The LIFO Coalition has learned of the following developments in the past week:

- The Senate Finance Committee has begun writing their version of a tax reform bill

- LIFO repeal is part of the tax reform discussion

Tax writers are actively looking for sources of revenue to pay for reduced tax rates and other reform proposals like expensing. The House “Blueprint” included a Border Adjustment Tax, or BAT, that would raise more than $2 trillion. That proposal proved to be very controversial and most tax observers believe it will not be included in a final tax reform proposal. Without the BAT, other revenue sources have to be found, and that search for other revenue puts LIFO in peril.

In short, LIFO is at greater risk today than it has been for years.

It is extremely important for LIFO tax-paying businesses & CPA firms to voice their support for LIFO to their respective members of Congress, and (if possible) explain to them how LIFO repeal would negatively impact their business (and/or clients). The citizens employed & communities supported by LIFO-taxpaying businesses are extremely influential in the tax reform policies made by their congressional representatives, and company outreach has historically been proven to be the most effective means of preserving LIFO.

How to Take Action

Contact Congress Online Tool

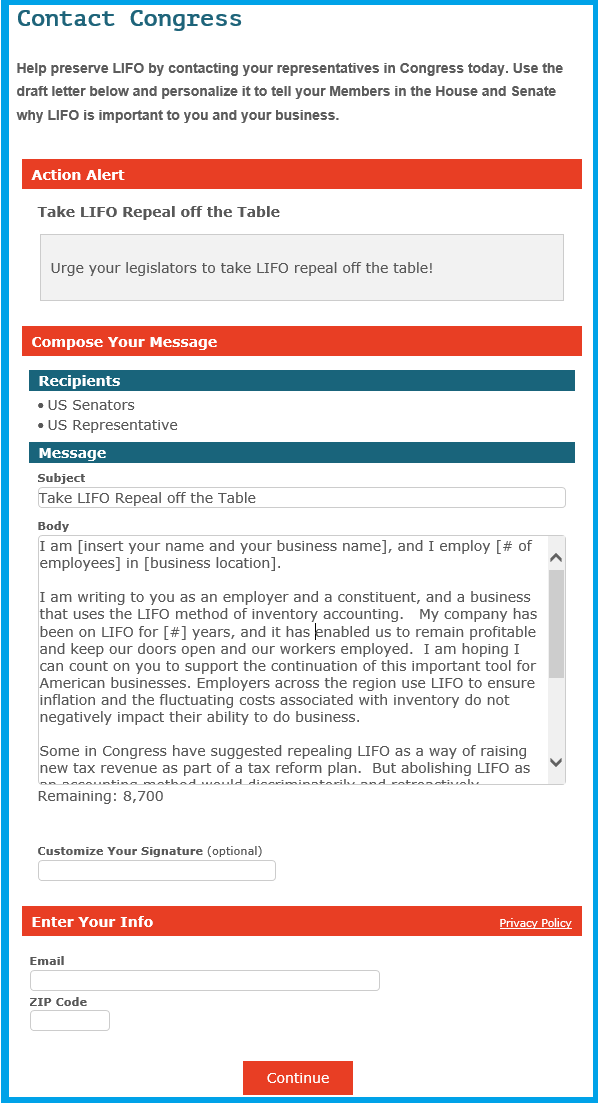

This tool automatically identifies the appropriate House Representatives and Senators to send your message to based on the zip code entered (free tool provided by the LIFO Coalition). Send a message in support of LIFO to your members of Congress online by clicking the Contact Congress button below:

Contact Congress Online ToolSend A Message to Congress

Providing specific details of the negative economic impacts of LIFO repeal that your company would suffer from is HIGHLY EFFECTIVE! Suggested talking points include:

- Reduction in profit margin and/or after-tax operating income

- Reduction in workforce and/or new hires

- Halt and/or slow company growth

- Restrict reinvestment in capital assets

- Restrict cash flow for replenishing inventories

- Full Name

- Company Name

- Company location

- Clearly state that your business is located in the congressmen’s constituency

Who to Contact

Companies should contact the following members of Congress:

1) House & Senate members that represent the state that your company is headquartered in

2) Republican Senate Finance Committee Members that represent a state that your company operates within

Contact Congress Resources

Representative/Senator Contact Information Lookup Facts & Figures Favoring the Preservation of LIFO Pro-LIFO Message TemplateLIFO Coalition Fact Sheet

LIFO Witness Testimonies During 03/18/1938 Senate Finance Committee Hearings on Revenue Act of 1938 (H.R. 9682)

LIFO Coalition’s Contact Congress Page: