Download LIFO Lookout PDF Report

2021 LIFO Lookout

- Inflation is alive & kicking

- Federal reserve has raised its 2021 year end inflation forecast from 1.8% to 2.2%

- Massive amounts of government stimulus & proposed infrastructure spending expected to create above-average inflation in many industries

- Improved economic outlook & GDP growth expected to further accelerate price increases

- Inflation increased substantially in the final months of 2020 & is continuing so far in 2021 in many other industries

- Many of the raw commodities currently showing inflation will create ripple effect on intermediate & final demand goods, meaning a much wider range of goods are likely to have above average inflation for 2021 year end tax incentives

- Soaring fuel prices will create upward pressure on almost all goods as rising delivery/transportation costs will be realized in all industries

- LIFO’s here to stay

- Widespread IFRS adoption has not come to fruition in the U.S. & is not likely to ever cause LIFO to be impermissible under GAAP

- The misnomer that just-in-time accounting would eliminate inventories from the balance sheet has been widely debunked because:

- Use of this method only eliminates one of the three stages of production for manufacturers (finished goods), meaning raw materials & WIP will always be on the balance sheet to maintain adequate supply to maintain production of WIP & FG

- Wholesalers & retailers widely unaffected by this method since they must maintain a minimum base stock of inventory

- Used by tens of thousands of companies who have consistent inflation & sufficient inventory balances as a tax incentive

- Higher tax rates on the horizon

- Current political environment suggests increased corporate tax rates for both C-corps & S-corps will be enacted by Congress

- Increased tax rates make LIFO more valuable since after-tax cash savings from LIFO = tax rate * LIFO reserve

- Possible relief for qualified inventory liquidations: Could provide relief to LIFO taxpayers who suffered COVID-19 related inventory reductions that subsequently created LIFO income i.e. increased taxable income

LIFO Tax Incentives

-

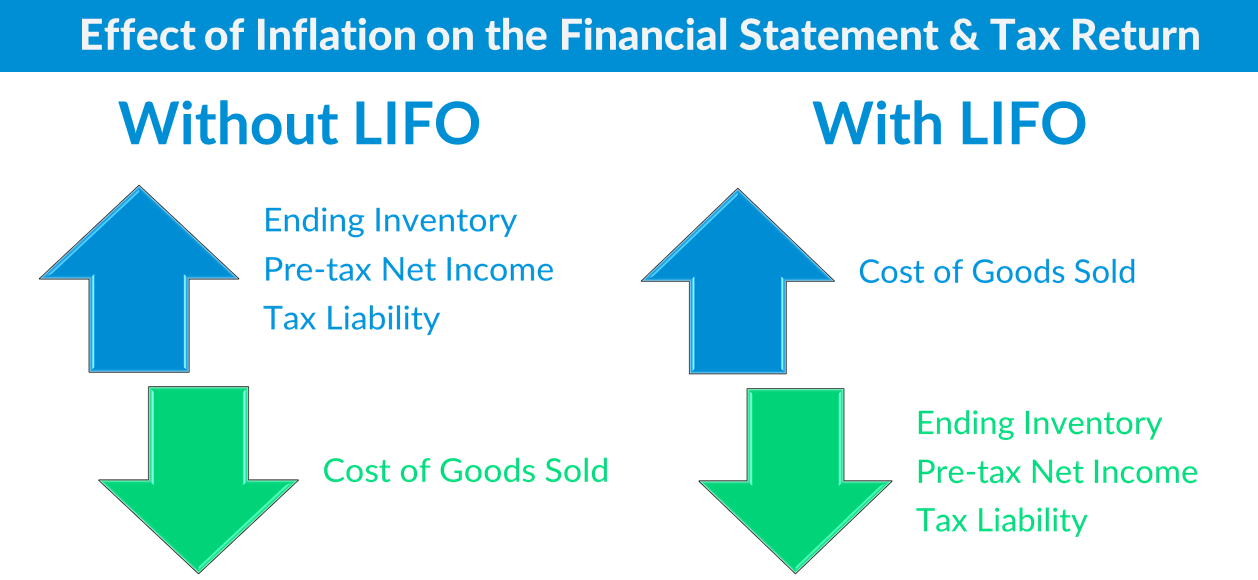

- During periods of rising costs, LIFO transfers inflated ending inventory from balance sheet to income statement by increasing cost of goods sold & reducing ending inventory balance

- Reduces taxable income in periods of inflation & can create material long-term after-tax cash savings

- Benefits grow in perpetuity & only decreases when there’s deflation or substantial inventory liquidation

- No changes required to accounting system as inventories maintained at same costs historically used & annual side calculation made to adjust inventories from cost (i.e. FIFO or average cost) to LIFO using contra inventory account called LIFO reserve

- Related LIFO calculation effort can be easily managed or outsourced altogether using LIFOPro’s complete range of solutions

Reduces taxable income in periods of inflation & can create material long-term after-tax cash savings

