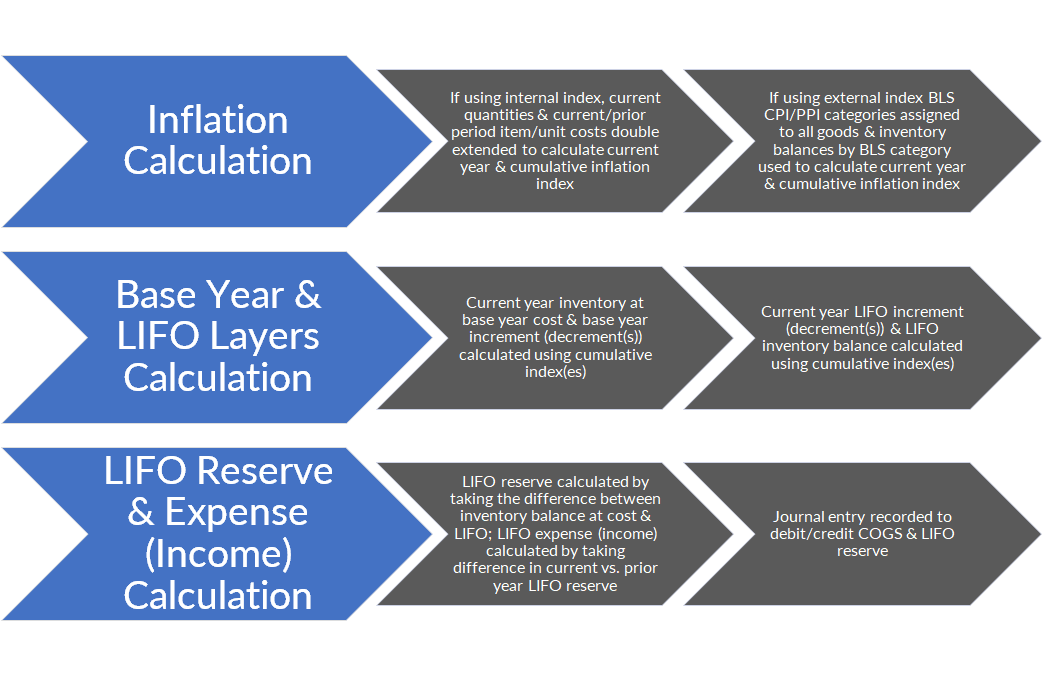

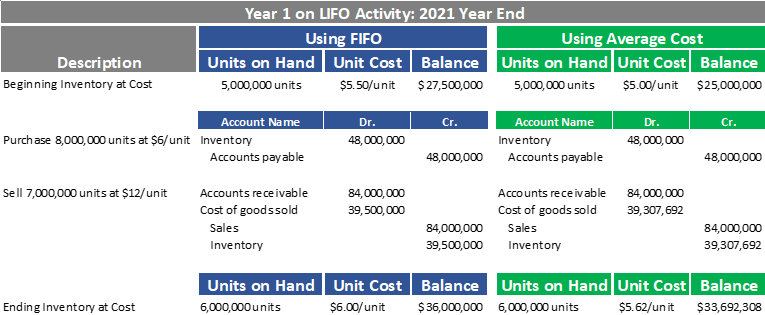

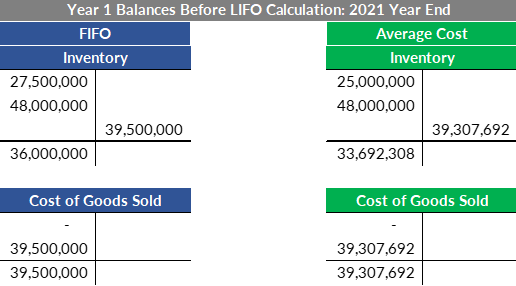

For dollar-value LIFO method users, a company will continue tracking inventory costs within their accounting database using the same method that was used prior to adopting LIFO. This means that beginning inventory, purchases, sales & cost of goods sold recorded during the reporting period continues to be valued any of the available non-LIFO methods (i.e. FIFO, average cost, earliest acquisitions etc.). Illustration 1 below provides an example of common inventory activity occurring during the course of a reporting period using FIFO or average cost:

Illustration 1. Accounting for Inventory Activity Under LIFO – Year 1 on LIFO

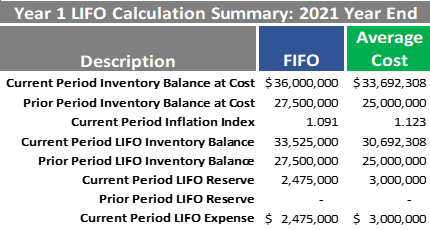

The LIFO reserve contra account is shown with a zero balance because this example assumes that the company will be adopting LIFO for the 2021 year end. The main consideration is to realize that companies on LIFO continue using some non-LIFO method such as FIFO or average cost to account for current period inventory activity. Once the period has been closed and all inventory related activity has been posted, the side calculation to compute the required LIFO values can now be made. Once the current year index is computed, the ending inventory balance at cost (i.e. FIFO, average cost etc.) is used along with the current period inflation index to compute the current period LIFO inventory, LIFO expense & reserve values. Using the same inventory data from Illustration 1, an example is shown below of the period end side calculation made to compute the LIFO inventory, expense & reserve balances as well as the general ledger adjusting journal entry required to account for the difference between inventory at cost & LIFO (LIFO expense is the difference in cost of goods sold between LIFO vs. cost & is the difference between the current & prior period’s LIFO reserve):

Illustration 2. LIFO Calculation & General Ledger Adjusting Journal Entry Year 1 on LIFO

Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances.

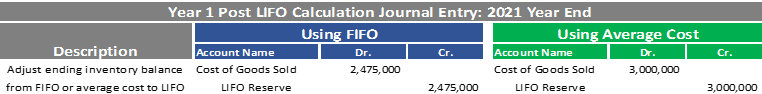

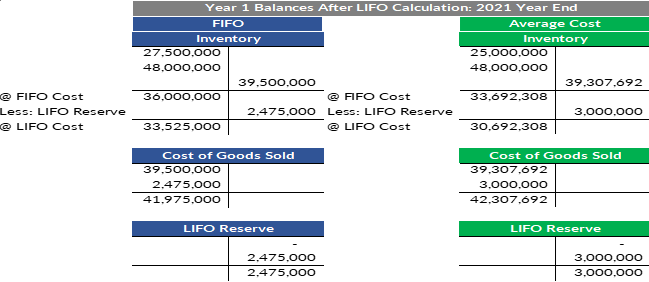

As shown in the calculation summary above, the LIFO inventory balance is between $2 – $3 million less than the current period end inventory balance at cost. This difference represents the LIFO expense (current – prior period LIFO reserve) & LIFO reserve balances (inventory at cost – LIFO inventory). It also represents how LIFO transfers inflationary inventory costs from the balance sheet (inventory) to the income statement (cost of goods sold). The debits and credits in the journal entry shown above represent increases to both cost of goods sold and the LIFO reserve contra inventory account. Since the LIFO reserve account is a contra inventory account, ending inventory gross of LIFO reserve represents inventory at cost & while ending inventory net of LIFO reserve represents inventory at LIFO. The cost of goods sold account is essentially the vehicle that allows for LIFO taxpayers to reduce their taxable income. Using the data from the illustrations above, the example below shows the 2021 year end balances after the LIFO general ledger adjusting journal entry has been made:

Illustration 3. Post LIFO Calculation Inventory Balances Year 1 on LIFO

As shown above in Illustration 3, the cost of goods sold account is now $2 – $3 million higher after the LIFO calculation. Aside from any other adjusting entries required after the LIFO calculation, this will be the amount used for financial reporting and tax purposes. Although the cost of goods sold account balance will be closed out after recording the closing entries, the LIFO reserve contra inventory account is a permanent account that will be carried forward into the next reporting period.

