For companies on LIFO, the LIFO reserve represents the difference between their ending inventory balance at FIFO or average cost (commonly referred to as “current year cost) vs. LIFO cost (for dollar-value LIFO calculations, a non-LIFO costing method must be used to track inventory costs throughout the year in order to determine the “pre-LIFO” ending inventory balance that will be used to make the LIFO calculation; most commonly-used methods are FIFO & average cost). For example, a company with an ending FIFO balance of $5 million & LIFO balance of $4 million will have a $1 million LIFO reserve. The LIFO reserve essentially represents the cumulative change to the cost of goods sold & net income that has occurred since LIFO was elected. From year to year, an annual LIFO calculation is made to determine the change in the current vs. prior year LIFO reserve balance. For example, a company with a current year LIFO reserve of $1 million whom had a $500,000 LIFO reserve in the prior year will recognize $500,000 of LIFO expense, meaning their current year end cost of goods sold was increased & net income was decreased by the $500K as a result of the change in their LIFO reserve (this is called LIFO income when current vs. prior year LIFO reserve decreases).

Many believe that in order for the LIFO reserve to increase from one year to the next, a company’s current vs. prior period current year cost balance must either grow or at least stay the same. This is not true, and by the end of this blog, we will have completely busted one of the bigger LIFO myths. To reiterate, the LIFO reserve can grow even if the current vs prior period’s current year cost is the same or lower than it was last year. For dollar-value link-chain LIFO calculations, the most important variable related to the change in the current vs. prior period’s LIFO reserve is inflation rate computed for the LIFO calculation (using internally calculated price indexes based on the current vs. prior/base period costs or external indexes published by the BLS such as Producer Price Indexes or Consumer Price Indexes aka CPI/PPI). Considering the majority of companies using LIFO also use dollar-value link-chain LIFO, it’s safe to say that inflation is the most predominant factor affecting the annual change in the LIFO reserve (LIFO reserve changes involve other factors when less-commonly used methods other than dollar value link chain LIFO is used such as double-extension or specific goods LIFO). Although growing inventory balances can help the overall size of your LIFO reserve in the long run, calculating the change in your LIFO reserve is a combination of the following two components:

- Inflation effect LIFO expense (income): Prior year current year cost balance * current year inflation rate

- Layer erosions effect LIFO expense (income): (Current – prior period inventory at base year cost; aka decrease at base year costs) * (current year cumulative index – weighted average index of layer(s) eroded; this amount is only calculated in the event of the current vs. prior period inventory at base year cost being lower)

In most cases, the most significant adjustment that comes into calculating the change in the current vs. prior period LIFO reserve is the inflation effect LIFO expense (income), and as seen above, the current year ending inventory balance doesn’t even come into play for this portion of the calculation. When there is a decrease in the current vs. prior period ending inventory balance, the net decrease is largely reduced when it is multiplied by the sum of the current year cumulative deflator index – average index of the layers eroded. To further illustrate the impact of the change in your ending inventory balance on your LIFO reserve, lets use a company that elected LIFO for the 2016 year end, has been on LIFO for four years & has the following variables related to their 2019 year end LIFO calculation:

Example 1

Assumption: 2015 – 2019 year end current year cost balances decreases by $50K/year ($200K total)

Result: 2016 – 2019 year end LIFO reserve increases by $12K – $19K per year ($61K total).

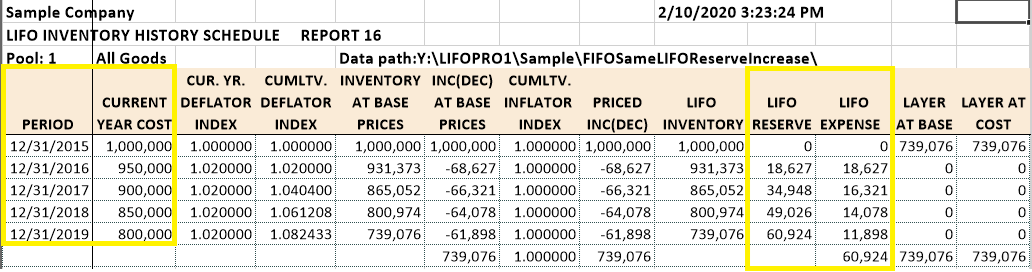

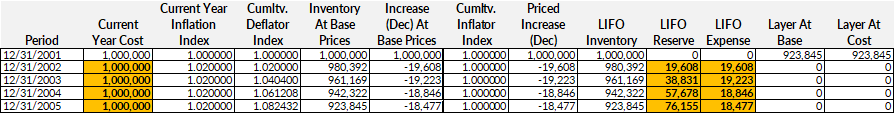

Using our LIFOPRO software, the LIFO calculation results for all periods are shown below:

In the above example, LIFO was elected for the 12/31/2016 year end, and therefore the base layer would have been the 2015 year end (or 1/1/2016) inventory balances. Since the 12/31/2015 period row shown above represents the base year, no LIFO reserve is accumulated for that year (1st year LIFO reserve shown on 12/31/2016 row). As seen above, the current year cost balance declined by $50,000 for each of the past five years including the base year layer. Despite the current year cost balances decreasing in all periods, the LIFO reserve increased in all of them because the inflation effect LIFO expense was greater than the layer erosions effect LIFO income for all periods. As shown above, the 2019 year end LIFO reserve increased by roughly $12,000 even though the 2019 current year cost decreased by $50,000 between 2018 & 2019. To break down the components involved in arriving at the 2019 year end amounts shown above, LIFOPro’s report 18a is shown below:

The change in the current year LIFO reserve is computed by calculating the following two components:

- Inflation effect LIFO expense (income): when there is inflation, this represents the component that causes the current vs. prior period LIFO reserve to increase. It’s calculated as follows:

- Prior year end current year cost balance * (current year inflation index – 1)

- Layer erosions effect LIFO expense (income): when there’s a decrease in the current vs. prior period current year cost, this component will typically cause the current vs. prior period LIFO reserve to decrease (this component is not calculated if there is an increase at base year costs; certain exceptions exist where a decrease will actually cause this component to increase the LIFO reserve). It’s calculated as follows:

- (Base year cost decrease: Current – prior period inventory at base year costs) * (current year cumulative index – average cumulative index of layer(s) eroded)

- Total current year LIFO reserve change: inflation effect LIFO expense (income) + layer erosion effect LIFO expense (income)

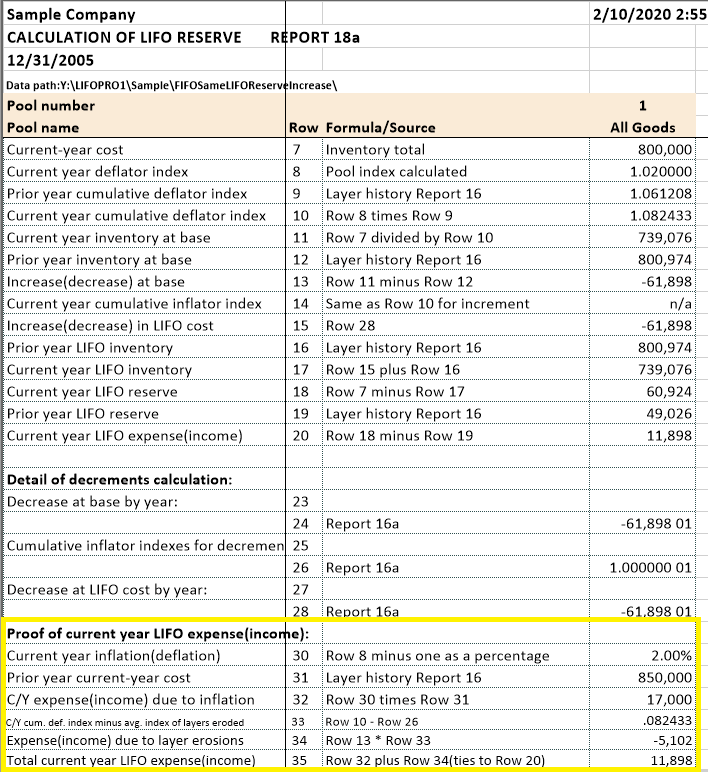

Using the LIFO calculation results from Example #1 shown above, the LIFO expense (income) components involved with determining the current year LIFO reserve change are shown below:

- Inflation effect LIFO expense components:

- Prior year end current year cost balance: $850,000

- Current year inflation rate: 2%

- Layer erosions effect LIFO income components:

- Base year cost decrease: ($61,898)

- Current year cumulative index – average cumulative index of layer(s) eroded: .082433

- Total current year LIFO reserve change:

- Inflation effect LIFO expense component: $850,000 * .02 = $17,000

- Layer erosions effect LIFO income component: ($61,898) * .082433 = ($5,102)

- Inflation effect LIFO expense + Layer erosions effect LIFO income: $17,000 – $5,102 = $11,898 LIFO expense (LIFO reserve increase)

When comparing the two components used to determine the current year LIFO reserve change, the biggest difference are the prior year end current year cost & base year cost decrease amounts. When comparing the two, the prior year end current year cost balance is 10 times the size of the base year cost decrease amount. Since the prior year current year cost balance is a single amount whereas the base year cost decrease is the difference between the current vs. prior period inventory at base year cost, it can be assumed that the amount used to calculate the inflation effect LIFO expense will more often than not be greater than the layer erosions effect LIFO income as long as there is inflation & a significant inventory balance decrease does not occur. To reiterate this idea, the following should be noted:

- The component responsible for causing the current vs prior year LIFO reserve to increase is calculated using 100% of the prior year end FIFO balance

- The component typically responsible for causing the current vs. prior year LIFO reserve to decrease is calculated using the difference between the current vs. prior period inventory at base year costs, which in most cases will be a fraction of the prior year end FIFO balance

- The inflation effect LIFO expense will typically be higher than the layer erosions effect LIFO income. When this is the case, LIFO expense is created & the LIFO reserve will increase

- The LIFO reserve will increase even when the current vs. prior period current year cost balance stays the same or decreases as long as the prior year’s current year cost balance is greater than the change at CY vs. PY base year costs & there’s enough inflation to offset the decrease

