What Rules Exist Regarding LIFO Disclosures for Financial Reporting Purposes?

The IRS tax law commonly referred to as the “LIFO conformity rule” is the authoritative guidance that prescribes the financial report and statement requirements for companies that use the LIFO method (assuming financial reports or statements are issued to external parties; these rules are not applicable for companies that don’t issue financial reports/statements to external users). Those rules are as follows:

- The face of the annual or year end income statement must present income, profit or loss using the LIFO method beginning no later than the year that LIFO is adopted for tax purposes (see discussion below regarding interim statement requirements)

- Once LIFO has been elected for tax purposes, income, profit or loss must be computed using LIFO on the face of all subsequent annual financial statements (unless LIFO is terminated for tax purposes)

Are Non-LIFO Disclosures or Information Allowed to be Presented Within Annual Financial Reports/Statements?

Included within the IRS LIFO conformity rule are provisions that allow for non-LIFO disclosures and information to be presented within annual financial reports and statements as long as it’s separated from the primary presentation of income, profit or loss. The following non-LIFO disclosures and information are allowed while also maintaining LIFO conformity compliance (see IRS Regs. §1.472-2(e)):

- Reporting cost of goods sold or operating profit on a non-LIFO basis and reporting LIFO as a nonoperating item in the primary income statement – Companies are allowed to present cost of goods sold and operating profit on a non-LIFO basis without violating the LIFO conformity rule as long as there’s an adjustment so that ending net income is calculated on a LIFO basis. This can be accomplished by including the LIFO adjustment as a nonoperating item on the income statement (supplemental schedule of nonoperating items could be included if there are multiple nonoperating items).

- Supplemental and explanatory information using a non-LIFO method – Includes anything other than the primary presentation of the income statement, which includes the following:

- Notes to the income statement – Information reported within this section is considered a supplement to or explanation of income, profit or loss, not a primary component of it. Accordingly, a disclosure regarding income that would have resulted if a non-LIFO method was used is allowed to be made within the income statement notes. See IRS Regs. §1.472-2(e)(3)(i)

- Appendices and supplements to the income statement – Information reported in an appendix or supplement to the income statement is considered a supplement to or explanation of the primary presentation or income, profit or less if it accompanies the income statement in a single report and the information is clearly identified as a supplement to or explanation of the income statement. Examples include:

- Disclosure made in the context of making a comparison to the corresponding information disclosed both on the face of the income statement and in the supplement or appendix

- Restatement of cost of goods sold based on a non-LIFO method (as long as the supplement or appendix containing the restatement contains a general statement that all information based on the non-LIFO method is reported in the appendix or supplement as a supplement to or explanation of the taxpayer’s primary presentation of income, profit, or loss as reported on the face of the taxpayer’s income statement)

- Other reports – Sections of the financial report other than the primary face of the income statement can also include non-LIFO disclosures. Earnings per share using a non-LIFO method or the non-LIFO income are often disclosed within these types of report sections. Common examples of other report sections include:

- Management’s discussion and analysis

- Statement of changes in financial position

- Letters to shareholders, partners or other stakeholders

- Summary of key figures

- Inventory asset value disclosures – The use of a non-LIFO method can be used to value inventories on the balance sheet. Furthermore, the balance sheet can also disclose the income, profit or loss using a non-LIFO method as long as a disclosure is made in the form of a footnote to the balance sheet or a parenthetical disclosure on the face of the balance sheet. For example, the inventory valued using FIFO and LIFO can be presented on the balance sheet, and a footnote to the balance sheet could include income using a non-LIFO method while maintaining compliance with the LIFO conformity rule.

Are Internal Management & Interim Reports Required to be Presented on a LIFO Basis?

- Internal management reports – The use of a non-LIFO method is allowed on all portions of internal management reports as long as the reports will not be issued or released to parties outside of the organization. Examples include earnings projections, budgets, sales and sales forecasts. See IRS Regs. §1.472-2(e)(1)(iii).

- Interim reports – The LIFO disclosure requirements for interim reports are nuanced, but can be most simply understood by separating them into the following two categories (rules described below assumes these reports will be issued to external parties):

- Interim financial reports that cover a single continuous period of operation of less than one year (for example, quarterly reports):

- GAAP & SEC filers – The same LIFO disclosure rules described above for annual financial reports apply for interim financial reports prepared in accordance with GAAP and/or SEC regulations

- Non GAAP filers – Non-GAAP filers are not required to issue interim reports that value inventories using the LIFO method. See IRS Regs. §1.472-2(e)(1)(iv).