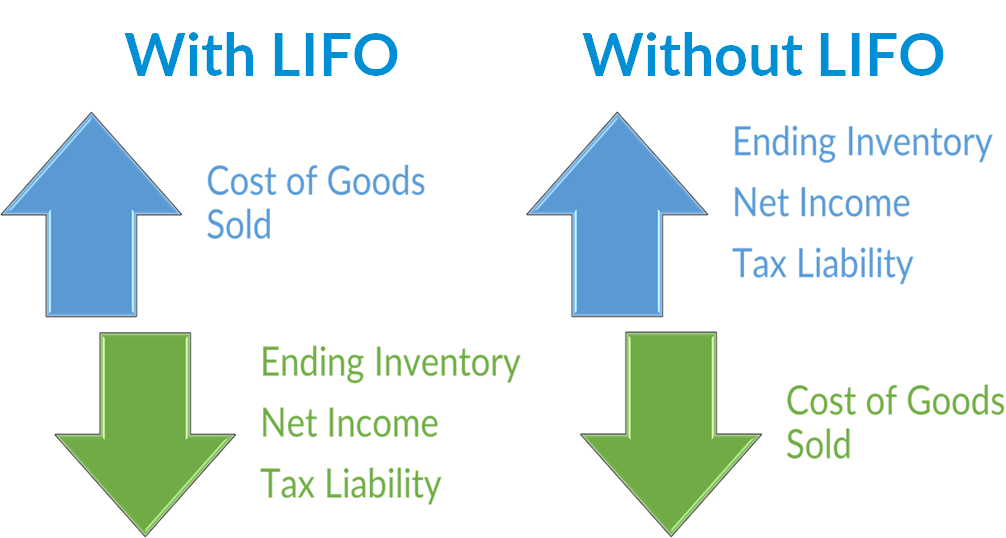

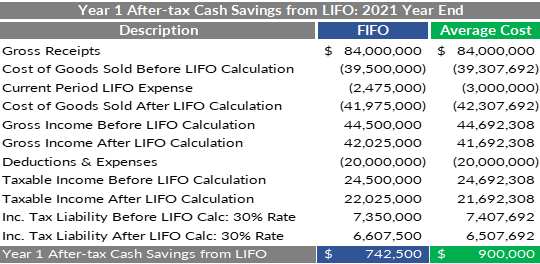

As illustrated above, the cost of goods sold account was increased, which represents the mechanism for companies on LIFO to reduce their taxable income & tax liability, which results in after-tax cash savings. Using the 2021 year end (year 1) data from the illustrations above, the example below shows the after-tax cash savings from LIFO.

Illustration 4. After-tax Cash Savings Created from Year 1 on LIFO

Once elected, a LIFO calculation must be made annually at year end. This allows for LIFO to be a tax savings tool that accrues benefits in perpetuity & not just a one-time deduction. Using the data from the illustrations above, the examples shown below illustrate how inventory costs will be tracked when going from the first to the second reporting period on LIFO:

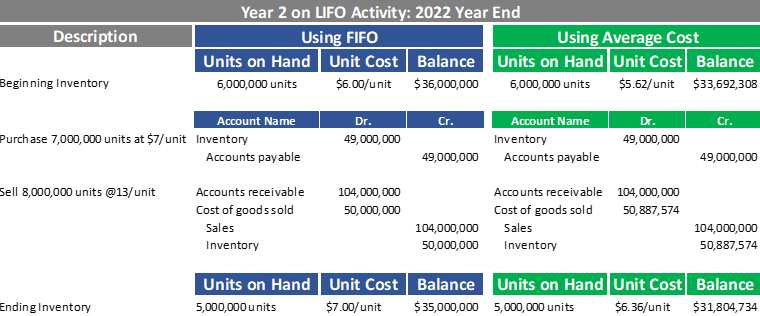

Illustration 5. Accounting for Inventory Activity Under LIFO – Year 2 on LIFO

As shown above, beginning inventory, purchases, sales & cost of goods sold continue being valued at cost throughout the course of the second period on LIFO (will remain the case for all subsequent periods on LIFO). As explained earlier, the LIFO reserve contra inventory account remains in place because the beginning inventory balance net of LIFO reserve represents inventory at LIFO cost. The example below illustrates the year 2 LIFO calculation results along with the adjusting journal entries and post-LIFO calculation general ledger inventory balances:

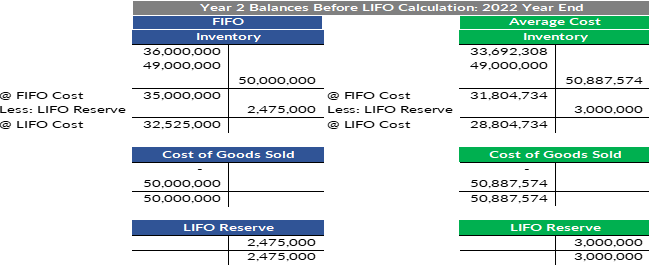

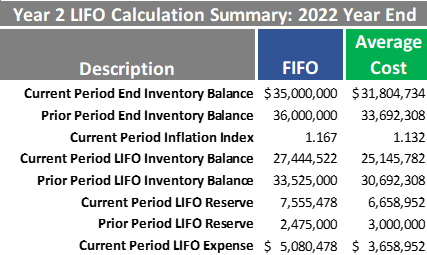

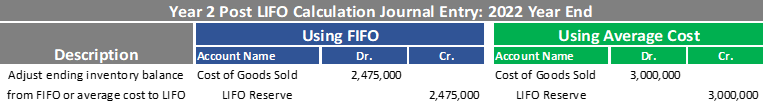

Illustration 6. LIFO Calculation, General Ledger Adjusting Journal Entry & Account Balances – Year 2

Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances. Note: Above figures portrays a simplified version of a LIFO calculation & does not show the detailed math required to calculate current period inflation index, LIFO inventory & LIFO reserve/expense balances.

