Although LIFO is the biggest inventory-related tax savings tool for companies with inflation, it’s important to understand the requirements & sub methodology options available related to LIFO elections. This blog outlines the most important LIFO election requirements, provides a comprehensive list of LIFO method alternatives & breaks down the pros & cons of each alternative.

Election Requirements

- Financial reporting & tax

- Inventories must be valued on both the financial statements & tax return using LIFO beginning in the year of adoption & in subsequent periods – For example, if inventories were valued using LIFO on the 12/31/2021 tax return, then the 12/31/2021 financial statements must also report inventories at LIFO. This remains true in perpetuity until the LIFO election were to be terminated. This is the first of two requirements related to the LIFO conformity rule.

- Scope of goods valued under LIFO for tax purposes can not be greater than the financial reporting scope – This is the second requirement of the LIFO conformity rule. The LIFO election scope is the term used to describe which goods are included in the LIFO election. Selective elections can be made where portions of inventories are valued using LIFO & the remaining inventories are valued using methods other than LIFO. Although companies are allowed to make selective elections, the goods valued under LIFO for tax purposes must be equal to or less than the goods valued under LIFO on the financial statements. For example, if a chemicals manufacturer valued its raw materials & finished goods under LIFO on the tax return, it could not value the finished goods under LIFO & raw materials under FIFO on the financial statements.

- Tax only

- Beginning & ending inventories must be valued at cost in the year of LIFO election & subsequent to adoption – For financial reporting purposes, LIFO inventories can be valued at the lower of cost or market aka LCM (inventories valued under all other non-LIFO methods must be valued at the lower of cost or net realizable value). For tax purposes, LIFO inventories must be valued at cost, and can not be valued at the lower of cost or market. This is important to understand because many companies maintain inventory reserves other than a LIFO reserve such as LCM excess, obsolete (E&O) & slow-moving inventory reserves. Although these reserves are allowed to be maintained for financial reporting even after LIFO is elected, for tax purposes, no inventory-related reserves are allowed to be maintained for goods valued under LIFO.

- Write-downs & the preexisting inventory reserves must be restored into income over a three year period via a §481(A) adjustment – For financial reporting purposes, companies can continue to maintain any non-LIFO related inventory reserve subsequent to adoption. For tax purposes, companies must restore those reserves into income over a three year period & can no longer apply write-downs to inventories valued under LIFO.

- Must remain on LIFO for at least five tax year ends in order to terminate LIFO under automatic consent procedures – Although a LIFO taxpayer could terminate its LIFO election beginning in it’s second year on LIFO, it would be required to file an advanced approval Form 3115 by or prior to their tax year end & pay an $11,800 IRS user’s fee. The same would be true until a company’s sixth year on LIFO as this accounting method change falls under the IRS five-year change rule.

- Must wait five years to reelect LIFO after terminating LIFO election – A LIFO taxpayer seeking to do the opposite of the above bullet would be prevented from reelecting LIFO in less than six years under the same IRS five-year change rule.

Disclaimers

- Portions or all of LIFO reserve may be taken back into income if the following occurs:

- Portion of LIFO reserve may be taken back into income if either of the following occurs:

- Years where there is deflation

- Years where material inventory liquidation occurs when comparing current vs. prior year end inventory balance

- All of LIFO reserve will be taken back into income over four years if the following occurs:

- C to S Corp conversions

- Business asset sale (in the event of a stock purchase, LIFO reserve may transfer to the acquiring entity)

- Portion of LIFO reserve may be taken back into income if either of the following occurs:

Method Alternatives

- LIFO Index Computation Method:

- Dollar value method– A shortcut cost flow method which measures inventory layers in terms of dollars rather than physical units. Inventory items are grouped by pools and are priced in terms of each pool’s aggregate base year cost. The result is compared to each pool’s aggregate base year cost at of the end of the prior year to determine whether the inventory levels have increased or decreased.

- Specific Goods Method (Unit LIFO)– An approach to applying LIFO in which changes in the quantity of individual types of inventories are the basis for determining whether the inventory levels have increased or whether a portion of the existing inventory has been liquidated.