- Series of interim financial reports – The same LIFO disclosure rules described above for annual financial reports apply for a series of interim reports. A series of credit statements or financial reports is considered a single statement or report covering a period of operations if the statements or reports in the series are prepared using a single inventory method and can be combined to disclose the income, profit, or loss for the period. For example, if 12 monthly financial reports are issued to creditors that cover a single reporting period and collectively can be used to ascertain the annual income, profit or loss, than those series of reports are considered the equivalent of an annual report, and are subject to the same LIFO disclosure requirements listed above for annual reports.

- Interim financial reports that cover a single continuous period of operation of less than one year (for example, quarterly reports):

Examples of LIFO and non-LIFO Financial Report Disclosures, Supplements and Information

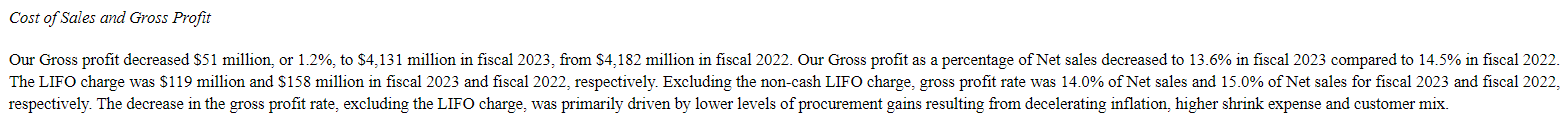

Figure 1. Example Notes to the income statement showing comparative earnings results on a LIFO and non-LIFO basis

