What is the Supply Chain Disruptions Relief Act?

This bill was drafted to provide tax relief to new motor vehicle dealerships using the LIFO method who had qualified inventory liquidations solely attributable to supply chain disruptions that occurred between 2020 – 2021, which in turn caused LIFO recapture & increased tax liabilities to be recognized during this period. This bill works in conjunction with IRS Reg. §473, which is a preexisting regulation that was originally codified in 1980 to provide relief to taxpayers suffering qualified inventory interruptions as a result of the 1979 oil embargo.

What is the Status of this Bill?

The bill was initially introduced into the Senate in April of 2022, and passed on December 22nd. The bill was received in the House of Representatives on December 23rd. In order for the bill to become a law, it will need to be passed by the House & signed by the President.

Who will be Eligible for Relief?

The Senate bill’s text describes eligibility as follows: “The term ‘new motor vehicle’ means a motor vehicle— (A) which is described in section 163(j)(9)(C)(i) of the Internal Revenue Code of 1986, and (B) the original use of which has not commenced.”

Section 163(j)(9)(C)(i) of the IRC describes the term “motor vehicle” as follows: “Any self-propelled vehicle designed for transporting persons or property on a public street, highway or road.”

Based on the Senate bill & the Sec. 163 language, our best interpretation of the types of vehicles & dealerships that will be eligible for relief are as follows:

- Vehicles expected to be included for qualified liquidations

- New automobiles, including, cars, SUVs, crossovers, minivans & trucks (including heavy-duty trucks or semi trucks)

- New motor homes or motorized recreational vehicles (RVs)

- New motorcycles

- Dealerships expected to be included for qualified liquidations

- Auto dealerships

- Heavy duty truck dealerships (aka semi truck & trailer dealerships)

- R.V. dealerships

- Motorcycle dealerships

What will the Relief Eligibility Period be?

The current version of the bill states that a qualified liquidation will be one that occurred between March 20th, 2020 – December 31st, 2021. What this likely means is that many dealers will be eligible for relief from liquidations occurring for multiple tax year ends. For example, lets say you have a December year end, had a 2019 year end inventory balance of $10M, a 2020 year end balance of $7M & 2021 year end balance of $4M. Under this fact pattern, you would have had two separate periods where layer erosion LIFO income and qualified liquidations were reported on the tax return that were only a result of supply chain disruptions.

How will the Relief Work?

This is how the relief could work if it follows the text of the current version of the Senate bill & in accordance with Sec. 473:

- New motor vehicle dealers may elect to not recognize any income solely attributable to a qualified liquidation that occurred during an eligible relief period

- New motor vehicle dealers are provided a “replacement period” to replenish inventories to pre-liquidation period levels. The Senate bill states that taxpayers will have until December 31, 2025 to replenish inventories to pre-liquidation levels.

- If inventories are replenished to pre-liquidation levels by or before the end of the replacement period, then the income that would have otherwise been recognized if the Sec. 473 election had not been made will continue to be deferred (i.e., the LIFO reserve carried forward will be gross of liquidations that would have otherwise occurred if Sec. 473 relief was not obtained)

- If inventories aren’t replenished by the end of the replacement period, taxpayers are to pay the cumulative income that would have been recognized if the Sec. 473 election had not been made, plus interest on the underpayment

Since most new motor vehicle dealers have already recognized LIFO reserve recapture resulting from qualified liquidations on their 2020 and 2021 year end tax returns, it will be up to the Treasury Department & IRS to provide specific guidance on how exactly the relief is to be obtained. But the Senate version of this bill states relief can be obtained in the form of a change in accounting method via Sec. 481a adjustment that will be recognized on the next tax return to be filed.

Illustrative Example

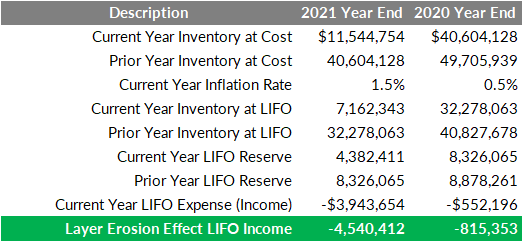

Figure 1. Auto Dealer 2020 – 2021 Year End LIFO Calculation Summary

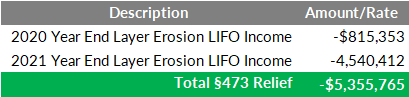

Figure 2. Auto Dealer Sec. 481a Taxable Income Reduction Calculation

What’s Next?

The next step is for the House of Representatives to debate and hopefully pass the bill. The new Congress begins on January 3. If and when it passes in the House, President Biden must sign the bill for it to be enacted. Also, the current bill text instructs the Treasury Department to prescribe regulations or other guidance within 90 days of the bill’s enactment. In the meantime, you can get notifications from LIFOPro on all updates related to the Supply Chain Disruptions Relief Act! Enter your email address below to sign up for notifications!

Want to learn more about this bill or want to schedule a free call/meeting with LIFOPro to further discuss? Select the schedule call/meeting button below to use our online booking tool. Alternatively, select the Contact Form button below, call us at 402-330-8573 or email us at lifopro@pro.com

Get a Complimentary Sec. 473 Estimate Analysis & Find out the Amount of Tax Relief You Could be Eligible For!

Most auto dealers experienced substantial LIFO layer liquidations as a result of the supply chain disruptions. Assuming the Supply Chain Disruptions Act is enacted in the near future, material taxable income reduction will likely be available for dealers applying for Sec. 473 relief! Let the leading LIFO experts estimate the amount of tax relief your dealership may be eligible for. The process is quick & easy and only requires uploading or sending your 2020 – 2021 year end LIFO calculation documentation. Click the button below to get your free Sec. 473 Analysis today! LIFOPro will deliver your Sec. 473 Relief Estimate Analysis PDF report within 1 week of receipt of your 2021 year end LIFO calculation documentation.

View Supply Chain Disruptions Relief Act

Sec. 473 Relief Analysis Request Form

Schedule Free Call or Online Meeting

Contact us Form

Tax Code: §473 - Qualified liquidations of LIFO inventories