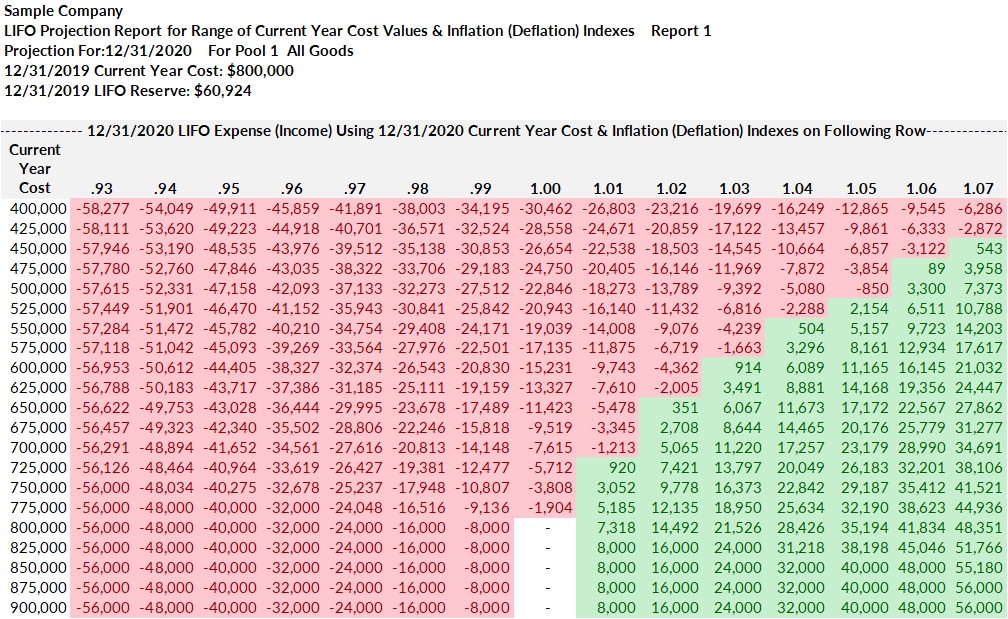

Using the LIFO calculation inputs from Example #1 where the 2019 y/e current year cost was $800,000, shown below are the LIFO expense (income) amounts that would occur for the 2020 year end’s LIFO calculation based on a range of inflation (deflation) rates & current year cost balances (next period to be closed):

As seen above, the amounts in green indicate the current year cost balances & corresponding inflation indexes that will create LIFO expense or a LIFO reserve increase for the 2020 year end. This report further illustrates the fact that the LIFO reserve will increase even if the current vs. prior period current year cost balance stays the same of decreases. For example, the 1.01 column which represents 1% inflation shows that the LIFO reserve will increase even if the current vs. prior period’s current year cost balance were to decrease from $800,000 to $725,000 (the $5,185 LIFO expense amount shown on the $775K Current year cost row indicates that the LIFO reserve would increase even if the current year cost balance decreases from $800K to $775K from 2019 – 2020). Although the same holds true as the inflation rate increases from 1 – 2% and upward, the report illustrates that the minimum current year cost balance required for the LIFO reserve to increase becomes smaller as the inflation rate becomes bigger. Also, as the inflation rate approaches 7% or 1.07, the report shows that the LIFO reserve would increase even if the 2020 vs. 2019 current year cost balance were to decrease from $800,000 to $450,000.

Shown below are three other examples showing the relationship between the LIFO reserve & the change in the current vs. prior period’s current year cost balance:

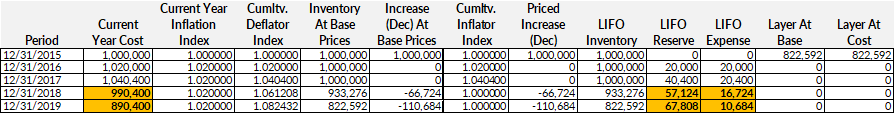

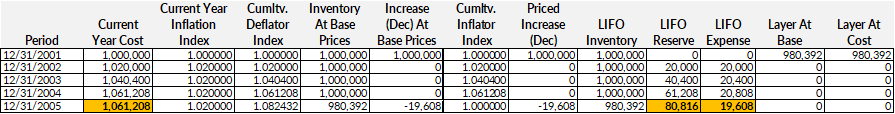

Example 2

Assumption: 2018 current year cost is $50K less than 2017 & 2019 current year cost is $100K less than 2018. There’s 2% inflation calculated for all periods.

Result: 2018 & 2019 LIFO reserve increases by $18K & $16K.

Example 3

Assumption: Current year cost is the same for all years & there’s 2% inflation calculated for all periods.

Result: 2016 – 2019 LIFO reserve increases by $18K – $20K per year ($76K total).

Example 4

Assumption: Current year cost increases by 2% per year between 2015 – 2018, but stays the same from 2018 – 2019 & 2% inflation calculated for all periods.

Result: 2019 LIFO reserve increases by just under $20K.

To summarize, the key takeaways are as follows:

- LIFO reserve can increase even if the current vs. prior period ending inventory balance is the same or lower as long as there is inflation

- The inflation (deflation) rate has a much bigger effect on determining the change in the current vs. prior year LIFO reserve when compared to the effect of the current vs. prior period current year cost change

- If there is inflation, the inflation effect LIFO expense will typically be greater than the layer erosions effect LIFO income unless a significant inventory liquidation occurred over the last year

- The facts above are mainly due to the fact that the prior year current year cost balance used to calculate the inflation effect LIFO expense will almost always be larger than the difference between the current vs. prior year inventory at base year cost used to calculate the layer erosions effect LIFO income