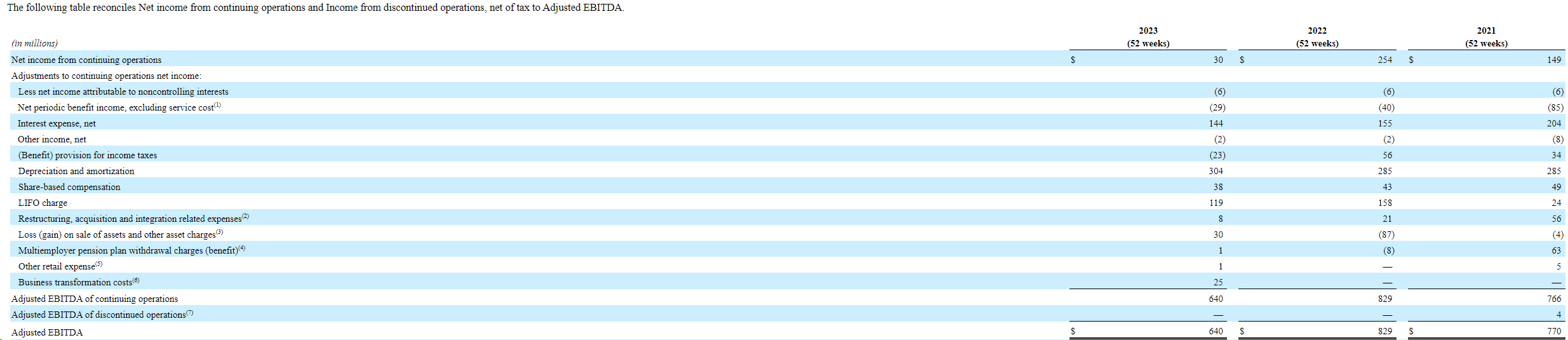

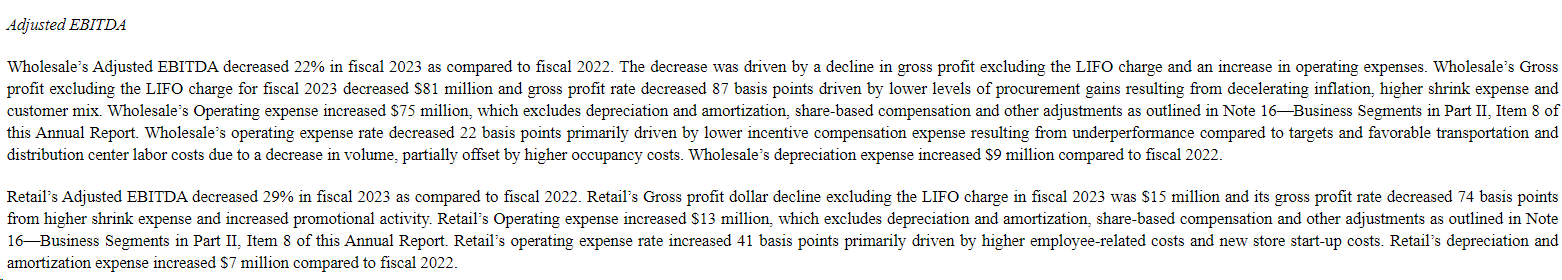

Figure 2. Example supplemental and explanatory income statement information regarding LIFO

Figure 3. Example supplemental and explanatory income statement information regarding LIFO

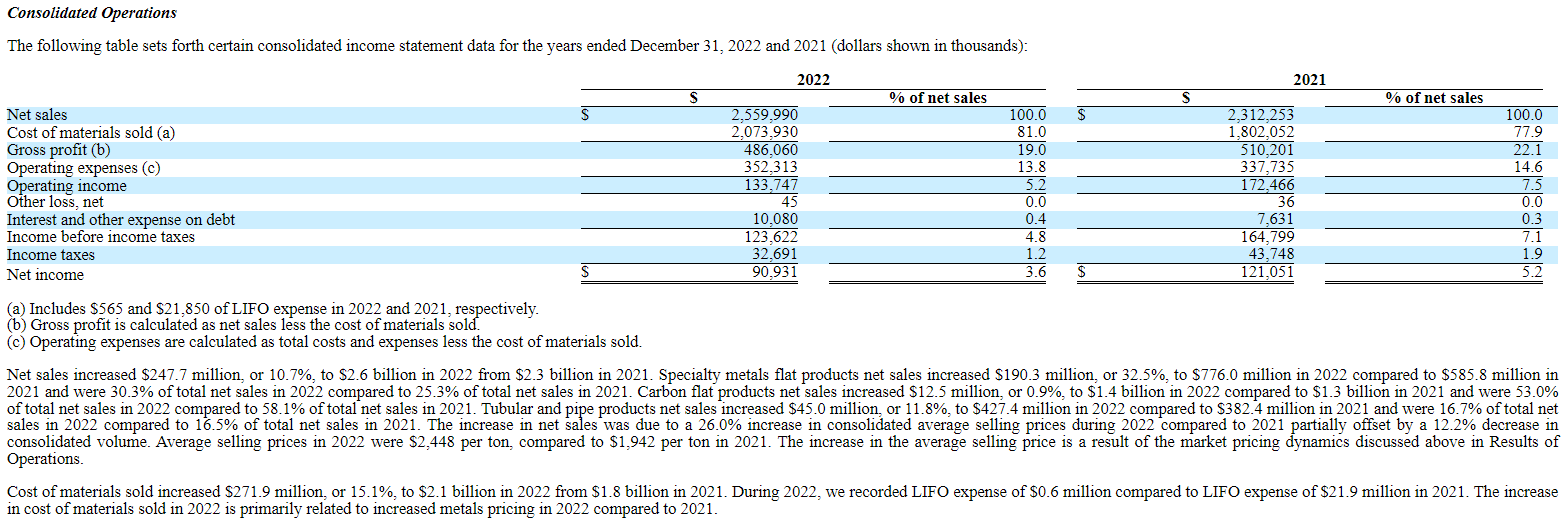

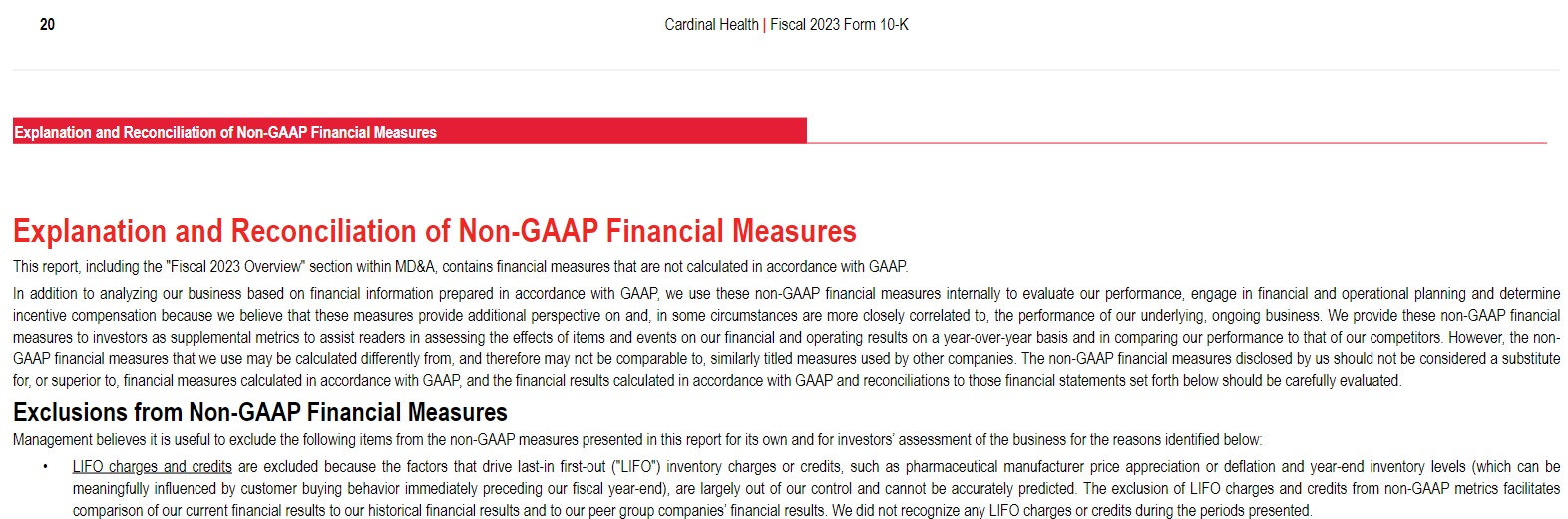

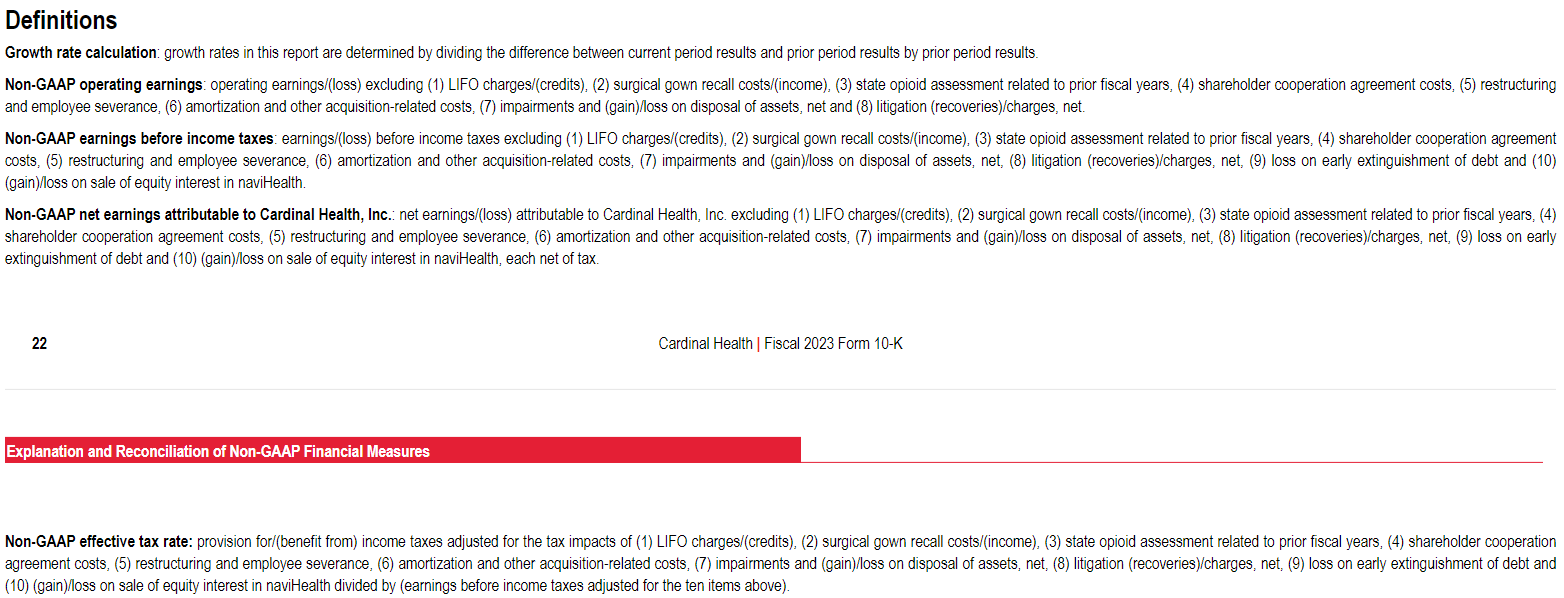

Figure 4. Example supplemental and explanatory information regarding Non-GAAP Financial Measures