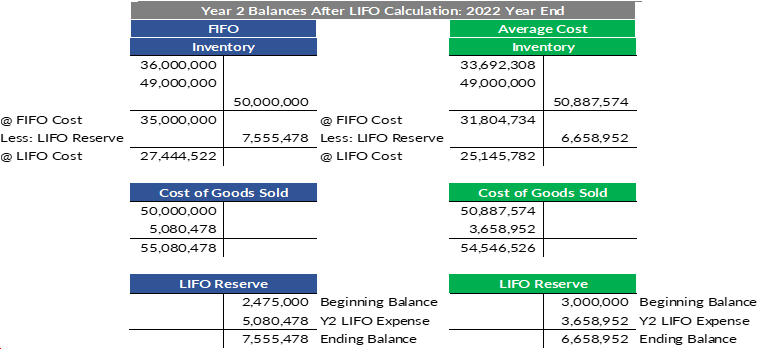

As shown above, the current period LIFO calculation resulted in 17% & 13% inflation for each of the two calculations that resulted in approximately $5 million & $3.7 million of LIFO expense (increase to cost of goods sold). Although the LIFO inventory balance is the difference between ending inventory gross and net of the current period LIFO reserve, the LIFO expense is the difference between the current & prior period LIFO reserve and represents the current period increase to cost of goods sold. Using the data from the illustrations above, the example below shows the 2022 year end balances after the LIFO general ledger adjusting journal entry has been made:

Illustration 7. Post LIFO Calculation Inventory Balances – Year 2 on LIFO

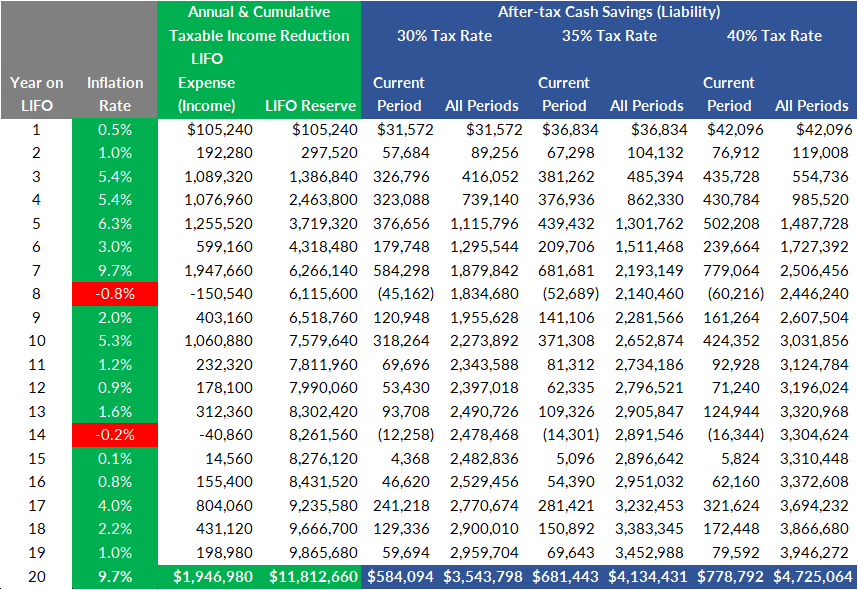

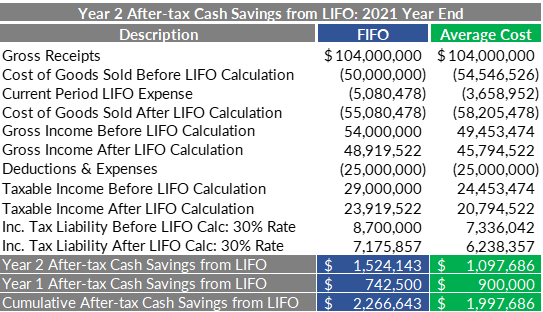

Using the data from the illustrations above, Illustration 9 below shows both the current period & cumulative after-tax cash savings from LIFO.

Illustration 8. After-tax Cash Savings Created from Years 1 & 2 on LIFO

As shown above, the year two after-tax cash savings from LIFO was between $1M – $1.5M under FIFO & average cost when assuming a 30% tax rate. This amount can also be more simply calculated by taking the product of the current period LIFO expense & a company’s tax rate. The LIFO expense represents the current period increase in the current vs. prior period’s LIFO reserve (called LIFO income when current vs. prior period LIFO reserve decreases). The cumulative after-tax cash savings from LIFO represents the sum of the Year 1 & Year 2 after-tax cash savings from LIFO. It can be more simply calculated by taking the product of the current period LIFO reserve & a company’s tax rate.

Companies perform interim LIFO estimates for a wide array of reasons, including:

Companies that don’t issue interim financial reports are not required to perform interim LIFO estimates

Companies that issue non-GAAP interim reports are also not required to perform interim LIFO estimates

LIFOPro offers solutions to make quickly obtain accurate interim LIFO estimates

Up to 3 interim estimates are included in LIFOPro’s outsourcing engagements for companies using the IPIC method

Trial the software for 90 days. Get a complimentary analysis for companies considering using LIFO. Get a complimentary review for companies on LIFO. Request a cost estimate. Use our simple form to submit your request.

Sign up today to receive industry news & promotional offers from LIFO-PRO