- Inventories maintained at same costs historically used & annual side calculation made to adjust inventories at cost (i.e. FIFO or average cost) to LIFO cost using contra inventory account called LIFO reserve

- Benefits grow in perpetuity & only decreases when there’s deflation or substantial inventory liquidation

- Quick LIFO tax incentives formula:

- CY Taxable Income Reduction (LIFO expense) = Current Year Inflation Rate * Prior year ending inventory balance @ cost (i.e. FIFO, average cost)

- CY After Tax Cash Savings = Current Year LIFO Expense * Tax Rate

- LIFO tax savings example:

- Inputs

- Year end FIFO balance: $10M

- Current year inflation rate: 2.5%

- Tax rate: 30%

- Outputs:

- CY Taxable Income Reduction (LIFO expense): Year end FIFO balance * Current year inflation rate = $250K ($10M * 2.5%)

- CY After Tax Cash Savings: LIFO Expense * tax rate = $75K ($250K * 30%)

- Inputs

Top LIFO Candidates

- In general:

- Almost any industry other than consumer electronics are good LIFO candidates stand to benefit from tax incentives from LIFO

- Includes manufacturers, wholesalers & retailers

- Top LIFO candidates by industry/primary business activity

- Supermarkets & convenience stores

- Dealerships

- Auto dealers

- Ag/farm machinery & equipment dealers

- RV & powersport dealers

- Construction machinery & equipment dealers

- HVAC & plumbing equipment/supplies manufacturers, wholesalers & retailers

- Alcohol manufacturers, wholesalers & retailers

- Home supply, building supply & hardware stores

- Furniture manufacturers, wholesalers & retailers

- Plastic resins & product manufacturers, wholesalers & retailers

- Chemicals manufacturers/wholesalers

- Metal/metal products & machinery manufacturers/wholesalers

- 2021 Top LIFO candidates

- Metals & metal products

- Lumber & wood products

- Chemicals & allied products

- Processed foods & feeds

- Rubber & plastic products

Optimization Strategies for 2021

- Tax savings maximization

- Switching from internal to external indexes (IPIC CPI/PPI)

- Expanding LIFO election scope for maximum tax incentives

- Reducing the number of LIFO pools

- Best LIFO practices

- Correcting calculation errors, including:

- Increment & decrement calculation errors

- Cumulative index calculation errors

- Switching from double extension to link chain

- Switching from dual to single index method

Automation & Outsourcing Opportunities

- Software

- Replace manual spreadsheet LIFO calculations with software to eliminate calculation errors & guarantee accuracy

- Simplify calculation procedures & reduce time spent on LIFO

- Improve internal controls, reduce financial statement audit risk & substantive testing

- Standardize LIFO policies & procedures to safeguard against employee turnover & simplify training procedures by leveraging software

- Turnkey outsourcing solutions

- Completely eliminate the hassle of calculations while growing & maintaining your LIFO tax savings

- Minimize time spent on LIFO to sending year end inventory documentation, reviewing LIFOPro reports & completing journal entries

- Improve internal controls, reduce financial statement audit risk & substantive testing

- Comes with the assurance of a SOC 1 Type II report & 40 hours audit support

Key Takeaways for 2021

- Companies not on LIFO:

- Get a complimentary LIFO Election Benefit Analysis Report

- Get the most accurate, in-depth LIFO cost vs. benefit analysis that’s only available from the LIFO experts

- LIFOPro runs a 20 year pro forma LIFO calculation to:

- Identify if your company’s product mix has historically provided sufficient inflation to warrant ever making a LIFO election

- Quantify what the long-term benefits of LIFO could bring in the future based on the historical results

- A current year LIFO Calculation estimate is also made to project the tax savings that could be achieved if LIFO were elected this year

- Includes LIFOPro’s recommendations & proposed costs for outsourcing your LIFO calculation or licensing our software

- Get a complimentary LIFO Election Benefit Analysis Report

- Companies on LIFO:

- Get a complimentary LIFO Calculation, Methods & Best Practices Review Report

- LIFO calculation reviewed for accuracy using LIFOPro software to maximize tax incentives

- Receive in-depth analysis & pro forma LIFO calculation comparisons of present vs. proposed methods from the only LIFO experts

- Identify opportunities for maximizing tax deferral & reducing IRS audit risk

- Recommendations, requirements & steps for making changes

- Includes sample LIFOPro reports using your company’s actual LIFO data

- Also includes software license & turnkey outsourcing solutions cost estimates

- Trial the LIFOPro software

- Plug & play using your company’s actual historical LIFO data

- Run parallel manual calculations & automated calculations in software to compare the results

- Quantify amount of time savings from automating calculation

- Identify opportunities for improving reporting transparency & simplifying documentation

- Get a complimentary LIFO Calculation, Methods & Best Practices Review Report

Learn more about LIFOPro's Offerings

Request Benefit Analysis, Review, Cost Estimate or Software Trial