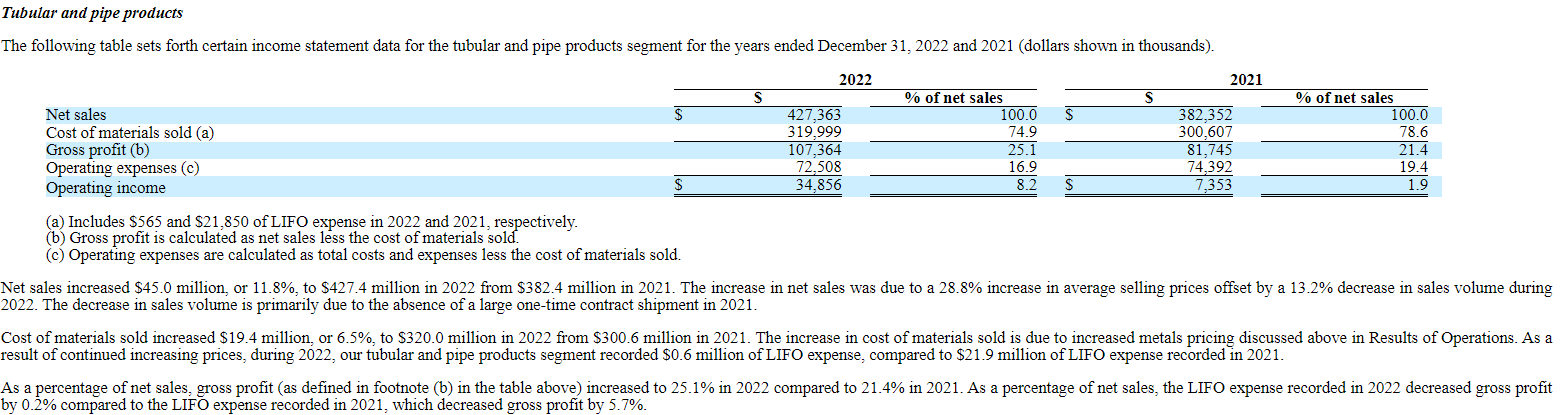

Figure 5. Example Appendices and supplements to the income statement on a non-LIFO basis

Figure 6. Example Appendices and supplements to the income statement on a non-LIFO basis

