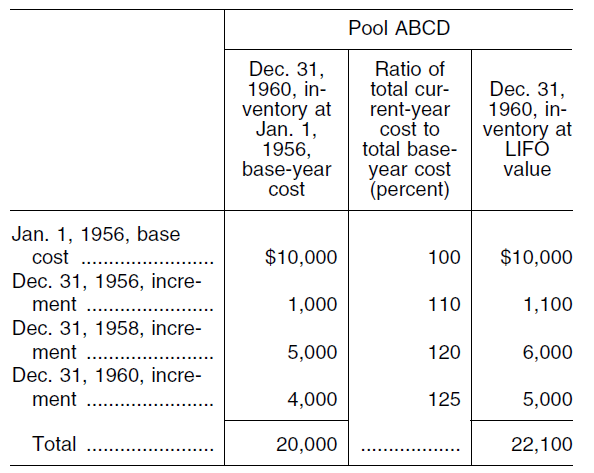

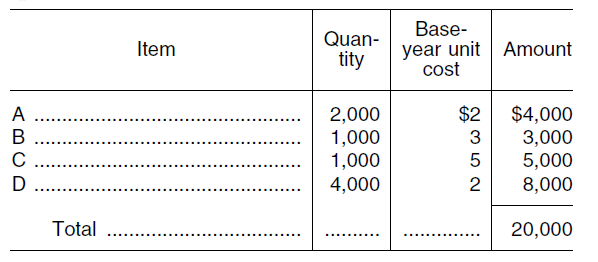

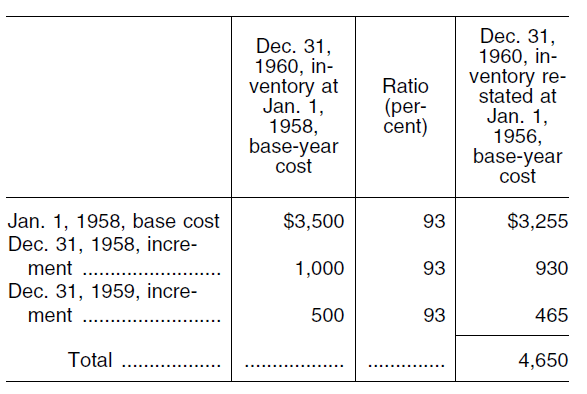

(iv) To determine whether there is an increment or liquidation in a pool for a particular taxable year, the end of the year inventory of the pool expressed in terms of base-year cost is compared with the beginning of the year inventory of the pool expressed in terms of base-year cost. When the end of the year inventory of the pool is in excess of the beginning of the year inventory of the pool an increment occurs in the pool for that year. If there is an increment for the taxable year, the ratio of the total current-year cost of the pool to the total base-year cost of the pool must be computed. This ratio when multiplied by the amount of the increment measured in terms of base-year cost gives the LIFO value of such increment. The LIFO value of each such increment is hereinafter referred to in this section as the “layer of increment” and must be separately accounted for and a record thereof maintained as a separate layer of the pool, and may not be combined with a layer of increment occurring in a different year. On the other hand, when the end of the year inventory of the pool is less than the beginning of the year inventory of the pool, a liquidation occurs in the pool for that year. Such liquidation is to be reflected by reducing the most recent layer of increment by the excess of the beginning of the year inventory over the end of the year inventory of the pool. However, if the amount of the liquidation exceeds the amount of the most recent layer of increment, the preceding layers of increment in reverse chronological order are to be successively reduced by the amount of such excess until all the excess is absorbed. The base-year inventory is to be reduced by liquidation only to the extent that the aggregate of all liquidation exceeds the aggregate of all layers of increment.

(v) The following examples illustrate inventories under the double-extension the computation of the LIFO value of method.

Example 1.

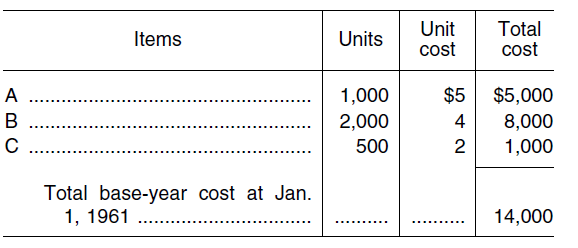

(a) A taxpayer elects, beginning with the calendar year 1961, to compute his inventories by use of the LIFO inventory method under section 472 and further elects to use the dollar-value method in pricing such inventories as provided in paragraph (a) of this section. He creates Pool No. 1 for items A, B, and C. The composition of the inventory for Pool No. 1 at the base date, January 1, 1961, is as follows:

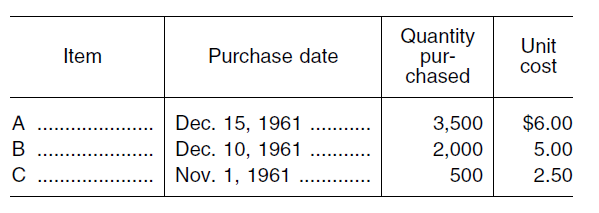

(b) The closing inventory of Pool No. 1 at December 31, 1961, contains 3,000 units of A, 1,000 units of B, and 500 units of C. The taxpayer computes the current-year cost of the items making up the pool by reference to the actual cost of goods most recently purchased. The most recent purchases of items A, B, and C are as follows:

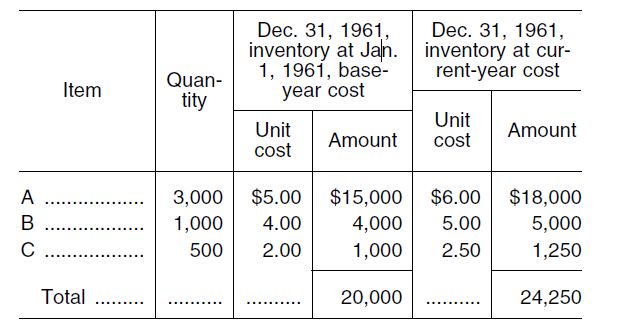

(c) The inventory of Pool No. 1 at December 31, 1961, shown at base-year and current-year cost is as follows:

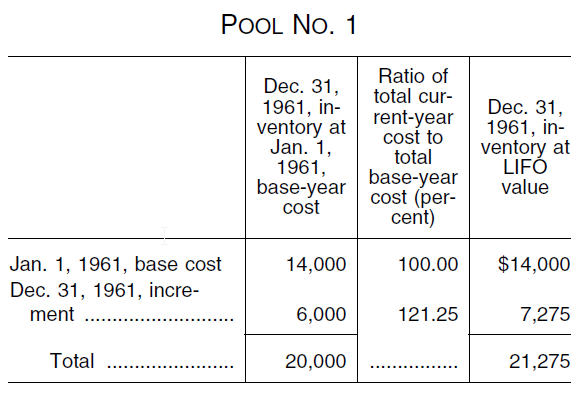

(d) If the amount of the December 31, 1961, inventory at base-year cost were equal to, or less than, the base-year cost of $14,000 at January 1, 1961, such amount would be the closing LIFO inventory at December 31, 1961. However, since the base-year cost of the closing LIFO inventory at December 31, 1961, amounts to $20,000, and is in excess of the $14,000 base-year cost of the opening inventory for that year, there is a $6,000 increment in Pool No. 1 during the year. This increment must be valued at current-year cost, i.e., the ratio of 24,250/20,000, or 121.25 percent. The LIFO value of the inventory at December 31, 1961, is $21,275, computed as follows:

Example 2.

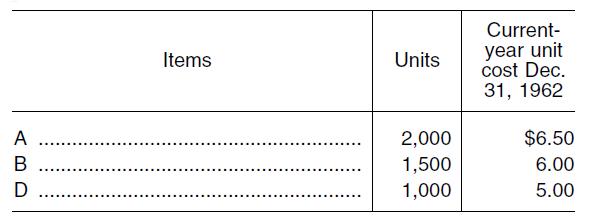

(a) Assume the taxpayer in Example 1 during the year 1962 completely disposes of item C and purchases item D. Assume further that item D is properly includible in Pool No. 1 under the provisions of this section. The closing inventory on December 31, 1962, consists of quantities at current-year unit cost, as follows:

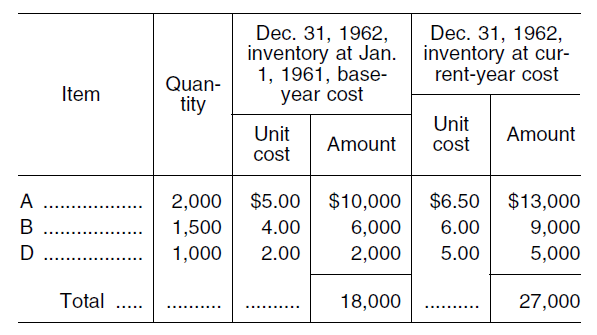

(b) The taxpayer establishes that the cost of item D, had he acquired it on January 1, 1961, would have been $2.00 per unit. Such cost shall be used as the base-year unit cost for item D, and the LIFO computations at December 31, 1962, are made as follows:

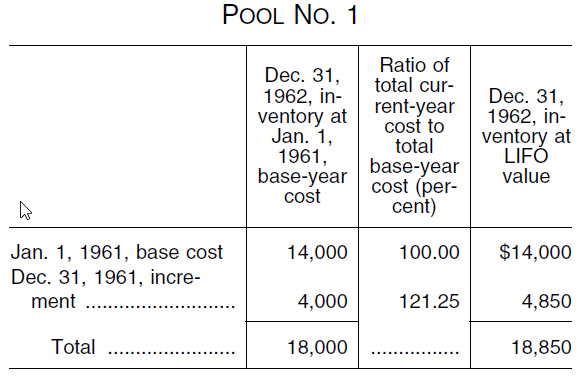

(c) Since the closing inventory at base-year cost, $18,000, is less than the 1962 opening inventory at base-year cost, $20,000, a liquidation of $2,000 has occurred during 1962. This liquidation is to be reflected by reducing the most recent layer of increment. The LIFO value of the inventory at December 31, 1962, is $18,850, and is summarized as follows:

(3)Inventory price index computation (IPIC) method –

(i)In general. The inventory price index computation method provided by this paragraph (e)(3) (IPIC method) is an elective method of determining the LIFO value of a dollar-value pool using consumer or producer price indexes published by the United States Bureau of Labor Statistics (BLS). A taxpayer using the IPIC method must compute a separate inventory price index (IPI) for each dollar-value pool. This IPI is used to convert the total current-year cost of the items in a dollar-value pool to base-year cost in order to determine whether there is an increment or liquidation in terms of base-year cost and, if there is an increment, to determine the LIFO inventory value of the current year’s layer of increment (layer). Using one IPI to compute the base-year cost of a dollar-value pool for the current taxable year and using a different IPI to compute the LIFO inventory value of the current taxable year’s layer is not permitted under the IPIC method. The IPIC method will be accepted by the Commissioner as an appropriate method of computing an index, and the use of that index to compute the LIFO value of a dollar-value pool will be accepted as accurate, reliable, and suitable. The appropriateness of a taxpayer’s computation of an IPI, which includes all the steps described in paragraph (e)(3)(iii) of this section, will be determined in connection with an examination of the taxpayer’s federal income tax return. A taxpayer using the IPIC method may elect to establish dollar-value pools according to the special rules in paragraphs (b)(4) and (c)(2) of this section or the general rules in paragraphs (b) and (c) of this section. Taxpayers eligible to use the IPIC method are described in paragraph (e)(3)(ii) of this section. The manner in which an IPI is computed is described in paragraph (e)(3)(iii) of this section. Rules relating to the adoption of, or change to, the IPIC method are in paragraph (e)(3)(iv) of this section.

(ii)Eligibility. Any taxpayer electing to use the dollar-value LIFO method may elect to use the IPIC method. Except as provided in this paragraph (e)(3)(ii) or in other published guidance, a taxpayer that elects to use the IPIC method for a specific trade or business must use that method to account for all items of dollar-value LIFO inventory. A taxpayer that uses the retail price indexes computed by the BLS and published in “Department Store Inventory Price Indexes” (available from the BLS by calling (202) 606-6325 and entering document code 2415) may elect to use the IPIC method for items that do not fall within any of the major groups listed in “Department Store Inventory Price Indexes.”

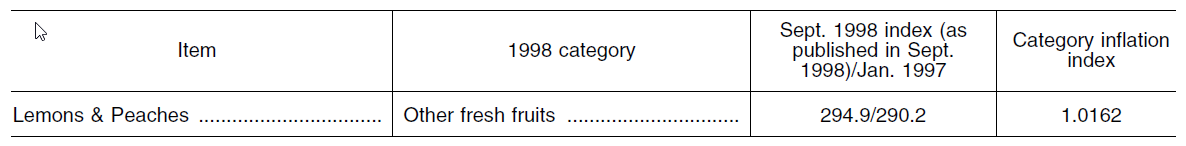

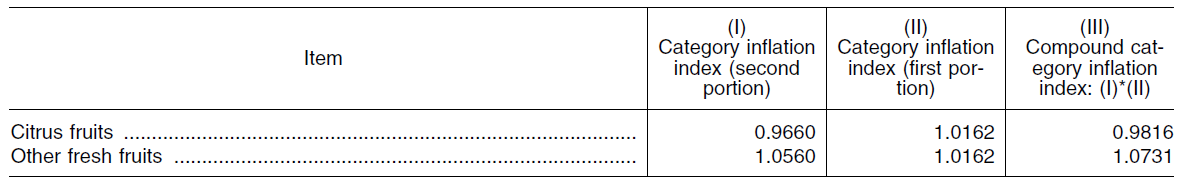

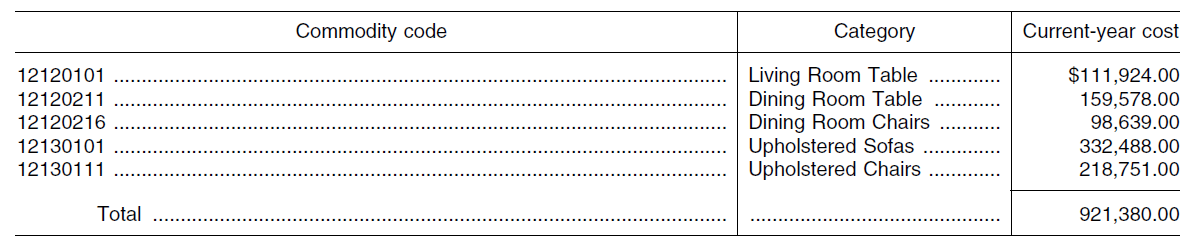

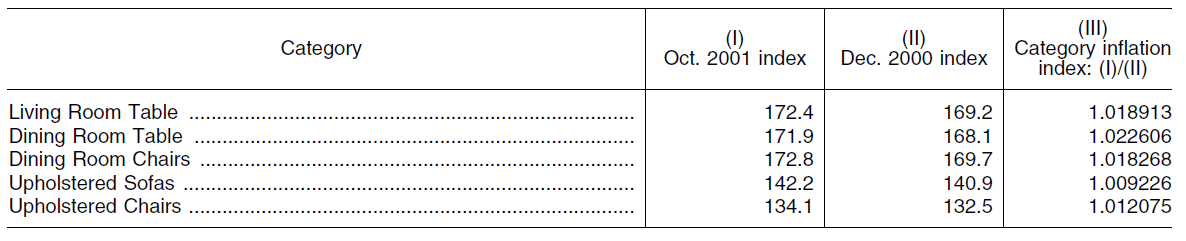

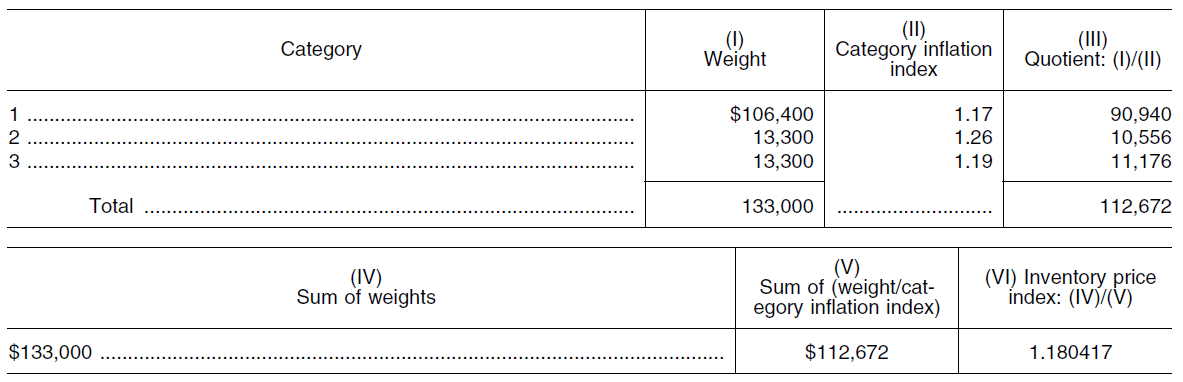

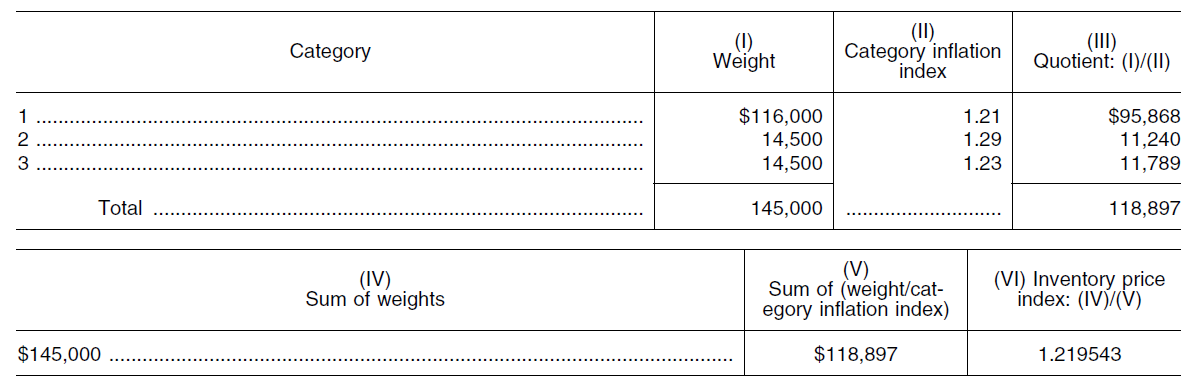

(iii)Computation of an inventory price index –

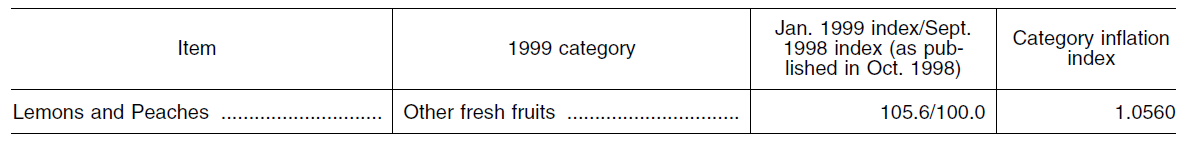

(A)In general. The computation of an IPI for a dollar-value pool requires the following four steps, which are described in more detail in this paragraph (e)(3)(iii): First, selection of a BLS table and an appropriate month; second, assignment of items in a dollar-value pool to BLS categories (selected BLS categories); third, computation of category inflation indexes for selected BLS categories; and fourth, computation of the IPI. A taxpayer may compute the IPI for each dollar-value pool using either the double-extension method (double-extension IPIC method) or the link-chain method (link-chain IPIC method), without regard to whether the use of a double-extension method is impractical or unsuitable. The use of either the double-extension IPIC method or the link-chain IPIC method is a method of accounting, and the adopted method must be applied consistently to all dollar-value pools within a trade or business accounted for under the IPIC method. A taxpayer that wants to change from the double-extension IPIC method to the link-chain IPIC method, or vice versa, must secure the consent of the Commissioner under § 1.446-1(e). This change must be made with a new base year as described in paragraph (e)(3)(iv)(B)(1).

(B)Selection of BLS table and appropriate month –

(1)In general. Under the IPIC method, an IPI is computed using the consumer or producer price indexes for certain categories (BLS price indexes and BLS categories, respectively) listed in the selected BLS table of the “CPI Detailed Report” or the “PPI Detailed Report” for the appropriate month.

(2) BLS table selection. Manufacturers, processors, wholesalers, jobbers, and distributors must select BLS price indexes from Table 6 (Producer price indexes and percent changes for commodity groupings and individual items, not seasonally adjusted) of the “PPI Detailed Report”, unless the taxpayer can demonstrate that selecting BLS price indexes from another table of the “PPI Detailed Report” is more appropriate. Retailers may select BLS price indexes from either Table 3 (Consumer Price Index for all Urban Consumers (CPI-U): U.S. city average, detailed expenditure categories) of the “CPI Detailed Report” or from Table 6 (or another more appropriate table) of the “PPI Detailed Report.” The selection of a BLS table is a method of accounting and must be used for the taxable year of adoption and all subsequent years, unless the taxpayer obtains the Commissioner’s consent under § 1.446-1(e) to change its table selection. A taxpayer that changes its BLS table must establish a new base year in the year of change as described in paragraph (e)(3)(iv)(B) of this section.