- LIFO Election Scope: can be selective (by stage of production, product groups, departments, business segment, parent on LIFO but subsidiary is not, etc.) with these exceptions:

- Manufacturers using Natural Business Unit Pools (NBU)

- If IRS Technical Advice Memorandum would prevent selective elections within IPIC pooling method

- Item Definition Method:

- Individual items

- Fungible commodities measured in gallons, pounds, board feet, etc.

- Inflation Comparison Period:

- Link-Chain Method-Compare current year-end prices to prior year-end prices

- Double-Extension Method-Compare current year-end prices to base-year prices

- Current Year Cost & Layer Valuation Method:

- Latest acquisitions (FIFO)

- Earliest acquisitions

- 12-month moving average or rolling-average (i.e. weighted-average or average cost)

- LIFO Pooling Method:

- Resellers (retailers & wholesalers)-By line, type or class of goods

- Manufacturers:

- Natural Business Unit pools (separate pool required for parts purchased for resale)

- Raw materials content pools

- Multiple pools

- IPIC pooling method using Consumer/Producer Price Index major groups (for IPIC method taxpayers)

- Inflation Measurement Source:

- Internal indexes:

- All inventory items used

- Representative sampling (index method)

- External indexes – IPIC method:

- BLS Index Selection:

- Consumer Price Indexes (CPI)

- Producer Price Indexes (PPI)

- Index timeframe selection:

- Final Indexes

- Preliminary Indexes

- Discontinued categories treatment:

- Compound inflation method

- Substitute index method

- Weighted-Average pool index calculation method:

- 10% method

- Most detailed category method

- BLS Index Selection:

- Internal indexes:

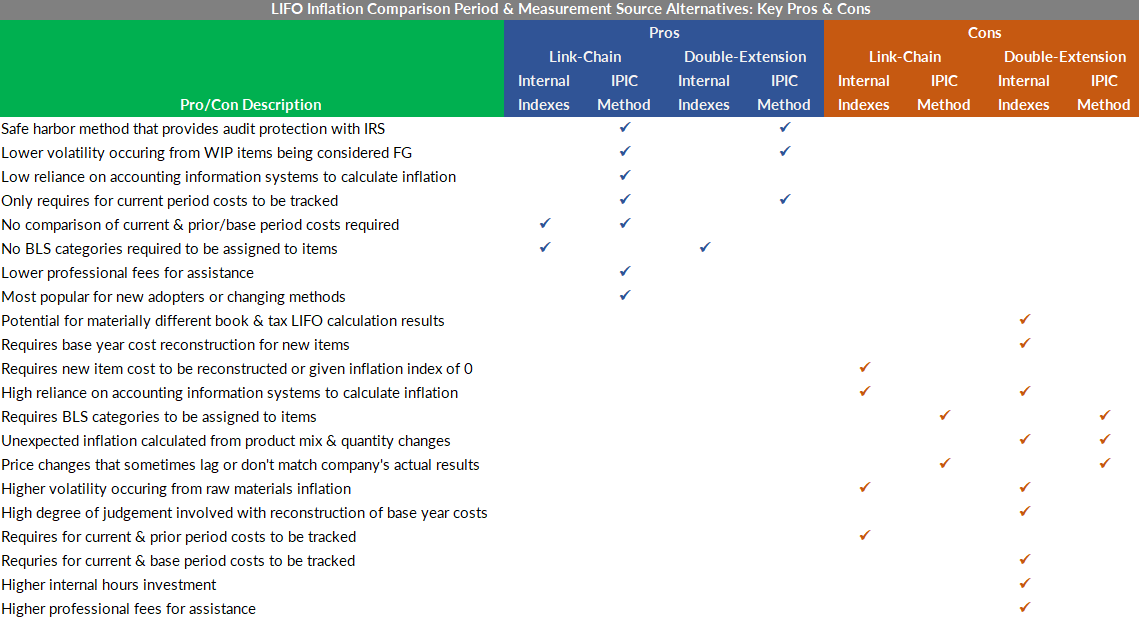

LIFO Submethod Pros & Cons