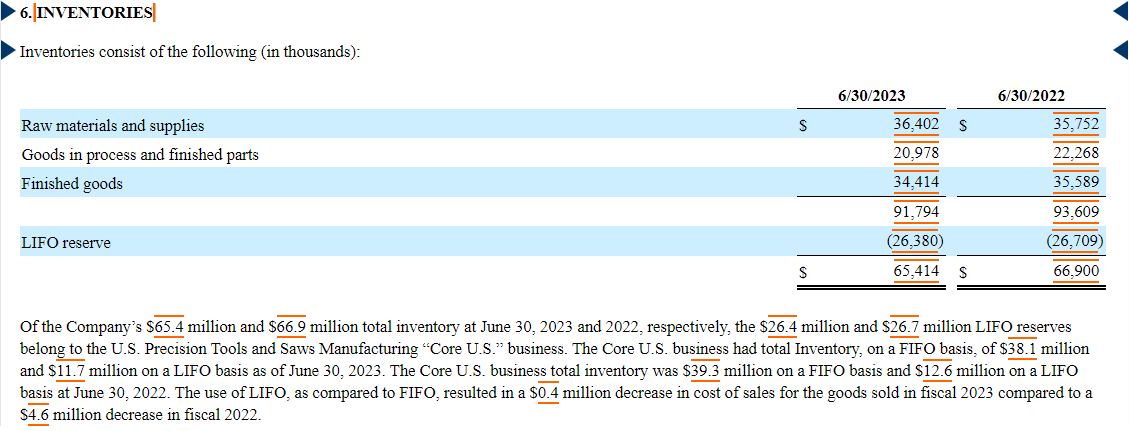

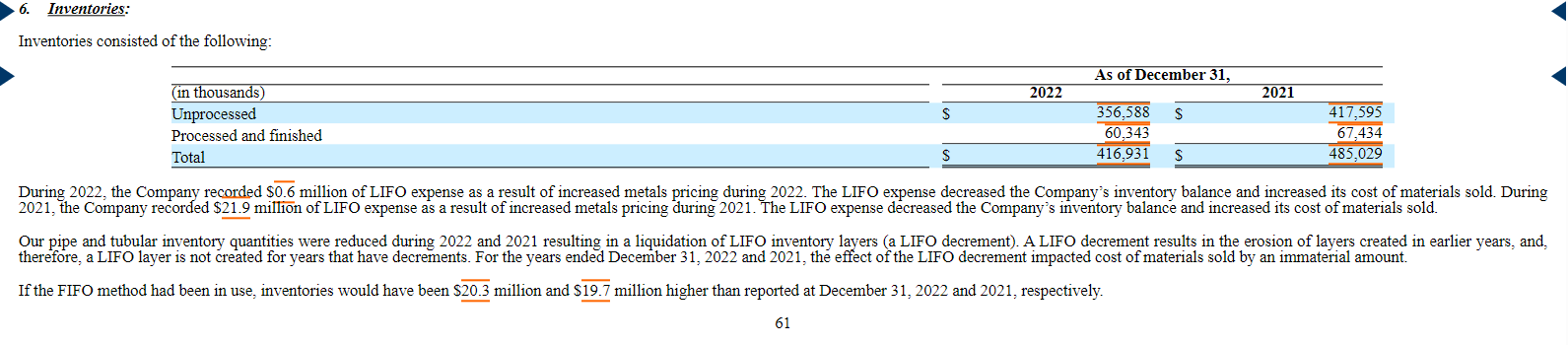

Figure 7. Example inventory asset value disclosure on a LIFO and non-LIFO basis presented on notes to the financial statements

Figure 8. Example inventory asset value disclosure on a LIFO and non-LIFO basis presented on notes to the financial statements

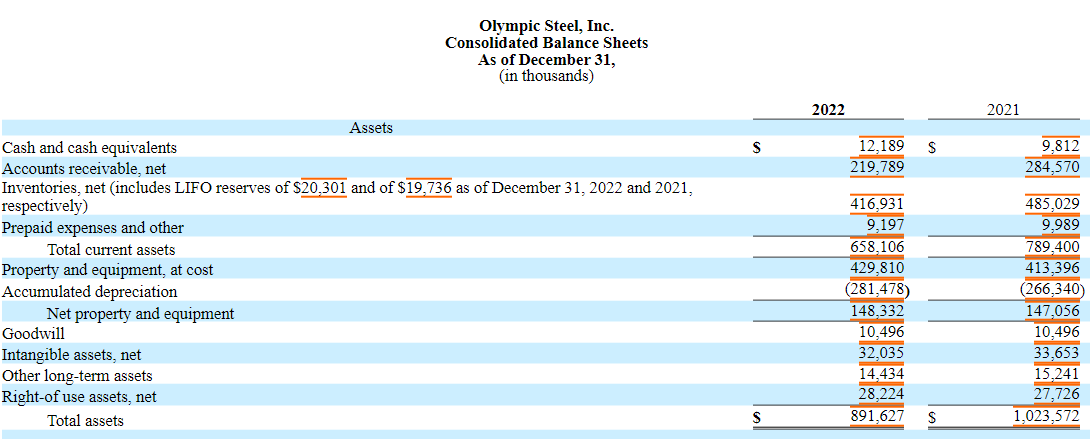

Figure 9. Example inventory asset value disclosure regarding LIFO presented on balance sheet

Figure 9. Example inventory asset value disclosure regarding LIFO presented on balance sheet

LIFO Conformity for Foreign-Controlled Consolidated Groups with U.S. Subsidiaries

Exploring Interim LIFO Estimate Options

How the IPIC Method Could Help Grow or Preserve Your LIFO Reserve

Top 2023 LIFO Election Locks